General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWe talk about entitlement cuts as something that could happen. they already have

and more are proposed. The Sequester has cut entitlements as well as such programs as Head Start.

And all of those who poo poo the President supporting a chained CPI? For pete's sake, it's in his 2014 budget.

Cuts to Medicaid, Medicare, Social Security and more are coming.

http://nationalpriorities.org/analysis/2013/president-obamas-fiscal-year-2014-budget/

http://www.csmonitor.com/Business/Robert-Reich/2013/0411/Obama-budget-Why-entitlement-cuts-are-a-grand-bargain-we-don-t-need

If the repukes weren't so insane, arrogant and greedy, they'd acknowledge that they're getting most of what they've been demanding.

global1

(25,251 posts)So when will they start taking credit for the effect of all these cuts on the economy.

The President has been touting some of the positive things that are happening to the economy. I'm thinking it won't be long before the Repugs will start saying all these good things are happening to the economy because they've force and fought for them.

ProSense

(116,464 posts)universal Pre-K, which was recently advocated by Bill de Blasio http://www.democraticunderground.com/10023459112

On the President's plan.

By Dylan Matthews

President Obama used his State of the Union address to launch a push for massively expanding pre-K and other early childhood education programs. But he was pretty vague about it. Not anymore. At 6 a.m. today, the administration released its detailed plan for early childhood education. Its three main components are:

- A state-federal partnership to guarantee pre-K to all 4-year-olds in families at or below 200 percent of the poverty line, to be provided by school districts and other local partners, and to use instructors with the same level of education and training as K-12 instructions.

- A massively expanded Early Head Start program — building on the existing program, which has proven very effective in randomized controlled trials — which provides early education, child care, parental education, and health services to vulnerable children ages 0 to 3.

- Also expanding Nurse Family Partnerships, a program that has also earned top marks in randomized trials, and which provides regular home visits from nurses to families from pregnancy through the child's second birthday, intended to promote good health and parenting practices. update - it appears that the White House program is broader than just NFPs but the general practice is the same, if less well-evaluated. Sorry for the confusion

Upon opening the plan for the first time (while on the phone with me) Nobel laureate and early childhood education expert James Heckman exclaimed "Holy smokes!" in approval. Your mileage may vary — see the full plan outline, courtesy of the White House, below.

- more -

http://www.washingtonpost.com/blogs/wonkblog/wp/2013/02/14/read-obamas-pre-k-plan/

"Holy smokes!" President Obama Releases Full Pre-K Plan

http://www.democraticunderground.com/10022372550

More on the President's budget:

<...>

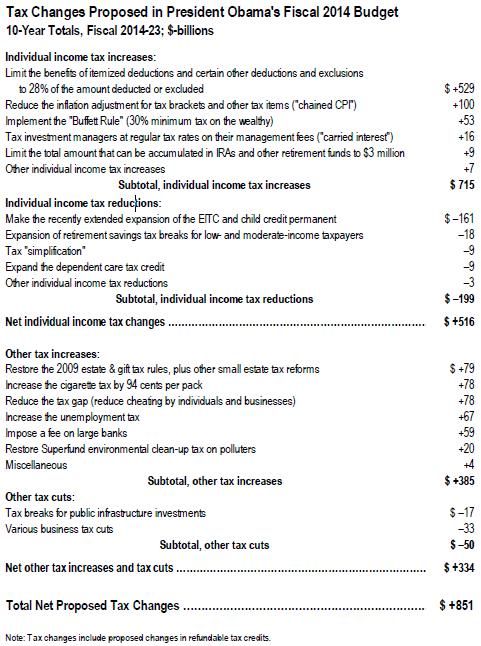

Here are the percentage changes in federal taxes that Obama proposes over the upcoming decade by type of tax:

■ Personal income taxes, mostly on the wealthy, would go up by 4 percent.

■ Corporate taxes would increase by 1 percent.

■ Excise taxes would increase by 10 percent.

■ Estate and gift taxes would go up by 40 percent.

In total, federal revenues would increase by 2.8 percent over 10 years.

Except for the excise tax increases (mainly almost a $1 per pack tax hike on cigarettes), most of the President’s proposed net tax increases would fall on the very well off.

