General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe Stock Market Has Officially Entered Crazytown Territory

Investment Watch - 12/26/13, Michael Snyder

[font size=1]Looney Tunes - Photo by Ramon F Velasquez[/font]

It is time to crank up the Looney Tunes theme song because Wall Street has officially entered crazytown territory. Stocks just keep going higher and higher, and at this point what is happening in the stock market does not bear any resemblance to what is going on in the overall economy whatsoever. So how long can this irrational state of affairs possibly continue? Stocks seem to go up no matter what happens. If there is good news, stocks go up. If there is bad news, stocks go up. If there is no news, stocks go up. On Thursday, the day after Christmas, the Dow was up another 122 points to another new all-time record high.

In fact, the Dow has had an astonishing 50 record high closes this year. This reminds me of the kind of euphoria that we witnessed during the peak of the housing bubble. At the time, housing prices just kept going higher and higher and everyone rushed to buy before they were “priced out of the market”. But we all know how that ended, and this stock market bubble is headed for a similar ending. It is almost as if Wall Street has not learned any lessons from the last two major stock market crashes at all.

Just look at Twitter. At the current price, Twitter is supposedly worth 40.7 BILLION dollars. But Twitter is not profitable. It is a seven-year-old company that has never made a single dollar of profit. Not one single dollar. In fact, Twitter actually lost 64.6 million dollars last quarter alone. And Twitter is expected to continue losing money for all of 2015 as well. But Twitter stock is up 82 percent over the last 30 days, and nobody can really give a rational reason for why this is happening.

Overall, the Dow is up more than 25 percent so far this year. Unless something really weird happens over the next few days, it will be the best year for the Dow since 1996. It has been a wonderful run for Wall Street. Unfortunately, there are a whole host of signs that we have entered very dangerous territory.

MORE

- Get your waders out and batten-down the hatches, looks like it's about to get deep.....

- Get your waders out and batten-down the hatches, looks like it's about to get deep.....Blue_In_AK

(46,436 posts)We took our retirement accounts out of the stock market back in 2008 when things were going south, before we lost everything. We never put it back, and I have no regrets. I am almost positive that it will crash hard at some point.

bad part about it is when or if it dives, Uncle Sam will come along and scrape up the sheet, like this self cleaning dog does.

DeSwiss

(27,137 posts) - Good 'ol Credit Union.

- Good 'ol Credit Union.yeoman6987

(14,449 posts)I can't believe that in all the posts, no one mentioned the money the fed is putting into the stock market as a reason for the increase in the stock market. They have manipulated the market for years now.

socialist_n_TN

(11,481 posts)yet EVERYBODY acts so surprised and hurt when the busts happen. ![]()

DeSwiss

(27,137 posts)And those with the most money in the game decide whether those booms and busts will happen, and when.

- The rest grab their ankles......

- The rest grab their ankles......

Eleanors38

(18,318 posts)House of Roberts

(5,178 posts)each time paying the other more than the last time. It doesn't make the car worth more, it just means the last owner loses, while the other party makes off with too much money.

Your 401Ks are the last owner of these inflated stocks.

DeSwiss

(27,137 posts)Nor an IRA.

It's all a huge crapshoot with loaded dice.

And with the croupier constantly handing The Players money under the table to so as to keep the game going until they've milked it ALL back.

- Like George said:

- Like George said:

moondust

(19,993 posts)My pet theory is that the rise is partly explained by gold bugs selling off their gold and ploughing the money into the booming stock market instead. They don't care if it's a bubble or not; they just see it rising and want a piece of the action.

Over the past year the price of gold has decreased by more than 25%--down about $450 an ounce.

![]()

DeSwiss

(27,137 posts) - Except when they're using their butt-boy HBSC to do their dirty works.......

- Except when they're using their butt-boy HBSC to do their dirty works.......

