Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsSocial Europe Journal: Greece: There will be Blood

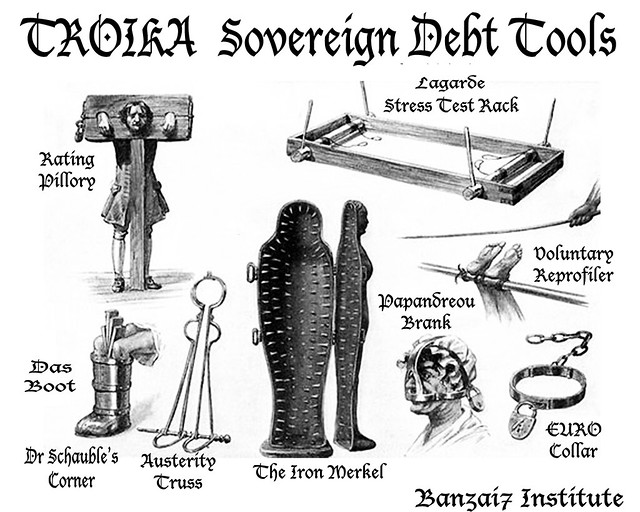

http://www.social-europe.eu/2012/02/greece-there-will-be-blood/The almost nightly dose of television horror about Greece is hard to watch, and must be nearly unbearable for Greeks themselves — but it is going to get even worse. Even if the current ‘bailout’ package is approved by the troika (EU/ECB/IMF), Greece is headed towards serious conflict and possibly even a military coup.

First, let’s be clear that the ‘bailout’ is not really a bailout of Greece, but rather of the mainly German and French banks. Why? Over the past decade, Germany kept domestic wages flat, helping it to run a massive trade surplus with Greece and other peripheral Eurozone (EZ) countries. These surpluses have been recycled by private banks lending to the periphery (pdf1 http://www.researchonmoneyandfinance.org/media/reports/eurocrisis/fullreport.pdf and pdf2 http://www.researchonmoneyandfinance.org/media/reports/RMF-Eurozone-Austerity-and-Default.pdf ), much in the same way as the 1973/79 oil surpluses were recycled largely through London in the form of highly profitable loans to Latin America. And just as Latin America (and other peripheral countries) suffered a debt crisis in the 1980s, while IMF-imposed austerity designed to repay the debt led to riots and trade union resistance, so we are witnessing much the same thing in the EZ. Nowhere more than Greece has troika-imposed austerity brought such pain, the country’s GDP having fallen by 15 per cent since early 2009 and unemployment affecting nearly half of all youth.

Now that EU banks have cut their exposure http://www.researchonmoneyandfinance.org/media/reports/RMF-Eurozone-Austerity-and-Default.pdf to Greek debt, Germany and others are having second thoughts http://www.nytimes.com/2012/02/16/world/europe/doubting-greeks-resolve-euro-zone-may-hold-back-full-bailout.html about Greece staying in the euro. http://ftalphaville.ft.com/blog/2012/02/21/888981/get-greece-out/ Whether it happens in the coming weeks or months, a decision by the troika that Greece is in breach of its loan obligations could lead to the ECB halting its weekly refinancing operations with the Central Bank of Greece thereby forcing an immediate Greek default. It is generally agreed that if default leads to contagion in the EZ, the economic consequences for the EU could be disastrous. http://www.guardian.co.uk/commentisfree/2012/feb/12/grexit-greek-default-catastrophic-consequences

Less satisfactorily examined are the internal political consequences http://www.guardian.co.uk/commentisfree/2012/feb/16/what-europe-loses-if-greece-forced-out of a Greek default. Greece is a relatively weak state, having been run since 1974 alternately by the two populist parties which retained power largely through patronage and corrupt practices: the centre-right New Democrats under the Karamanlis family and the centre-left PASOK under the Papandreou succession. The general election in April will almost certainly show these mainstream parties to be thoroughly discredited as a result of ‘austerity’, while in the wings await the Greek Communist Party (KKE) on the left and LOAS (Popular Orthodox Rally), the right-wing headed by the ultra-nationalist Georgios Karatzaferis. Each party has pledged to leave the euro.

snip

-------------------------------------------------

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

2 replies, 1202 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (3)

ReplyReply to this post

2 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

Social Europe Journal: Greece: There will be Blood (Original Post)

stockholmer

Feb 2012

OP

burrowowl

(17,641 posts)1. K&R

CAPHAVOC

(1,138 posts)2. The deal covered the credit default swap problem

No need to worry about the Greeks now.