- more -

http://ctj.org/ctjreports/2013/04/president_obamas_tax_proposals_in_his_fiscal_2014_budget_plan.php

http://ctj.org/images/2013/obamafy2014budget.pdf

Posted by

CNN White House Producer Adam Aigner-Treworgy

Washington (CNN) – Buried deep inside President Obama's 2014 budget released on Wednesday is a new proposal to expand federal health insurance benefits to same-sex domestic partners.

Framed as a measure to reduce the deficit, the proposal would amend the Federal Employee Health Benefits Program beginning in 2015 to add a "self plus one" enrollment option in addition to the "self" and "family" options. Like the Domestic Partnership Benefits and Obligations Act that the administration has endorsed in prior budgets, this new FEHB formulation would work within the current legal constraints of the Defense of Marriage Act by adding a new classification for additional enrollees beyond family.

<...>

According to language in the budget, the proposed changes would allow the OPM to contract with "modern types of health plans rather than being limited to the current four statutorily-defined plans reflective of the 1950s insurance market."

"The health insurance marketplace has changed significantly since the FEHBP was enacted in 1959, and the current governing statute leaves little flexibility for the program to evolve with the changing market," the budget reads.

- more -

http://politicalticker.blogs.cnn.com/2013/04/10/obama-budget-adds-domestic-same-sex-partners-to-obamacare/

http://www.whitehouse.gov/omb/budget/factsheet/strengthening-the-economy-for-the-lgbt-community

Maintains Strong Support for Worker Protection. The Budget includes nearly $1.8 billion for DOL’s worker protection agencies, putting them on sound footing to meet their responsibilities to protect the health, safety, wages, working conditions, and retirement security of American workers. The Budget preserves recent investments in rebuilding DOL’s enforcement capacity and makes strategic choices to ensure funding is used for the highest priority activities.

• Strengthens Enforcement of Wage and Hour and Family Leave Laws. The Budget provides an increase of $3.4 million for the Wage and Hour Division (WHD) for increased enforcement of the Fair Labor Standards Act and the Family and Medical Leave Act, which ensure that workers receive appropriate wages, overtime pay, and the right to take job-protected leave for family and medical purposes. The Budget also provides $5.8 million for WHD to develop a new integrated enforcement and case management system to allow investigators to capture higher quality and more timely data to analyze trends in labor law violations, target investigations and compliance assistance efforts, and evaluate the impact and quality of enforcement.

• Promotes Worker Health and Safety. The Budget provides $571 million for the Occupational Safety and Health Administration (OSHA), allowing OSHA to inspect hazardous workplaces and work with employers to help them understand and comply with safety and health regulations. The Budget includes an additional $5.9 million to bolster OSHA’s enforcement of the 21 whistleblower laws that protect workers and others who are retaliated against for reporting unsafe and unscrupulous practices.

• Protects the Health and Safety of the Nation’s Miners. The Budget provides $381 million for the Mine Safety and Health Administration (MSHA), including additional funding for MSHA’s enforcement programs to enforce and promote mine safety and health laws and to implement recommendations from the Internal Review conducted in the wake of the Upper Big Branch mine disaster.

• Detects and Deters the Misclassification of Workers as Independent Contractors. When employees are misclassified as independent contractors, they are deprived of benefits and protections to which they are legally entitled, such as minimum wage, overtime, unemployment insurance, and anti-discrimination protections. Misclassification, together with the underreporting of cash income for those paid as independent contractors, also costs taxpayers money in lost funds for the Treasury and in Social Security, Medicare, the Unemployment Trust Fund, and State programs. The Budget includes approximately $14 million to combat misclassification, including $10 million for grants to States to identify misclassification and recover unpaid taxes and $4 million for personnel at WHD to investigate misclassification.

- more -

http://www.whitehouse.gov/sites/default/files/omb/budget/fy2014/assets/labor.pdf

By ANNIE LOWREY

The great economic focus of the White House, the financial crisis and recession aside, has been inequality...The Obama budget proposal released Wednesday, like other White House budgets before it, also emphasizes the problem of inequality and the failure of the American economy to promote a thriving middle class.

<...>

The budget includes several proposals to tackle inequality and wage stagnation.

