General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWall Street Frets That You're Getting Paid Too Much

Wall Street money managers are worried about two things: that they won’t get paid enough and that ordinary Americans will get paid too much.

The fight over who gets what from the bonus pool is an unseemly annual rite at Wall Street firms. Last year the average bonus paid to securities industries employees in New York City was $164,000, the most since the financial crisis, according to New York State Comptroller Thomas DiNapoli.

In contrast, concern over rising pay for the rest of America is a monthly, not annual, ritual. Today the Bureau of Labor Statistics reported that average hourly earnings in July were flat, vs. an expected 0.2 percent increase. They’re up only 2 percent over the past year. However, hawks pointed out that the Employment Cost Index—which covers both wages and benefits—rose a more-than-expected 0.7 percent in the second quarter, its biggest rise since 2008.

“Wages are trending up, and once wage inflation takes hold, it continues for four to five years,” says Torsten Slok, chief international economist at Deutsche Bank. Slok notes that a survey by the National Federation of Independent Business finds an increased share of companies—around 15 percent—are “planning to raise wages up significantly in recent months.” He says in a chartbook for clients: “A broad-based pickup in wages in the pipeline.”

For Wall Street, the risk is that higher wage growth will lead to more inflation, which will push up interest rates, which will push down stock prices. The rate-setters of the Federal Reserve think that unemployment can fall to 5.4 percent before inflation starts to be a problem. Slok says inflation could come much sooner, citing academic studies that put the inflationary threshold anywhere from 6 percent unemployment all the way up to 7.2 percent.

MORE

http://www.businessweek.com/articles/2014-08-01/wall-streeters-worry-that-theyre-paid-too-little-and-youre-paid-too-much

Journeyman

(15,036 posts)Brigid

(17,621 posts)The sooner the torches and pitchforks come out.

PoliticAverse

(26,366 posts)

Initech

(100,079 posts)Seriously eat a big, steaming bag of fertilizer. You are tanking our economy and getting away with grand larceny. It's only a matter of time before the pitchforks and torches come out. ![]()

Nye Bevan

(25,406 posts)He is simply expressing his opinion, as he is paid to do, that higher wages may lead to inflation and higher interest rates which could negatively impact stock prices. I don't see him telling employers to cut people's salaries or benefits. In fact, if he believes his own analysis he may well have shorted the stock market in which case he would personally be rooting for wage inflation.

BlueJazz

(25,348 posts)Most people in this country would be in heaven if their bonus was 164,000 CENTS.

awoke_in_2003

(34,582 posts)than double my annual salary.

WillyT

(72,631 posts)Populist_Prole

(5,364 posts)You people ( and I do mean "you people" in the pejorative way the term is used...ya jerkweeds ) knock yourselves out pushing this supply side "trickle down" economics thing as an article of faith. You people ferociously deride any talk of "demand side" or Keynesian economics as false or counter productive.

OK. So if the theory of the prole's ability to drive the economy via their spending power is rejected due to ideological/wonkish supply side dictums....why are you so worried about said prole's spending power that you worry about inflation?

I mean, if the 99 percent's economic vitality means fuck all in the grand scheme of things, why do you people care if they get deeper pockets? Isn't this alarmist BS about inflation in fact a thinly, insidiously lame admission that it really IS the spending power of the proles that make "the economy" chug along?

You can't have it both ways.

Are the 99 percent vital or not?

bhikkhu

(10,718 posts)that I have a bit of discretionary income. Which lets me be a customer, and indirectly boost the bottom lines of some Wall Street firms. Of course, being choosy about which ones is a nice perk.

woo me with science

(32,139 posts)Tsiyu

(18,186 posts)which further enhances Wall Street. They like living in a nation where human beings' incarceration is a "revenue stream" as shown in this clip

Edit: wrong clip added here:

But this one is good as well.

You keep them so poor, they can't afford lawyers.

You keep them so poor, they can't hide in fancy subdivisions to do their drugs so they get caught far more easily. You keep them so poor, they can't afford fancy addiction treatment centers, and then you criminalize their addiction and send them to prison over a health issue.

You keep them so poor that their cars are beaters - further reason to get pulled over and enter the system - because cops are trained to pull over and arrest the poor, not the ones who can afford to make bail.

You charge them court costs, fines, probation fees, costs for their incarceration, on and on and on and on until there is no way they or their families can ever climb out of poverty.

But dayum, all those poor suckers in prison make for 6 million dollar bonuses for prison CEOs!

What a great economic system we have here in the land of the free in the year 2014.

Greed is king, and until everyone gets so poor they can't buy any Wall Street traded corp products, or until people start doing something to raise wages, we're all screwed.

Except for Wall Street, which is trading at obscene levels.

TBF

(32,063 posts)FU bankers.

![]()

hankthecrank

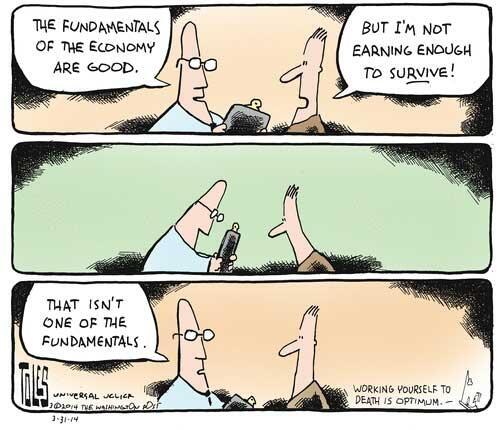

(653 posts)Rich people get huge increase in income = every thing okay

Little people make a little more salary = inflation