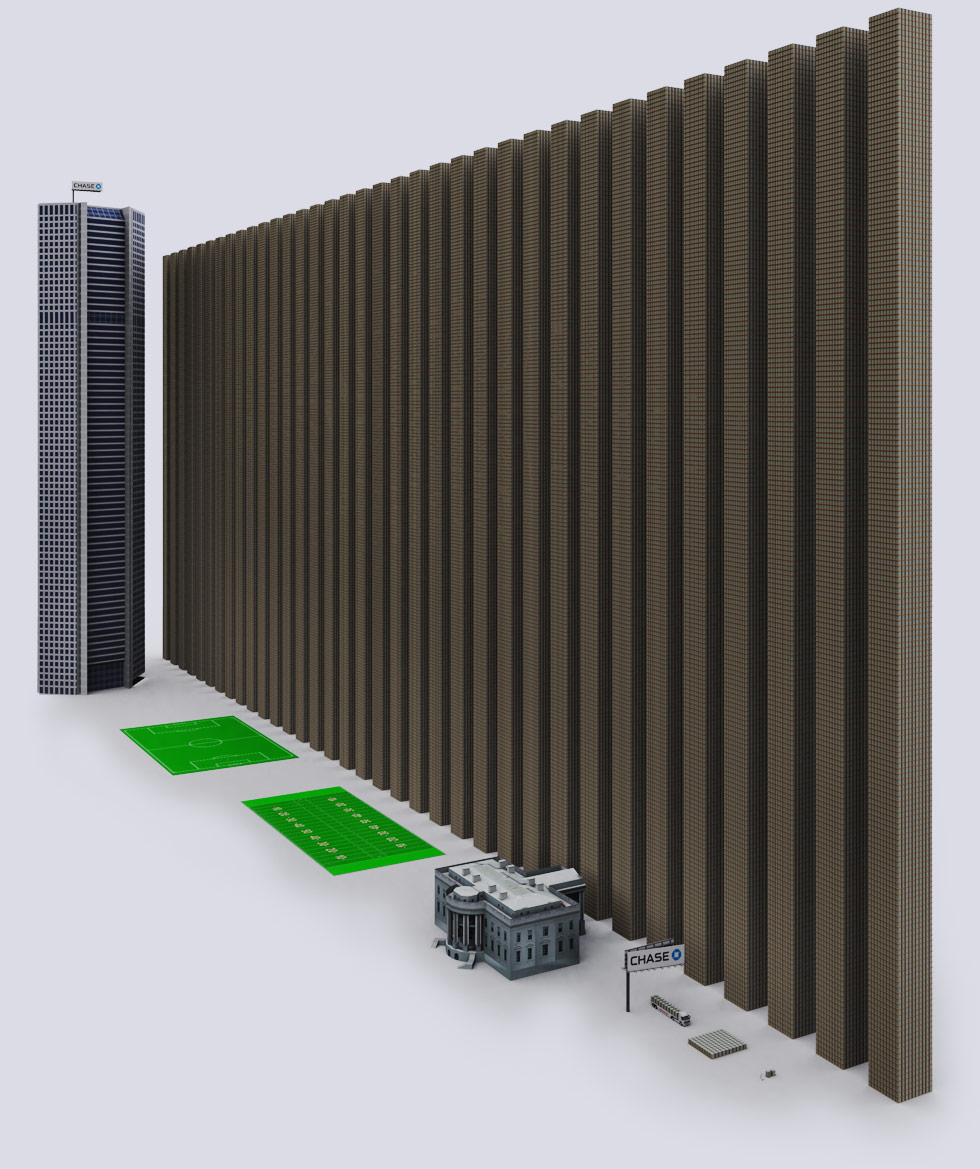

JP Morgan Chase (JPM)

JP Morgan Chase has a derivative exposure of $70.151 Trillion dollars.

$70 Trillion is roughly the size of the entire world's economy.

The $1 Trillion dollar towers are double-stacked @ 930 feet (248 m).