- Increasing the federal minimum wage to $9 an hour from its current rate of $7.25, and indexing it to inflation. The White House asserts that this would lift the wages of about 15 million low-wage workers.

- Creating a “Preschool for All” initiative to provide early childhood education to 4-year-olds from low- and middle-income families. The big idea is that this might improve economic mobility in the future.

- Increased taxes on wealthy Americans, including taxing carried interest as ordinary income. Hedge-fund managers and the like use the carried interest loophole to pay preferential rates on their earnings.

- Increased support for manufacturing, which the White House argues might be an important source of middle-class jobs.

- Making permanent the expansion of the earned income tax credit and child credit, which were due to expire in 2017. The proposal also makes permanent the American Opportunity Tax Credit, which helps families with students pay for college.

You might not think that the Affordable Care Act had much to do with inequality – it is a health care bill, after all – but it did. Rising insurance costs have eaten away at workers’ wages; the law has a number of provisions to try to bend the cost curve. Medical bills are a primary driver of bankruptcy for middle-class families; the law removes the lifetime benefit limit, ends denial of coverage for pre-existing conditions and contains other rules that might help reduce the number of bankruptcies.

Moreover, the law provides free or low-cost access to health coverage to tens of millions of Americans, financed by the government. That might not address the problem of income inequality. But it does address the problem of consumption inequality and perhaps even economic mobility.

- more -

http://economix.blogs.nytimes.com/2013/04/10/a-budget-focus-on-inequality/

Posted by Sarah Kliff

Brad wrote earlier this week about how pharmaceutical companies were one of the biggest losers in President Obama’s budget. This BGov graph shows how much, exactly, they’re losing by — a lot.

The Obama budget cuts for pharmaceuticals work out to $164 billion, just under half the total health-care budget cuts the president is seeking.

Most of this grows out of the White House proposal to change the way Medicare pays for drugs to make it look more like the Medicaid program...Medicaid gets a great deal on drugs: Pharmaceutical companies must sell prescriptions to the entitlement program at the very best price they offer private insurance plans, or 23.1 percent lower than the average price...The Office of the Inspector General at Health and Human Services estimates that the provision has reduced Medicaid spending on drugs by 45 percent.

Medicare Part D, which covers prescriptions for seniors, does have the power to negotiate with drug companies. But that same OIG report found that that tends to lead to smaller discounts: 19 percent vs. the 45 percent reduction that Medicaid receives.

- more -

http://www.washingtonpost.com/blogs/wonkblog/wp/2013/04/12/obama-budget-is-a-disaster-for-drugmakers/

http://www.democraticunderground.com/10022807040

cali

(114,904 posts)<snip>

President Obama's position is much closer to this than many of his critics and supporters may suspect. For example, Obama's 2014 budget included cuts in Medicare payments to healthcare providers, and raises funds by requiring greater payments by its beneficiaries. The President also proposed cutting Medicaid. He also proposed linking Social Security Payments to a chained measure of CPI, which would slow the benefits growth.

<snip>

http://seekingalpha.com/article/1738312-what-next-for-u-s-fiscal-policy-a-dispassionate-discussion

'Chained CPI' Worked Into Obama's 2014 Budget

<snip>

the budget calls for new spending on early childhood education and infrastructure. It identifies cuts and a variety of targeted tax increases. But of all the things President Obama imagines in this $3.8 trillion plan, the items that really got members of Congress talking are his proposed changes to Social Security and Medicare. Changes that he says were championed by Republican members of Congress.

PRESIDENT BARACK OBAMA: And I don't believe that all these ideas are optimal, but I am willing to accept them as part of a compromise, if - and only if - they contain protections for the most vulnerable Americans. But if we're serious about deficit reduction, then these reforms have to go hand in hand with reforming our tax code.

KEITH: The White House estimates changing the way the cost of living is adjusted for Social Security payments and the rest of the government would reduce the deficit by more than $200billion dollars over the next decade. In economic short-hand, it's called chained CPI. For many Democrats, particularly progressives, this idea violates a campaign promise to protect Social Security and the middle class

<snip>

http://www.npr.org/2013/04/11/176880579/chained-cpi-worked-into-obamas-2014-budget

Top 5 Things to Know About President Obama’s 2014 Budget

This week President Obama released his fiscal 2014 budget proposal, which set a record for arriving two months after the legal deadline of the first Monday in February. Here are the top five things to know about the new budget.

