General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsNYTimes readers comment on government/bank mortgage scam settlement

http://www.nytimes.com/2012/02/10/business/states-negotiate-26-billion-agreement-for-homeowners.html?_r=1#commentsContainer

http://www.nytimes.com/2012/02/10/business/states-negotiate-26-billion-agreement-for-homeowners.html?comments#permid=249

just dont get sick

Princeton

Banks got 7 trillion no questions asked and then they have to give back 25 billion. Government math for ya.

Feb. 9, 2012 at 3:25 p.m.

..................................

http://www.nytimes.com/2012/02/10/business/states-negotiate-26-billion-agreement-for-homeowners.html?comments#permid=247

WlllT26

Durham, NC

If this the best deal the government could get when the President is 'liberal' I shudder to think what would have happened if we had a conservative President.

....................................

http://www.nytimes.com/2012/02/10/business/states-negotiate-26-billion-agreement-for-homeowners.html?comments#permid=242

Mike

Chicago, IL

I'm utterly disgusted by this article. It contains three pages of hype and almost no pertinent facts. This is such a big deal that it could very well set precedents that could make or brake our country. I'm in utter shock how the article flippantly dances around the pertinent details.

Post a PDF of the proposed settlement NYT!!

.....................................

http://www.nytimes.com/2012/02/10/business/states-negotiate-26-billion-agreement-for-homeowners.html?comments#permid=235

Richard J Mullin

NC

A TRAVESTY! Leave it to the politicians to do the bank's bidding and comply with their whining. $26 billion is an insult no matter how it is spun by the administration. It won't hardly make a dent in the total losses sustained by homeowners because of the absolute fraudulent practices of the banks, almost ALL the banks! And to pour salt in the wounds, our wimpy government has agreed not to pursue criminal charges against the bankers.

"Turning the page" seems to be a prevalent philosophy of our hoped for President!

......................................

http://www.nytimes.com/2012/02/10/business/states-negotiate-26-billion-agreement-for-homeowners.html?comments#permid=234

Justin

Atlanta, GA

Homeowners will never see this money. Just like HAMP, loan services such as Bank of America will devise all manner of excuses for why homeowners don't qualify for the relief and endlessly demand paperwork to delay qualification until doomsday. The fundamental fact remains that the servicers will not risk violating their PSAs with investors by modifying mortgages.

.....................................

http://www.nytimes.com/2012/02/10/business/states-negotiate-26-billion-agreement-for-homeowners.html?comments#permid=231

Jim Poplin

Jaffrey, NH

What a false claim. To let the banks get away with destroying the wealth of American Home owners by $7 trillion for a measly $26 billion is a disgrace. I don't know where anyone can get justice in this country. The banks set up a fraud that forced the housing market to skyrocket and perpetuated itself until the entire world financial system was involved. And they are going to be let free of their crimes for fractions of a thousandth of a cent on the dollar for the disaster they created? What are these people thinking? Have they all gone mad?

..................................................

http://www.nytimes.com/2012/02/10/business/states-negotiate-26-billion-agreement-for-homeowners.html?comments#permid=227

Mauricio Torres-Toro

Florida

The law has been sold out. No crimes will be punished and in the end, time will deal with memory and we will all forget that these bank executives ordered and/or were familiar with title wrongdoings, sale induced appraisals, fraudulent mortgage packaging and sales to investors, lying under oath in court, forging documents and signatures, etc, etc, etc.

This is the real bailout by the government for the banks. Now they will be able to retire to their golf courts and enjoy the millions they received in payment for screwing the largest number of Americans ever screwed by anyone including the mob. People who fought the unequal battle of foreclosure and lost their homes to deception, will receive $2,000 in compensation for sleeping in their cars and facing additional hardships for their families. That money will help them to repair their car-home, or pay due bills at a motel. But it won't matter because we are living in the depersonalized era, everyone for himself.

The banks will not lose those billions, you and I will pay that money in higher fees for every little damn thing they can think of.

Maybe I am too much of an idealist, but I did expect some kind of trial and punishment for those people, not institutions, that caused the country to almost collapse. The law does not have to be fair, it just has to be a universal mandate. This time the law was swapped for candy and the cheaters got a free ride to heaven. Hurrah for the government, congratulations to the bankers.

............................

http://www.nytimes.com/2012/02/10/business/states-negotiate-26-billion-agreement-for-homeowners.html?comments#permid=220

Steve B.

USA

He (Obama) said the government will continue to pursue violations of law in the packaging and selling of risky mortgages that led to the crisis.

