General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsHot damn.....Morgan & Morgan Files Class Action Lawsuit Against CEO of JPMorgan Chase

alleging that Mr. Dimon and the other members of the bank’s Board of Directors allowed JPMorgan to embark on an unprecedented course of recklessness and unlawful conduct to increase their own personal fortunes.

The class action lawsuit describes a number of high-profile scandals involving the once-revered Wall Street bank.

http://www.forthepeople.com/blog/morgan--morgan-files-class-action-lawsuit-against-ceo-of-jpmorgan-chase

We can only hoipe they are successful......

octoberlib

(14,971 posts)jsr

(7,712 posts)Sanity Claws

(21,849 posts)Poorly written article says it is a class-action lawsuit but does not identify the class. Without this information, it is impossible to say whether the class have standing to bring these claims.

malthaussen

(17,202 posts)Haven't seen any other source yet, but maybe later today? It would seem to be kind of a critical point, no?

-- Mal

magical thyme

(14,881 posts)From their website:

Our New York attorneys represent investors who have been defrauded as a result of federal securities law violations. Executives at publically traded companies have a duty to tell the truth to the investing public. When this duty is breached and investors lose money, a securities attorney may be able to help shareholders receive compensation for their losses.

Sanity Claws

(21,849 posts)There are a lot of hurdles to jump through before a suit like can proceed.

Of course, I hope they win but let's not forget that our corporate overlords have written the laws to suit themselves, including ways to insulate themselves from accountability, even to their own shareholders.

magical thyme

(14,881 posts)I'm sure that the law firm is aware of the hurdles they need to jump...at least, I hope they are ![]()

L0oniX

(31,493 posts)calimary

(81,304 posts)I would love to see some of these high-priced whores (like jamie dimon and lloyd blankfein) get sent to PRISON. Where they belong!

leftieNanner

(15,115 posts)And not one of those country club prisons. San Quentin perhaps?

TexasTowelie

(112,232 posts)it is a civil lawsuit instead of a criminal suit so there won't be any prison.

leftieNanner

(15,115 posts)just dreaming. It's where these crooks belong. ![]()

magical thyme

(14,881 posts)which, in a situation like this, could be thousands or even millions.

1StrongBlackMan

(31,849 posts)what I really like is that the suit suits disgorgement of profits!

I'll have to look up the filing to see if Dimon and the Board Members are named personally.

To draw from the great Eddie Murphy/Dan Aykroyd Movie, Trading Places: "The best way to get back at a rich man is to make him a poor man."

Jack Rabbit

(45,984 posts)They are pimps. A whore is much more respectable.

I think you owe Moll Flanders an apology.

calimary

(81,304 posts)I do like "Legs Dimon" and "Pretty Boy Lloyd" though! You do make a good point. A whore at least does some work for a living. Pimps just mooch off 'em.

JDPriestly

(57,936 posts)Department feels compelled to go after J.P. Morgan. Not a likely outcome.

okaawhatever

(9,462 posts)charges. In fact, I think the reason this class action suit is even being pursued is because of actions of the Justice Dept, SEC, FBI, and Commodities Futures Trading Practices.

From the NYT:

For JPMorgan Chase, fines totaling billions of dollars are no longer sufficient to placate the government. Now the bank’s regulators want something stiffer: a mea culpa.

A month after JPMorgan acknowledged that “severe breakdowns” had allowed a group of traders in London to run up $6 billion in losses, the bank has preliminarily reached a rare agreement to admit that the trading blowup itself represented reckless behavior, according to people briefed on the negotiations.

SNIP

Unlike a settlement last month with the Securities and Exchange Commission, which largely took aim at porous controls and governance practices at the bank, the pact with the Commodity Futures Trading Commission zeros in on the bank’s actual trading practices. The agency, using new authority under the Dodd-Frank Act of 2010, argues that the bank’s trading was so large and voluminous that it violated a law preventing banks from recklessly using a “manipulative device” in the market for credit derivatives, financial contracts that let the bank bet on the health of companies like American Airlines.

SNIP

The aggressive policy can have repercussions for regulators. If a bank balked at making an admission, for example, it could lead to costly litigation that government agencies can ill afford.

The JPMorgan case nearly highlighted this risk.

The bank, arguing that its trading was legitimate, resisted an admission. And the trading commission drafted a potential lawsuit. Talks reopened in recent weeks, paving the way for the admission.

SNIP

Despite the recent push, the agency had yet to charge a big Wall Street bank over a “manipulative devices” violation. For years, the agency had to prove that a trader intended to manipulate the market, and successfully created artificial prices.

But under Dodd-Frank, the financial regulatory overhaul passed after the crisis, the agency must show only that a trader acted “recklessly.” The agency harnessed that new authority to pursue the JPMorgan trading, where it was unclear whether the traders had intended to distort the market. All together, the bank’s traders increased their position in a credit derivative index by $34 billion in early 2012, according to a Senate report.

“The commission is trying to flex its muscle under the Dodd-Frank standard and is also going an extra yard to get an admission,” said Hugh J. Cadden, a former enforcement official at the C.F.T.C.

SNIP

Even before a settlement, federal prosecutors and the Federal Bureau of Investigation in Manhattan have brought criminal charges against two of the traders: Javier Martin-Artajo and Julien Grout, who were accused of covering up the size of their losses. The traders deny wrongdoing. A third trader, Bruno Iksil, sidestepped charges, striking a nonprosecution deal

http://dealbook.nytimes.com/2013/10/15/jpmorgan-said-to-reach-deal-with-trading-regulator/

From Forbes:

It doesn’t seem like a big deal considering all the scrutiny he’s been under but Jamie Dimon’s move to give up the bank chairman role at JPMorgan Chase may be the beginning of something more ominous.

