General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe deductibles on the ACA seem to be really high. My brothers is $10,000. Is that per year?

That is the part that is scary. My wife's emergency gall bladder removal was over $20,000. So by brother, who has no savings, would still be bankrupt if that happens to him.

Am I missing something?

NoOneMan

(4,795 posts)I need his street address, chest girth and hair color before I can believe you

Rex

(65,616 posts)What plan did he go with?

Logical

(22,457 posts)kestrel91316

(51,666 posts)That's for one person. With subsidies, my premium is well under $50/mo, so if I DO incur major medical expenses, I can still survive that OOP limit.

I think a $10k deductible must be for a family of AT LEAST 6, and they probably mean an OOP limit and not a deductible.

moriah

(8,311 posts)If you're under 250% of the poverty line and enrolling in a Silver plan, they're supposed to knock down cost sharing significantly.

kestrel91316

(51,666 posts)NYC_SKP

(68,644 posts)...and high deductibles mean low monthly payments, as a rule.

We all have to balance what we can afford with what we think might happen to us.

Personally, I prefer higher rates with less fear of a catastrophic cost.

Hoyt

(54,770 posts)jaysunb

(11,856 posts)VanillaRhapsody

(21,115 posts)and is this a "High Deductible" or the total out of pocket cost? (the latter is the one I think).

Oh and is this for a single person or a family?

wercal

(1,370 posts)But seriously, could you volunteer some info:

1. age

2. dependents?

3. State

4. Smoker?

5. Income.

ReverendDeuce

(1,643 posts)nt

Pretzel_Warrior

(8,361 posts)Highest I saw was around $6,500. What state?

Grateful for Hope

(39,320 posts)Logical

(22,457 posts)Pretzel_Warrior

(8,361 posts)what is the BRONZE deductible? $20,000?

NoOneMan

(4,795 posts)or care....

That's for lower class bronze menschen

Pretzel_Warrior

(8,361 posts)so I deduce from that the Bronze that this person is looking at has even higher deductible.

I'm sort of politely calling bullshit and asking them to prove it.

NoOneMan

(4,795 posts)Of course, some levels will induce more self-rationing than others.

But if we want universal care and positive outcomes, why do we need all these bullshit different plans?

Pretzel_Warrior

(8,361 posts)NoOneMan

(4,795 posts)And yes, very familiar.

Pretzel_Warrior

(8,361 posts)that their good health will mean they don't use any services other than, say, wellness checks. Or, someone with higher likelihood of healthcare needs can pay higher premiums and have significantly lower deductible. This will ensure they don't have as much sticker shock if they do have a lot of health issues in the year that they would have to largely pay for until they hit a high deductible.

It provides choice based on a person's own assessment of their situation.

NoOneMan

(4,795 posts)How about the probablility of not getting sick so you dont get insurance?

And BTW, beyond risk, disposable income also impacts their bets

Pretzel_Warrior

(8,361 posts)in the hopes of bettering their lot in life. it may turn out that way or they may just be saddled with years of debt.

same with someone starting a business or choosing to take the 405 instead of the 5 on their commute.

Life is full of choices and "gambles".

NoOneMan

(4,795 posts)I think thats why Im a fan of a single plan with no deductible and copays. In fact, your view is preposterous in my opinion. It takes all kinds

NoOneMan

(4,795 posts)I think this tiered system creates some strange psychosis that tears the soul out of the concept of just taking care of the sick. Now its about craps tables, self-rationing, tiered care and deductibles that keep sick people at home. Frankly its disgusting to think about. Sorry I brought it up. I don't think the US people are ready for a real system yet

arely staircase

(12,482 posts)Always has. Do you not know this. I wont be participating in the exchange because I am lucky to have insurance through my employer. I pay very low monthly rates but have a high deductible. I could pay more and have a low deductible. Nothing new here.

Cal Carpenter

(4,959 posts)Exactly.

NoOneMan

(4,795 posts)Some systems simply pay for all sick people to be treated, funded progressively from each according to their ability

arely staircase

(12,482 posts)because it can't cost more than 10 percent of your income.

moriah

(8,311 posts)Hopefully they're being smart and combining that low-cost, high-deductible plan with a health savings account, so that the first year they have to touch their deductible they don't cry.

NoOneMan

(4,795 posts)But then we were told we have to increase the pool size. Why are we segmenting the pool and weakening it by sharding it up?