JP Morgan is rumored to hold 50->80% of the copper market, and manipulated the market by massive purchases. JP Morgan (JPM) is also guilty of manipulating the silver market to make billions. In 2010 JP Morgan had 3 perfect trading quarters and only lost money on 8 days. Lawsuits on home foreclosures have been filed against JP Morgan. Aluminum price is manipulated by JP Morgan through large physical ownership of material and creating bottlenecks during transport. JP Morgan was among the banks involved in the seizure of $620 million in assets for alleged fraud linked to derivatives. JP Morgan got $25 billion taxpayer in bailout money. It has no intention of using the money to lend to customers, but instead will use it to drive out competition. The bank is also the largest owner of BP - the oil spill company. During the oil spill the bank said that the oil spill is good for the economy.

JP Morgan Chase also received a SECRET $391 billion dollar bailout from the Federal Reserve.

In 2012, JP Morgan (JPM) took a $2 billion loss on "Poorly Executed" Derivative Bets.

MORE

redqueen

(115,103 posts)The market is due for a correction. Everyone agrees about this. Why it's inflating when it's understood to be already overvalued?

Is it

DeSwiss

(27,137 posts)They're getting the last of the gold dust, cash and even their plug-coins from the cracks and crevices.

That Quadrillion and a Half Dollar Derivative scam is coming due in March 2014.

- And there ain't no more of that Quantitative Easing salve left.....

- And there ain't no more of that Quantitative Easing salve left.....

redqueen

(115,103 posts)Excellent name for it, btw.

Looks like it'll be an interesting year.

WillyT

(72,631 posts)KoKo

(84,711 posts)ridiculous...like we learned nothing.

For Wall Street Traders, though...WOW! MANNA FROM HEAVEN!

For the rest of us "Savers"....it's "MEH!"

TWO AMERICAS....

DeSwiss

(27,137 posts) - Always was.

- Always was.

''We can, if we so desire, refuse to cooperate with the blind forces that are propelling us.'' ~Aldous Huxley

Benton D Struckcheon

(2,347 posts)...is even more bizarro than anything that happens there.

No one knows what moves it. The writer seems to think it should respond to some notion of rationality. He should simply admit that he doesn't know and move on. No one needs to pay attention to it if they're not involved.

Getting out your waders could be seriously embarrassing, since there is no reliable way of knowing if what's coming is a flood or a sunny day.

Bond prices, because they affect mortgages and student loans and credit card rates, are way more important. No one really knows what moves those either (remember Greenspan and his "conundrum"?). But at least paying attention to that is paying attention to something relevant to most people's daily lives.

DeSwiss

(27,137 posts)...then capitalism can be understood. As would also be the case with its extension, the stock market. Greed is ultimately based upon FEAR. Fear of loss, is its primary driver and it uses this same fear to frighten or compel others into risking their resources. For fear of what they'll lose if they don't.

- I agree with Russell Brand. It's time to recalibrate and create a fair system that eliminates these inequities.

- I agree with Russell Brand. It's time to recalibrate and create a fair system that eliminates these inequities.

Benton D Struckcheon

(2,347 posts)but that's not what the writer is talking about. A predictive conclusion on what will happen is being made. It's like trying to predict where the next earthquake will be, and when it will happen. No one knows.

DeSwiss

(27,137 posts)Sometimes I think I'm the only talking about it -- this way.

I don't believe that it can be fixed, nor should the effort to do so be expended.

We've wasted enough time already.

If people were dying in this country like they are elsewhere where our troops tend to be, they might be a little more perspicacious about getting the show on the road instead of negotiating with the terrorists running the show right now.

- They are a speck of dust compared to 7 billion strong. They know this but we don't. We haven't realized it yet because too many still have the eyes wide shut.

- They are a speck of dust compared to 7 billion strong. They know this but we don't. We haven't realized it yet because too many still have the eyes wide shut.

Ghost Dog

(16,881 posts)against specks of dust. Yes.

rhett o rick

(55,981 posts)big money is made in the fluctuations of the bubbles. Some bubbles are small and some are large. Big money can manipulate the bubbles to their benefit and the loss of the fools that think they might get rich (or even make an honest gain).