5. The president’s budget would reduce Social Security cost-of-living adjustments through “chained CPI.”

President Obama became the first Democratic president ever to propose reductions in Social Security benefits by endorsing an alternate measure of inflation –- known as chained CPI –- to shrink cost-of-living adjustments for retirees. The president plans to save $230 billion over 10 years through this change. Nearly 90 percent of Americans oppose cuts to Social Security.

<snip>

1. The budget includes $3.8 trillion in new spending and achieves deficit reduction with a 2.5-to-1 ratio of spending cuts to new tax revenue.

In total, the president’s budget projects $3.8 trillion in spending for fiscal 2014 and plans for $1.8 trillion in deficit reduction over the coming decade. Together with $2.5 trillion in deficit reduction already enacted, the president is proposing a total deficit reduction package heavily tilted toward reducing spending, with a 2.5-to-1 ratio of spending cuts to new tax revenue.

<snip>

http://billmoyers.com/2013/04/11/top-5-things-to-know-about-president-obamas-2014-budget/

http://billmoyers.com/2013/04/11/top-5-things-to-know-about-president-obamas-2014-budget/

cali

(114,904 posts)"what? No answer? I'm shocked"

...here is what you stated in the OP: "The Sequester has cut entitlements as well as such programs as Head Start. "

To which I responded: The President proposed universal Pre-K, which was recently advocated by Bill de Blasio http://www.democraticunderground.com/10023459112

You then asked: are you denying that his 2014 budget proposes the chained CPI?

Where did you get that from my comment?

Also, Head Start isn't an "entitlement."

FYI: The Senate budget ends sequestration and rejected chain CPI.

The Senate budget, which ends the sequestration, is being blocked. The spending levels are lower than when first proposed (and the comparisons are being made based on that), but the proposals are completely different. Warren talks about it here.

This piece is from July 1:

By Alan Pyke

Monday marks 100 days since the Senate passed a budget amid bipartisan praise of the open process. But initial Republican eagerness to work on a budget has given way to the obstructionism that’s defined the Senate minority under Minority Leader Mitch McConnell (R-KY).

Over the past hundred days, Republicans have blocked 15 separate attempts to go to a budget conference with the House of Representatives. Now that the House and Senate have passed their own versions, each is supposed to appoint representatives to a committee that reconciles them into one bill that can be passed by each body and signed by the president.

The handful of Republicans who are blocking a conference on the 2014 budget cite a variety of reasons, including fears that the conference agreement would include a deal preventing another debt ceiling crisis. Sens. Rand Paul (R-KY), Ted Cruz (R-TX), Mike Lee (R-UT), and Marco Rubio (R-FL) have insisted that the conferees be barred from addressing the debt ceiling, which needs to be increased by this fall to avoid a catastrophic default on U.S. obligations. McConnell, who has praised the use of the debt ceiling as a pressure point for extracting spending cuts despite the tactic’s negative impact on the nation’s credit rating, is one of many prominent Republicans who demanded “regular order” on the budget. In January, he called for a speedy budget conference because “that’s how things are supposed to work around here.”

Yet McConnell has joined the Cruz/Paul/Rubio wing of his caucus in blocking progress on the budget over the past 100 days. Spokespeople for the Republican Senate leader did not respond to multiple requests for comment on Monday, but by joining with members like Paul he’s wrapped his arms around the obstructionists’ spin. According to a sign Paul’s staff whipped up for a May floor speech, they’re “Preventing A Back Room Deal To Raise The Debt Limit” and counting the days without budget conferees as a mounting victory.

- more -

http://thinkprogress.org/economy/2013/07/01/2241941/republican-obstruction-of-budget-process-hits-100th-day/

That budget includes $100 billion in infrastructure spending.