Those who don't use care? They don't get in car accidents or get the flu?

moriah

(8,311 posts)It's not the flu that's going to bankrupt a person without insurance (unless they're like me and get double pneumonia in a week of having the flu), it's the car wreck that exceeds the maximum bodily injury claims for liability in your state. (Most insurance excludes costs from car accidents unless you allow them to subrogate and sue the driver's insurance on your behalf.)

NoOneMan

(4,795 posts)And then not create a system where bronzen menshen have to choose between food and surgery

moriah

(8,311 posts)... they're going to be on a plan with a cost-sharing reduction, because they will be low enough income to have purchased a Silver plan through the exchange with subsidies.

Now, I would HATE to be in a position where I had to take out a second mortgage on my home to pay for a knee replacement. But if I had a home to take a second mortgage out on, I'd hopefully have some other ways to fund it immediately -- like a good enough of a credit rating to get a CareCredit account and pay it off in a year interest free. (I had one, back in the day, for my cat's vet bills -- they really weren't a bad deal if you paid them off on time.)

Pretzel_Warrior

(8,361 posts)will pay a premium every single month and use virtually no health care for multiple years. That was certainly true of me in my 20's and most of my 30's. Their premiums will go toward helping the high users of health care have more reasonable costs. See? That is what it means to widen the risk pool, etc. etc.

Logical

(22,457 posts)Your out-of-pocket maximum for a Silver plan (not including the premium) can be no more than $12,700. Whether you reach this maximum level will depend on the amount of health care services you use. Currently, about one in four people use no health care services in any given year.

Not sure how accurate this is.

ScreamingMeemie

(68,918 posts)for Gold were much higher than those for Silver.

The other thing that people need to be very, VERY careful about is selecting a plan that has providers participating. I could not find any of the BC/BS Advantage plans with providers in my city (Houston). Very strange. Humana (the plan I went with) had tons.

DevonRex

(22,541 posts)IF you qualify for them. You get the same level of care, if you qualify, as you would in Gold and Platinum plans but you pay less in the way of deductibles, copays, etc. But you have to buy the Silver Plan to get the savings.

If you qualify for out-of-pocket savings, you must choose a Silver plan to get the savings. If you qualify for these savings, you'll get the out-of-pocket savings benefits of a Gold or Platinum plan for a Silver plan price. You can choose any category of plan, but you'll get the out-of-pocket savings only if you enroll in a Silver plan.

You'll be able to choose your plan category when you fill out your Marketplace application.

https://www.healthcare.gov/will-i-qualify-to-save-on-out-of-pocket-costs/

That link tells you all about it. And note all the links in the page. And the search bar at the top. You can search for terms and just about any question. I've been doing it all week. ![]()

ScreamingMeemie

(68,918 posts)We're basically going with the Humana Silver plan. It's a $1800/2900 max. With the 20% coinsurance for hospitalization, 25 copays for Dr. visits, etc. It's a good, solid plan. ![]()

DevonRex

(22,541 posts)Thanks for sharing those plans below. It couldn't get better than that. Some will roll the dice on the bronze for a low premium but they can't say they didn't have the information upfront. ![]()

ScreamingMeemie

(68,918 posts)linked. You could spend hours researching. ![]() (and I was a naysayer)

(and I was a naysayer)

Ms. Toad

(34,074 posts)regardless of the plan. So I'm guessing that the OP's brother is subsidized slightly (bringing it down from $12,700 to $10,000 for max out of pocket), and that the deductible is considerably lower.

Yo_Mama

(8,303 posts)ACA family out of pockets generally run around 12K. But the 70/30 silver split can be handled by any distribution of deductible and copayments, so they vary. The higher the deductible portion, the lower the premium.

In my home county in GA (Lowndes), for example, for a family with two kids, parents aged 50 and 52, non-smoking, there are various silver options, but the lowest premium is $1,445 a month and all the rest have monthly premiums above $1,500. But these are all real insurance - the highest premium has a $5,000 deductible, 10% coinsurance and an out-of-pocket maximum of $9,000, for a monthly premium of $1,568. The lowest has a $6,000 deductible, 10% coinsurance and an out-of-pocket maximum of $7,200 for $1,445 a month.

The lowest premium plan this family can buy on the exchange (and avoid the fine, I think) has a $986.00 monthly premium with a $12,700 deductible, no coinsurance. Once you pay $12,7000 in medical costs, the rest is paid for you. Coverages are of course the same. But $500 a month is $6,000 over the course of the year, so actually it makes financial sense to buy the "catastrophic" plan. If you do not have medical expenses you always come out ahead, and if you do you about break even. Plus, the money you save on premiums can be used to pay your medical costs.