The fools believe the propaganda that they are "investing" in the economy or in a company. That is a bald faced lie. If I buy General Motors stock today, the company will not see a dime of that money. They wont use my money to help their company. I am essentially laying my money down as a bet that the price will go up. It is like going to the window at the horse races and saying give me $1,000 on GM. I take my ticket and watch the "race" hoping to cash in with GM in the lead.

Company executives have learned that they can make more money by manipulating their companies stock price and cashing in.

Alan Greenspan, who is so out of touch with reality that he was shocked when he learned that company executives would put their personal gain ahead of the health of their company. Idiot.

The Stock Market is one way to transfer the wealth in retirement funds from the 99.99% into the pockets of the 0.01%.

quaker bill

(8,224 posts)and a page loaded with interesting ideas about the failure of economies, collapse of currencies, debt crises, the Obamacare nemesis, and the need to stash food and guns.....

The market is up, the economy is recovering and the pace of recovery is increasing. People are getting more affordable insurance. The market will continue upward generally for at least another year or two. Metals will continue to fall as equities produce more earnings and interest rates rise. more people will find jobs (lousy ones for sure, but jobs)

currencies will not collapse, western civilization will remain intact, no debt crisis will happen.. (cats and dogs may however sleep together - if that is their preference)

It was never going to go that way and there is no indication that it is about to. Risk aversion to paranoia are normal parts of the recovery process, this guy has a good dose.

DeSwiss

(27,137 posts) Fascinating......

Fascinating......

RobertEarl

(13,685 posts)There is new money flowing in because it looks like the stock market is the best place for new money. The day some other place looks better, the money will flow there and the stock market will sink.

DeSwiss

(27,137 posts)And I was taught by my brother and my brother-in-law many, many years ago when I was but a young 14-year old: ''BIG MONEY ALWAYS TAKES LITTLE MONEY.''

- You can guess the circumstances under which I learned this lesson. It's one I have not forgotten nor repeated......

- You can guess the circumstances under which I learned this lesson. It's one I have not forgotten nor repeated......

84% of all stock trades are by high-frequency computers… only 16% by humans

CanonRay

(14,106 posts)is it any wonder. What goes up, must come down.

DeSwiss

(27,137 posts)And that's the part they're showing us. It doesn't include all the under the table deals they're doing for GS and JPMC at the federal reserve itself.

- The whole goddamned shebang is a wash. I don't understand why people continue to support it other than habit and laziness. And FEAR.

- The whole goddamned shebang is a wash. I don't understand why people continue to support it other than habit and laziness. And FEAR.

Harmony Blue

(3,978 posts)drops out of the game watch the stock market tank.

DeSwiss

(27,137 posts) - If there's anything I can do to speed things along, just let me know......

- If there's anything I can do to speed things along, just let me know......

quaker bill

(8,224 posts)just the opposite really. Just a little throttle back and the market has gone to new records. The uptrend will continue as they taper, because they will do it on good news. The good news will beget more good news as banks become less risk averse and money flows quicken.

There will be another bust in the market, so keep predicting it and sooner or later (in this case much later) you will be right, then you can say you told us so.

(It is not going to tank because they are not taking the money back, they are just slowing the rate at which they are pumping it in)

OmahaBlueDog

(10,000 posts)Unemployment @7 means stable/low US labor costs for the foreseeable, meaning higher profits.

Many of the Dow stalwarts are flush with cash.

The automobile companies are back to offering relatively low cost leases -- meaning steady production from Detroit and it's suppliers.

Those who got slaughtered early in the Great Recession are pretty much creditworthy again -- if they have been fortunate enough to find gainful stable employment.

The deficit is down.

Gas is at or near $3 in most major markets, and looks stable-to-likly to drop at that range. Lack of supply pressure on fuel also means higher profits.

I agree we are due for a pullback. However, I'm more concerned about the rapid rise in prices back to 2005 levels in Miami and similar locales. As nearly as I can tell, we're setting up for another housing bubble. That would drag the Dow back down. How soon that bubble pops is anyone's guess, and it won't be as bad as the last bubble because the players have gotten more spphisticated about handling foreclosures.