General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsEvidence of Global Economic Recovery

Last edited Sun Mar 18, 2012, 03:52 PM - Edit history (1)

Everyone complains when gas prices go up. When gas prices go down it gets a shrug.

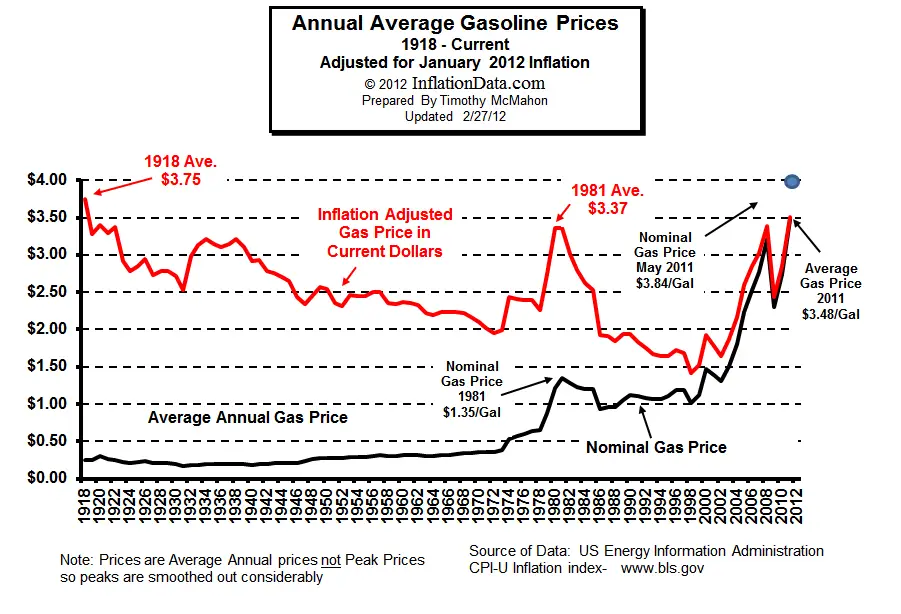

Almost all of the recent increases in gas prices are merely regaining ground from what was an incredible drop in the price of gas when the world economy collapsed.

And a chart of gas prices in the last 5-10 years is almost the same as a chart of the stock market. Both are rough gauges of global economic propects and without an extrenal factor that affects gas prices in speciffic (like the 70s Arab oil embargo or the Iranian revolution) it's normal that tgas and stocks and a lot of other things move in rough tandem.

I believe that Republican policies would, in fact, reduce the price of gas a great deal because they would precipitate another global economic collapse. That would indeed lower gas prices, just as it did 2008-2009.

But if anyone expects the global economy to recover then of course gas prices would also "recover." (For a lot of nations that depend on energy exports there could have been no hope of recovery at 2009 energy prices.)

People gettting hysterical about a return to what gas cost in 2008 is bizarre, but par for the course.

Zalatix

(8,994 posts)However, not even that reflects the REAL cost of gasoline.

We need to get away from it altogether.

cthulu2016

(10,960 posts)To believe that '98 remains the natural level for oil we would have to maintain that both global production and demand have remained the same since '98 and that's just not true.

Zalatix

(8,994 posts)cthulu2016

(10,960 posts)First world oil use has stayed consistant while "developing" nation demand skyrocketed.

China's oil consuption has doubled since 2000. (No surprise, since her GDP has increased five-fold in that time)

Global surplus production capacity was high circa 2000 and dropped to almost none by 2002

Global oil production flattened out in the early 2000s

The US invaded one of the world's large oil producers in 2003

The correlation of supply, demand and price are imperfect (as in most commodities) and there is certainly a lot of market manipulation (at least as much by oil producers as by outside speculators), but there is nothing in the supply/demand to suggest oil would not have gone up a lot in the last decade.

Higher demand. Flat supply.

Yes, speculation plays a part but it is impossible for speculation to keep anything jacked up indefinately.

Demeter

(85,373 posts)cthulu2016

(10,960 posts)Owlet

(1,248 posts)of global economic health, one way or the other. They're about as relevant as the Big Mag Index or hemlines on the stock market.

cthulu2016

(10,960 posts)There are seasonal and geopolitical and policy and local refining capacity issues that shape all local gas prices around the world, of course.

But to suggest that there is not a signifigant correlation of US gas prices and the spot price of a barrel of oil is obviously not correct.

http://www.GasBuddy.com/gb_retail_price_chart.aspx?city1=USA Average&city2=&city3=&crude=y&tme=72&units=us

Owlet

(1,248 posts)your OP asserted that the increase in US gas prices signaled global economic recovery, and that simply isn't the case.

girl gone mad

(20,634 posts)This only shows that our government stuffed Wall Street's coffers full of easy money and they're using the money to once again rob people blind. They were flush with money back when they were securitizing toxic mortgages and selling them by the boatload to unsuspecting investors, too.

bhikkhu

(10,718 posts)

...which indicates the almost perfect correlation between oil price and global economic growth.

So the take-away lesson should be that cheap oil and a good economy are two things that don't go together, and that high gas prices are the inevitable result of economic growth, which also provides jobs and opportunity around the world.

The pain at the pump is a wake-up call to transition to alternatives. I bicycle to work and I cook, as local as possible, so the increased fuel costs to my household have been minimal.