The bronze plans have family deductibles of over 10K.

Higher income families without the subsidy will only be able to buy bronze or catastrophic policies.

If this same family had an income of 70K rather than 95K, they would be able to get the best silver plan ($1,568 base premium) for $608 a month. A lot of people with their own businesses and families are just going to stop making as much, to be honest with you. Between the taxes and the higher premium cost, it pays you to work less.

Cost-sharing kicks in at lower incomes and drops the deductibles and copayments.

VanillaRhapsody

(21,115 posts)My friend with a $20,000 a year job (using her gross income) can get healthcare total silver plan for $57 a month when paid over 12 months. Her out of pocket estimate for 2014 total is $5700 and subsidies will pay her $5200. So in the end...she pays nearly NOTHING for healthcare for the year. AND this is a state that didn't expand Medicaid (South Carolina)! If Nikki Haley extended Medicaid she would be eligible for that practically free if not totally.

BTW, her $20,000 a year salary is considered 150% poverty.

So our friend got it wrong.

Logical

(22,457 posts)Ms. Toad

(34,074 posts)DevonRex

(22,541 posts)DURHAM D

(32,610 posts)pnwmom

(108,978 posts)rather than your deductible?

bluestate10

(10,942 posts)ScreamingMeemie

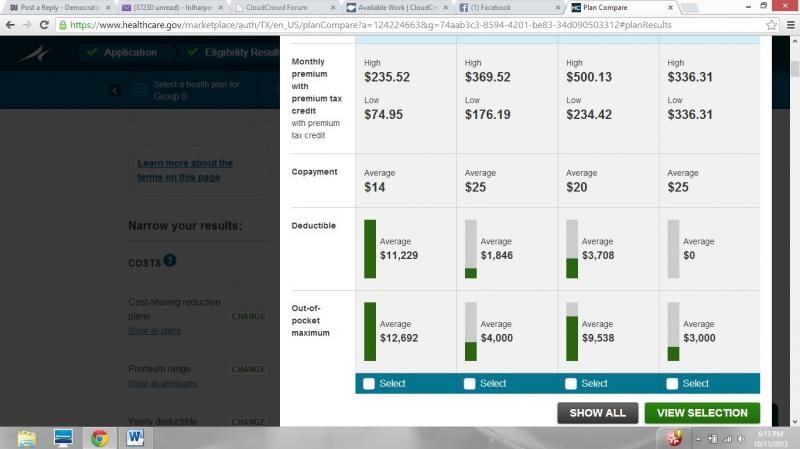

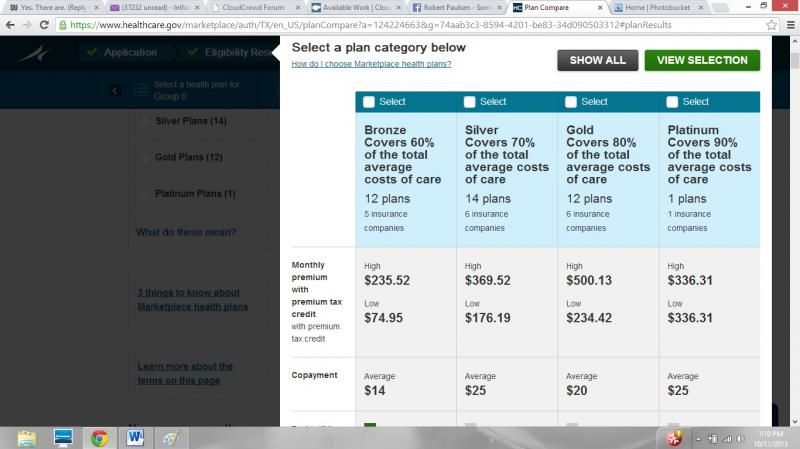

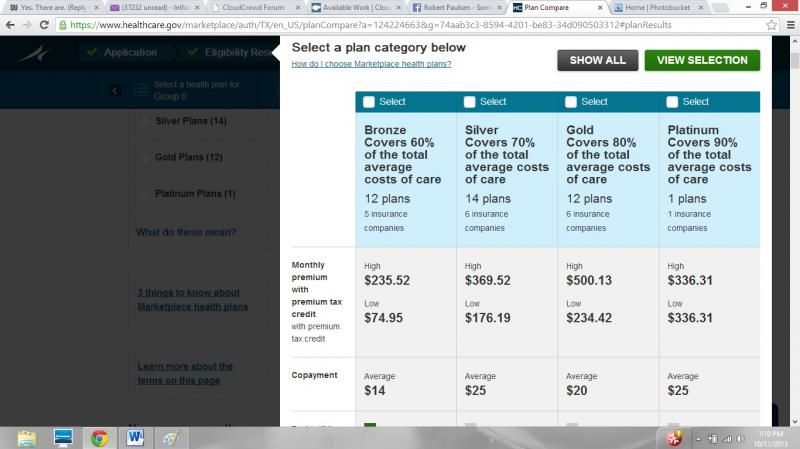

(68,918 posts)

This is in Texas.