What a laugh. As we read in the Times only yesterday, banks and their lawyers are thwarting the law with ease For Obama to assert that his administration has pursued violations of law demonstrates how easily he will say anything, regardless of its veracity. Civil penalties for criminal acts are an even bigger fraud upon the ordinary people who live, or used to, on Main Street. Who else in this country can get such a deal?

...........................

http://www.nytimes.com/2012/02/10/business/states-negotiate-26-billion-agreement-for-homeowners.html?comments#permid=203

WillT26

Durham, NC

Illegally taking a families home and then giving them $2000 is not a bail-out. It is an injustice. Last I looked houses in good repair are not selling for $2000. We hold individual people, who may or may not be financially literate, responsible for the actions of mega-banks with tens of thousands of (supposedly) qualified employees. What is wrong with that picture? No one forced the banks to give out lair loans- they chose to do so because they knew that no matter what they woudl come out ahead.

I call that theft. In a country which believes in the rule of law and the equal application of the law such actions, and the people who made them, would be prosecuted.

abelenkpe

(9,933 posts)I'm shocked.

MrCoffee

(24,159 posts)It's real bad.

Tierra_y_Libertad

(50,414 posts)ArcticFox

(1,249 posts)banned from Kos

(4,017 posts)down the Dutch economy. The Free Market has bubbles like gold is in one now.

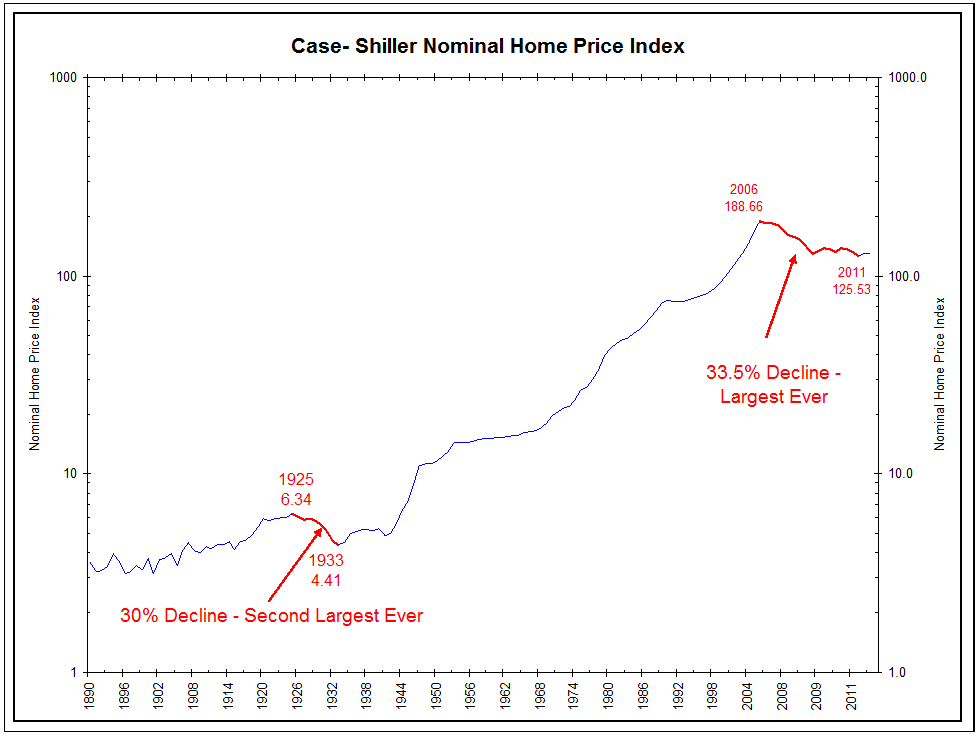

That graph tells the story. (I wish I could post it)

brentspeak

(18,290 posts)

banned from Kos

(4,017 posts)notion that "home prices only go up" is a market characteristic.

The banks made it easy because fees were so fat on mortgage originations.

TARP in OCT 2008 came AFTER the bubble popped. The bubble was market based. The fact is people are looking for an easy solution to a bubble problem.

It will take 30 years for that Case-Shiller Index to recover.

brentspeak

(18,290 posts)Dick Fuld of Lehman (the one big bank that was allowed to go kaput) openly admitted to Congress that he and the rest of Wall St. primed the housing bubble and created securities with the later intention of being bailed-out if necessary.

Nice try at disinfo, though. Gotta hand to you.

Kaleko

(4,986 posts)peddled to the gullible and chronically starry-eyed on this site.

Pfffffft...

"There will always be apologists for the powerful and politically connected who commit crimes."

-Eliot Spitzer

Response to brentspeak (Original post)

emulatorloo This message was self-deleted by its author.