The budget includes $100 billion of immediate infrastructure spending designed to boost the economy and raise $975 billion over the next decade through tax reform, which would eliminate various loopholes and tax expenditures.

http://tpmdc.talkingpointsmemo.com/2013/03/senate-passes-budget-after-all-night-debate.php

From American Progress, link to Senate's "comprehensive budget": http://www.budget.senate.gov/democratic/index.cfm/files/serve?File_id=85472b9c-d850-41bd-91df-94a68aa5d5ff

This budget replaces sequestration responsibly and invests in job creation to help families and the economy right away. It tackles our growing national deficits in education, infrastructure, and innovation to make sure we are laying down a strong foundation for broad-based economic growth for years to come. And it absolutely rejects a return to the failed trickle-down economic policies that devastated the middle class and led us to the Great Recession.

<...>

WASHINGTON, March 22 – The Senate tonight voted to block cuts in benefits for Social Security and disabled veterans.

The amendment by Sen. Bernie Sanders (I-Vt.) put the Senate on record against changing how cost-of-living increases are calculated in a way that would result in significant cuts.

“The time has come for the Senate to send a very loud and clear message to the American people: We will not balance the budget on the backs of disabled veterans who have lost their arms, their legs and their eyesight defending our country. We will not balance the budget on the backs of the men and women who have already sacrificed for us in Iraq and Afghanistan, nor on the widows who have lost their husbands in Iraq and Afghanistan defending our country,” Sanders said.

The amendment opposed switching from the current method of measuring inflation to a so-called chained consumer price index. President Barack Obama favors a chained CPI as part of what the White House calls a “grand bargain” that Obama hopes to reach with congressional Republicans.

The proposed change would affect more than 3.2 million disabled veterans receiving disability compensation benefits from the Department of Veterans Affairs. Veterans who started receiving VA disability benefits at age 30 would have their benefits reduced by $1,425 at age 45, $2,341 at age 55 and $3,231 at age 65. Benefits for more than 350,000 surviving spouses and children who have lost a loved one in battle also would be cut. Dependency Indemnity Compensation benefits already average less than $17,000 a year.

More than 55 million retirees, widows, orphans and disabled Americans receiving Social Security also would be affected by the switch to a chained CPI. That figure includes 9 million veterans with an average yearly benefit of about $15,500. A veteran with average earnings retiring at age 65 would get nearly a $600 benefit cut at age 75 and a $1,000 cut at age 85. By age 95, when Social Security benefits are probably needed the most, that veteran would face a cut of $1,400 – a reduction of 9.2 percent.

A chained CPI would cut Social Security benefits for average senior citizens who are 65 by more than $650 a year by the time they are 75 years old, and by more than $1,000 once they reach 85.

Groups supporting Sanders include AARP, the AFL-CIO, National Organization for Women, the American Legion, Veterans of Foreign Wars, Disabled American Veterans, AMVETS and others.

Sanders is chairman of the Senate Committee on Veterans’ Affairs and the founder of the Defending Social Security Caucus.

http://www.sanders.senate.gov/newsroom/news/?id=41f5d32d-b4bf-4f0e-9ceb-7df622262cac

There was no doubt that this had no chance of passing the Senate, and I doubt its chances have improved.

White House Press Secretary Jay Carney lauded the Senate for passing a budget early Saturday, its first in four years, which he said "will create jobs and cut the deficit in a balanced way." He also criticized the House for passing a budget that eliminates the deficit over the next ten years entirely through cuts, saying that "We will continue to insist that any solution has balance."

The full statement below:

Today, the Senate passed a budget plan that will create jobs and cut the deficit in a balanced way. Like the President's plan, the Senate budget cuts wasteful spending, makes tough choices to strengthen entitlements, and eliminates special tax breaks and loopholes for the wealthiest Americans to reduce the deficit.

The President and Democrats in Congress are willing to make difficult choices so we can cut the deficit while laying the foundation for long term middle class job growth. And it is encouraging that both the Senate and House have made progress by passing budgets through regular order. We will continue to insist that any solution has balance. The House Republican budget refuses to ask for a single dime of deficit reduction from closing tax loopholes for the wealthy and the well-connected but instead makes deep cuts to education and manufacturing while asking seniors and the middle class to pay more. That's not an approach we support and it's not an approach the majority of the American people support.