Pretzel_Warrior

(8,361 posts)Logical

(22,457 posts)MiniMe

(21,716 posts)We really have no idea what we are looking at

ScreamingMeemie

(68,918 posts)I can answer any question, and provide a snapshot. I've got my screen pulled up still.

MiniMe

(21,716 posts)ScreamingMeemie

(68,918 posts)

It's the overview of all the plans I can enroll in. I can choose to view them all or select the ones I'd like to compare.

MiniMe

(21,716 posts)I haven't gotten to the web site yet, and without the headers I had no idea what I was looking at.

ScreamingMeemie

(68,918 posts)Hope you get in soon. It is frustrating, but once I cleared my cache (I have to do that each time I want to get in) it worked for me on Chrome. The sooner everyone can access, the better.

Schema Thing

(10,283 posts)ScreamingMeemie

(68,918 posts)Ms. Toad

(34,074 posts)I'd like to see what it is that makes the difference. I'd suspect the left plan is the catastrophic one, except for the premium rate. Is it by insurance company? In which case, the one on the left probably won't get much business.

ScreamingMeemie

(68,918 posts)The left is the Bronze plans.

I've picked the Silver Plan that is listed at $176.19. I haven't pulled the trigger yet, but I'm 90 percent certain.

Ms. Toad

(34,074 posts)Look at your bills for the last few years. In our family, if we had a choice between a low deductible at $176.19 and a high deductible at $369.52 it might well be worth the additional $2300 in premium costs to buy the high deductible.

ScreamingMeemie

(68,918 posts)RA patient who hasn't had a treatment in over 4 years. Typical blood pressure runs 200/100-something. Tachycardia...basically lucky I held out long enough for this. Ran over it with a friend who is an insurance agent; decided this was for the best.

Ms. Toad

(34,074 posts)Since the averages you posted earlier has some high deductibles for the silver plans, it wasn't clear what the deductible was. I thought you might be going for cheapest high deductibel, which isn't necessarily the best option.

We're not on the exchanges, but we've got the same issue in our employment related plan. A difference in out of pocket maximum of $3000 can be purchased for about $2700. I think we'll hit the out of pocket max - either way, so we save $300 by buying it down. But they threw in the wrinkle that the prescriptions (about 1/3 of our costs) are not merged with the medical out of pocket. So it is a more complicated calculation.

Response to ScreamingMeemie (Reply #62)

darkangel218 This message was self-deleted by its author.

bluestate10

(10,942 posts)Subsidies are based upon income. If your brother makes more than the amount needed to qualify for subsidies and don't have savings something is wrong with how he plans his finances.

I haven't see a deductible of $10,000. Something sounds wrong about your information based upon what I have seen. Can you produce screen captures to buttress your claims?

VanillaRhapsody

(21,115 posts)A single person with a $20,000 a year job is 150% of poverty. If your provided health insurance is more than 9.5% of your salary...you qualify for subsidies through the exchange.

Logical

(22,457 posts)you saying maybe his subsidies may cover the deductible also? That would be good news.

Ms. Toad

(34,074 posts)at least to lower the out of pocket max.

Logical

(22,457 posts)Logical

(22,457 posts)Motown_Johnny

(22,308 posts)How many are in the family?

No way to know if you are missing something when you give us no information.

ileus

(15,396 posts)Remains the #1 focus...

Single payer now! Not some bullshit insurance exchange.

quinnox

(20,600 posts)I'm sure everyone has an extra 5k to 10k laying around a spare room in their mansions, so no big deal. ![]()

kestrel91316

(51,666 posts)Only the bronze is higher, and it's not anywhere NEAR $10k for a one person policy.

I can only buy that $10k if it's for a family of at least 3.

What state is your brother in? How many people in the family?

Any of them smokers? Ages? Income?

Without all that it's impossible to have any idea if he's even telling you the truth.