SNIP

Most recently, JPM appears to be on the hook for a giant settlement with regulators which some report could top $11 billion–one of the biggest Wall Street deals in history. Last week Dimon met with Attorney General Eric Holder to discuss the settlement after his bank’s offer to settle was reportedly rejected.

That all makes the timing of JPM’s announcement more peculiar especially considering Dimon gave up his bank chairman role back in July.

http://www.forbes.com/sites/halahtouryalai/2013/10/04/jamie-dimons-power-struggle-loses-bank-chairman-role-a-bigger-blow-may-come-next/

LittleGirl

(8,287 posts)LiberalArkie

(15,719 posts)The lawyers at Morgan & Morgan are actively involved in our respective communities throughout the states of Florida, Tennessee, Mississippi, Georgia, Kentucky, and New York. The firm requires that all of our partners hold at least one position of leadership in a charitable, service, or civic organization.

The partners at Morgan & Morgan have individually founded and maintained such worthy causes as the Boys Town USA Project, providing guidance during its inception and organizing fundraising and donations. John Morgan has been instrumental in assisting the Miami Project to Cure Paralysis, whose goal is to help people like his brother, who have neuromuscular and spinal injuries, eventually walk or live with more mobility. Nick Buonicotti Jr., whose father was a professional football player and founder of the Miami Project, is a partner with Morgan & Morgan.

1StrongBlackMan

(31,849 posts)a law firm with a social conscience!

Many years ago, I worked with a huge, multi-national law firm that tasked every 1st year associate to exclusively do pro bono work ... in areas of social justice, e.g., discrimination (employment or housing) or renter rights plaintiff work, or to serve as counsel to community organizations work for social justice. It was the one and only time in my career, my job choice was a political/ideological statement.

glowing

(12,233 posts)He's also the one who's pushing forward with the Medical Marijauna law. It's supposed to be on the ballot next election cycle.

calimary

(81,304 posts)A law firm with a social conscience. Whooda thunkit?

reusrename

(1,716 posts)Can't happen soon enough.

SunSeeker

(51,569 posts)All of the big banks were doing what Chase was doing.

1StrongBlackMan

(31,849 posts)bullsnarfle

(254 posts)pushing hard for the legalization of medical marijuana here in FL. He has personal experience with the benefits because of his father and brother (you can read the details on their website). Between the right-wing 'baggers and the Nazi in the governor's mansion it could be a tough haul.

I don't generally have much, if any, use for 'ambulance chasers', but when they go way out of their way to do a good thing that may not benefit them one iota I gotta tip the hat.

NightWatcher

(39,343 posts)Charlie Crist also works for his firm. He might be single-handedly turning Florida from purple to blue with those two moves.

calimary

(81,304 posts)Glad you're here! It is a refreshing change to see, isn't it? A law firm - with one eye on working for the greater good.

Dark n Stormy Knight

(9,760 posts)trade they make in the future with the offending organization.

peasant one

(150 posts)Dark n Stormy Knight that is the claim of many who object to such lawsuits--- but I have no such objection because if corporations swindle every customer out of $5.00 no one is gonna sue--- but a law firm that gets class action status could get at least some money back for those customers. In addition, the cost of defending the suit will provide some disincentive for the corporate bad actor to think about doing it again. I say go for it Morgan and Morgan!!!!

Dark n Stormy Knight

(9,760 posts)I just hate how every class action suit I have been a party to has taken more trouble for me to claim my "compensation" than that compensation was worth.

indepat

(20,899 posts)WillyT

(72,631 posts)sulphurdunn

(6,891 posts)will not bring criminal charges against any of these fuckers.

grahamhgreen

(15,741 posts)Kablooie

(18,634 posts)To fine the company is a waste of time.

The company may pay a fine but the management keep their personal billions so no one really cares.

It won't deter any future crimes because no matter how big the fine is, it will just be seen as the cost of doing business.

They have to go after the people in charge, personally.

Prison time, real prison time, may make future managers think twice.

Of course the country club prisons aren't that much of a deterrent anyway but that's another topic.

onethatcares

(16,169 posts)JPM will offer a settlement and it will be over. Of course the settlement will be for way less than

the amount they might have defrauded anyone out of and then Jamie Dimon will go on to become the

next governor of the state of Floriduh.![]()

DeSwiss

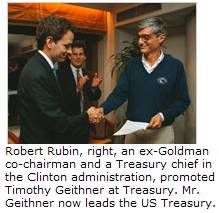

(27,137 posts) - Of course it's not like he didn't have help......

- Of course it's not like he didn't have help......

[center]

[/center]

Tommy_Carcetti

(43,182 posts)ms.smiler

(551 posts)http://www.reuters.com/article/2014/02/20/us-jpmorgan-madoff-idUSBREA1J21W20140220

"The lawsuit filed in federal court in Manhattan on Wednesday on behalf of shareholders against Chief Executive Jamie Dimon and 12 other current and former executives and directors was based in part by statements made by Madoff himself during a series of interviews. "

snip

"The lawsuit was filed on behalf of the Steamfitters Local 449 Pension Fund in Pittsburgh and Central Laborers' Pension Fund in Jacksonville, Illinois, both shareholders of JPMorgan."

"According to the complaint, senior bank officials who dealt with Madoff included Walter Shipley, a former chief executive of Chemical Bank and Chase Manhattan Bank; and Robert Lipp, a former JPMorgan senior adviser and director."

Central Laborers' Pension Fund et al v. Dimon et al, U.S. District Court, Southern District of New York, No 14-01041.

dixiegrrrrl

(60,010 posts)May they multiply. ![]()