General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsQuantitative Easing, The People And The Damage Done

There is an excellent analysis of the effects of the (85 billion per month) QE programme up at Naked Capitalism.

I still think QE is grand theft on a massive scale. Surely this topic belongs on the agenda of "economically populistic" democrats.

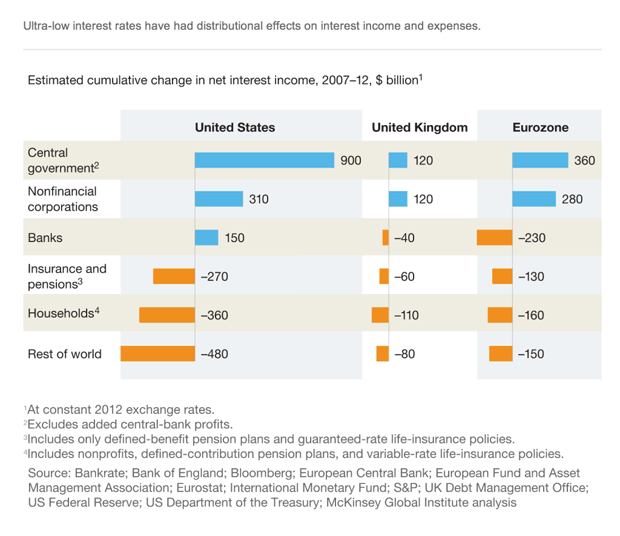

By 2012, Americans had lost $630 billion just in net interest income, some $2000 per capita. Today, that amount is undoubtedly higher. And Janet Yellen, faithful puppet of the architects of America’s worst ever financial crisis, will do her best to make sure it keeps on rising.

Why doesn’t America recognize the failure of QE and try something different? $85 billion a month, over $1 trillion a year, is about $3000 for every American, or close to $10,000 per household. If that were handed not to banks, but to these households, and it could achieve the same economic efficiency that foodstamps have, i.e. they create $1.7 worth of – primarily local – economic activity for every $1 they’re worth, the average household would have $10,000 extra to spend, and the benefit to the economy would be $17,000. That couldn’t fail to create jobs.

It’s theoretical, of course, and things being as they are, it’s almost certain that it will remain a theory only. But even if you would take just, let’s say, 10-20% of the amounts presently spent to relieve too big to fail but already failed anyway banks of their mortgage debt risk, that would still do a lot more to revive the economy than all of QEs relief does. Not that that’s hard, mind you, since QE has only made matters worse for the people. That’s what that graph from McKinsey tells us.

That graph from McKinsey is this one:

sendero

(28,552 posts).... well there is a single, simple metric you can use to determine whether we are nearing a normal economy.

That is the interest rate for short term loans. Right now, it is very very low, and as long as the Fed keeps interest rates very very low we are not in a normal economy.

solarhydrocan

(551 posts)various estimates of when it hits land. But printing $80 billion a month to hand to the bankers complete with pretty Christmas bows will have consequences.

Grand Theft Auto-matic. Just feed the printing presses.

The last 12 years have seen the biggest ripoffs in all of human history. Maybe time to bring back coliseums, bread and circuses. Wait- we have.

roamer65

(36,745 posts)We have to pay for all these wars somehow. We either pay through higher taxes or currency devaluation. The latter is usually easier for the bureaucrats to enact. Just wait until all this excess money really gains velocity.

sendero

(28,552 posts)..... because almost all of it is sitting on bankers' books to save their hides. Very little of that money is reaching the real economy, that's why we aren't seeing serious inflation (we are seeing some in food and whatnot and it's a lot more than official numbers reflect, but it is still not historically high), nor are we seeing the "stimulus" effect such money would have on the economy if it were reaching the pockets of spending Americans.

IMHO.

BelgianMadCow

(5,379 posts)for the accounts where banks park their excess money. That would make it loss-making for the banks to do that parking.

Like you, I agree there's been a shitload of money piled up IN ALL THE WRONG PLACES. But I think at some point (say, after proper deflation of some yummy assets, say the Greek public water system) that dam will break.

sendero

(28,552 posts)... if you are arguing that the Fed will lose control of this situation eventually, well I agree.

I don't think we are going to see negative interest rates in this country however.

Octafish

(55,745 posts)We the People get the I.O.U.

Makes perfect sense in a Friendly Fascist way.