William C. Erbey Has Built an Empire on Misery

http://inthesetimes.com/article/16467/william_c._erbeys_empire_built_on_misery

The head of Ocwen Financial runs a slew of companies that profit from foreclosures.

BY JOEL SUCHER

William C. Erbey, the executive chairman of Ocwen Financial, is a billionaire with a problem. After years of homeowner grievances, Ocwen has become ground zero for regulatory shelling by government agencies—and some members of the investment community aren’t happy with Erbey, either.

What do all these folks have against the 64-year-old Erbey, who cut his financial teeth as head of GE Capital’s mortgage Insurance unit in the early 1980s? After all, he looks kindly enough: more like a 1960s encyclopedia salesman than the head honcho of the country's largest nonbank mortgage servicer.

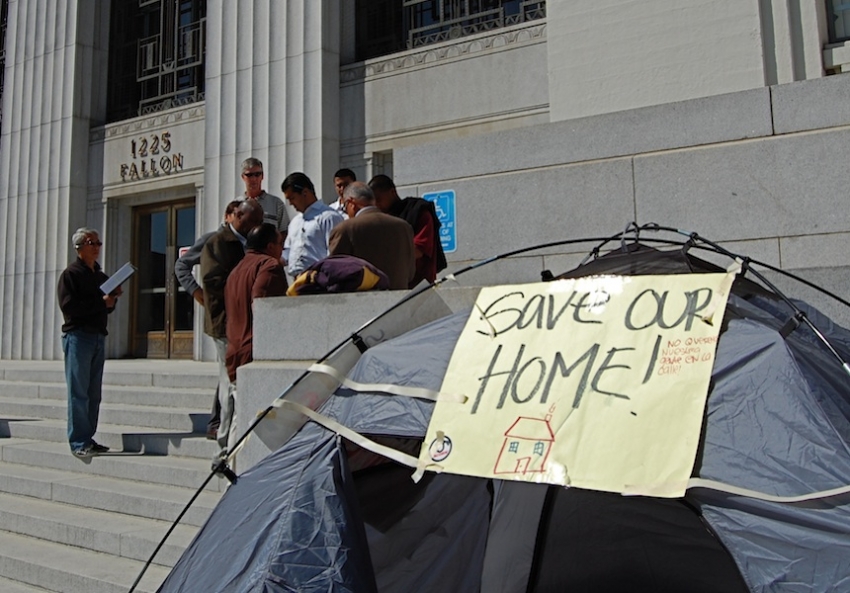

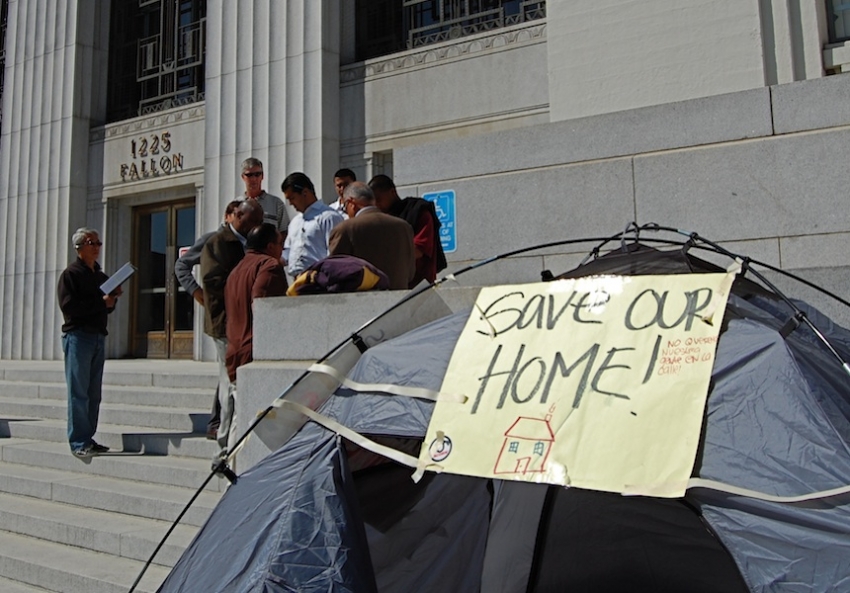

Homeowners have been voicing their displeasure with Ocwen Financial for years. Now regulatory agencies and investors have joined the call. Photo by Jacob Ruff / Flickr / Creative Commons.

The problem, it seems, is that even as Erbey’s power has grown, so too has the number of homeowners complaining about how their mortgages have been serviced—close to 9,500 since 2011, according to the Consumer Financial Protection Board (CFPB). In December 2013, the CFPB teamed up with authorities from 49 states to force Ocwen to settle allegations that the servicer refused to honor agreements with previous servicers, improperly denied homeowners loan modifications and levied unauthorized fees and penalties upon them.

According to Richard Cordray, head of the CFPB, “Ocwen took advantage of borrowers at every stage of the process.” In response, Cordray and his allies ordered the company to provide $2 billion in the form of principal loan reductions to homeowners struggling to stay afloat; there was also a provision that $127.3 million in refunds be set aside to pay the approximately 185,000 people whose properties had already been foreclosed upon.

Though the settlement didn’t force Ocwen to actually admit to wrongdoing, it was just the latest round in a series of escalating regulatory actions that have put Erbey and his empire in an increasingly unflattering public light.

FULL story at link.

Marta and I subscribe to In These Times