Now it is time for our leaders to come together to find common ground. The President has put a plan on the table that reflects compromise, and he will continue to work with both sides to see if there is an opportunity to reach a solution to our budget challenges. We hope we will find this compromise because that is what the American people expect and what they deserve.

http://livewire.talkingpointsmemo.com/entry/white-house-praises-senate-budget

http://www.democraticunderground.com/10022558947

cali

(114,904 posts)continues unabated.

You appear completely incapable of giving straight forward answer- to anything whatsoever.

ProSense

(116,464 posts)sabrina 1

(62,325 posts)SS cut known as the Chained CPI yet? He has shown now that he can stand up Republicans. So has he withdrawn SS cuts from the table?? I think that is what this OP is about.

ProSense

(116,464 posts)"What about Seniors? Has the President stated that he will not support the

SS cut known as the Chained CPI yet? He has shown now that he can stand up Republicans. So has he withdrawn SS cuts from the table?? I think that is what this OP is about."

...I have seen any reports in the news with comments from the President on the subject. Have you?

sabrina 1

(62,325 posts)to compromise with radicals on important issues anymore, that they will take a stand on this most important issue which has so many consequences for so many of the most vulnerable people.

We'll see, I would like Democrats to explain to the people right now what the Republicans are demanding. SS is one of the most popular programs across the political spectrum as was demonstrated even under Bush's failed attempts to assault it. I suspect the President would receive huge support for trying to protect it from the radical Right at this point.

ellenrr

(3,864 posts)are "on the table".

cali

(114,904 posts)sabrina 1

(62,325 posts)to compromise with the Far Right Radicals in order to get anything done. Now that Dems have learned that the best way to deal with bullies is to stand up to them, as we kept saying btw, I am assuming he no longer feels obligated to allow them to cut SS benefits, especially since it will do zero to lower the deficit.

Not to mention what a winner it would be for them to inform the American people of this stealth attempt to cut SS benefits and once again become the Party that protects SS.

But I've seen nothing about it which seems odd as this is a huge issue for a whole lot of people, as big an issue as HC actually.

fredamae

(4,458 posts)speaking - The Dems need to be Very careful that they too don't face a back-lash-right now Dems are unified and strong after 5 Years of caving and capitulation - until Now- they've Agreed through their votes, With the GOP and we Suffer their choices-People are Pissed Off at these Consequences and Will contract their consideration and loyalty of Party preference, and just stay Home. Now add that Anger to Voting Restrictions and they too will allow Defeat to be snatched from the jaws of Certain Victory...imo Doing the Correct and Noble thing Once does Not Erase the pain rendered upon Us in the Not too distant past.

Obama has Nothing to lose---He's not running again.

The Democrats must go forward carefully - They're still on Very thin Political ice, imo.

leftstreet

(36,108 posts)Good post

fredamae

(4,458 posts)DC Pols-yours, mine, theirs Often....and I do tell them. It goes something like this:

We pay taxes to support social services programs. We have a reasonable expectation to anticipate a Return on those collective investments when necessary and needed. It is your job to protect and enhance them, assuring us that our services are adequately meeting our needs.

In reality both Entitlement and Earned Benefits are fact. The GOP, otoh, has been allowed, by Not getting called out for sullying the term "Entitlement" to get away with this inaccuracy to elicit a negative and biased public response-so it is up to you to change the narrative-to correct "them" for we are indeed "Entitled to expect adequate returns From our Earned Benefits" Programs when and if needed.

ellenrr

(3,864 posts)was $127/month. says the average decrease will be $36.

I wish that my situation of monthly income of soc sec $900/month was the worst there is, but as we know, I am far from the worst off.

I feel like I've been kicked in the stomach, for myself, and more for the children. This is generations being handicapped forever by poverty and deprivation.

cali

(114,904 posts)fredamae

(4,458 posts)of what you're going through. I know I have not given up hope-the Dem Wing of the Dem Party aka: "THE LEFT" is on the rise...I just hope the good they do arrives in time for all who are in such unneeded and unnecessary pain caused over constant, repulsive, unrelenting manufacture of a non-existent state of crises fueled by the selfishness of the collective body of "representatives" in the Bubble of the DC elitist class/wings of both party's..