General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsDer Spiegel: It's Time To End the Greek Rescue Farce

Whether it be an escrow account or a budget commissioner, the latest demands by Germany show just how absurd negotiations over Greece's future have become. It is high time to bring an end to this tragicomedy.

For the past two years, Greece has wrangled with the euro-zone states and the International Monetary Fund (IMF) over its so-called "rescue." Austerity measures have been agreed to, aid has been paid and private creditors have been forced to accept "voluntary" debt haircuts. Despite all this, Greece is in even worse shape today than it was then. Its economy is shrinking, the debt ratio is rising and the country and its banks have been cut off from capital markets. There isn't even the slightest sign that the situation might improve. Something has gone very wrong with this rescue.

But none of the protagonists seem to have grasped this. They continue to negotiate as if things are business as usual, they let one "final ultimatum" after the other pass and they persistently fail to realize that their discussions have started to verge on the absurd. It would be a lot better to end this farce.

For weeks now, the Greek government has been negotiating with private creditors and the troika comprised of the IMF, European Union and European Central Bank (ECB) over a second bailout package. But it is already clear that this aid package will not save the country. It appears it will only delay a Greek insolvency -- and it will serve to create new hardships for the country's population. .........(more)

The complete piece is at: http://www.spiegel.de/international/europe/0,1518,813919,00.html

xchrom

(108,903 posts)Kalidurga

(14,177 posts)that austerity measures only made things worse?

Yo_Mama

(8,303 posts)The only recourse is to lighten the load.

Word has it that the ECB is now going to join the latest action with some sort of a write-down of its Greek holdings, but that still isn't enough.

KansDem

(28,498 posts)That why they refused to sell Greek bonds. But Wall Street stepped in and sold Greek bonds by issuing insurance! Now it looks like Wall Street is headed for financial turmoil.

Wait for it: TARP2!!

Yo_Mama

(8,303 posts)They actually bought a lot of them, and then as things developed they backed off and bought insurance.

And the banks have sold a lot of what they had - I think the hedgies have a lot of the short term stuff now. They bought most of them at a very steep discount.

The investment banks and investment/commercial enterprises that write CDS contracts do so for all sorts of investment-graded debt. You can buy CDS for Fannie bonds, for US bonds, for corporate bonds, etc. I know a hedgie who bought a chunk load of contracts on Fannie bonds back in 2008.

In any case, the ECB is managing this by lending big chunks of money to banks that are locked out of the money market, so TARP 2 ain't in the works.

From Robert Reich--

Follow the Money: Behind Europe's Debt Crisis Lurks Another Giant Bailout of Wall Street

The Street’s total exposure to the euro zone totals about $2.7 trillion. Its exposure to to France and Germany accounts for nearly half the total.

And it’s not just Wall Street’s loans to German and French banks that are worrisome. Wall Street has also insured or bet on all sorts of derivatives emanating from Europe – on energy, currency, interest rates, and foreign exchange swaps. If a German or French bank goes down, the ripple effects are incalculable.

Get it? Follow the money: If Greece goes down, investors start fleeing Ireland, Spain, Italy, and Portugal as well. All of this sends big French and German banks reeling. If one of these banks collapses, or show signs of major strain, Wall Street is in big trouble. Possibly even bigger trouble than it was in after Lehman Brothers went down.

That’s why shares of the biggest U.S. banks have been falling for the past month. Morgan Stanley closed Monday at its lowest since December 2008 – and the cost of insuring Morgan’s debt has jumped to levels not seen since November 2008.

It’s rumored that Morgan could lose as much as $30 billion if some French and German banks fail. (That’s from Federal Financial Institutions Examination Council, which tracks all cross-border exposure of major banks.)

--more--

http://robertreich.org/post/11033625495

Yo_Mama

(8,303 posts)Most of them didn't at the time that they bought it. One reason that they didn't is that quite frankly, Greece was cooking their books.

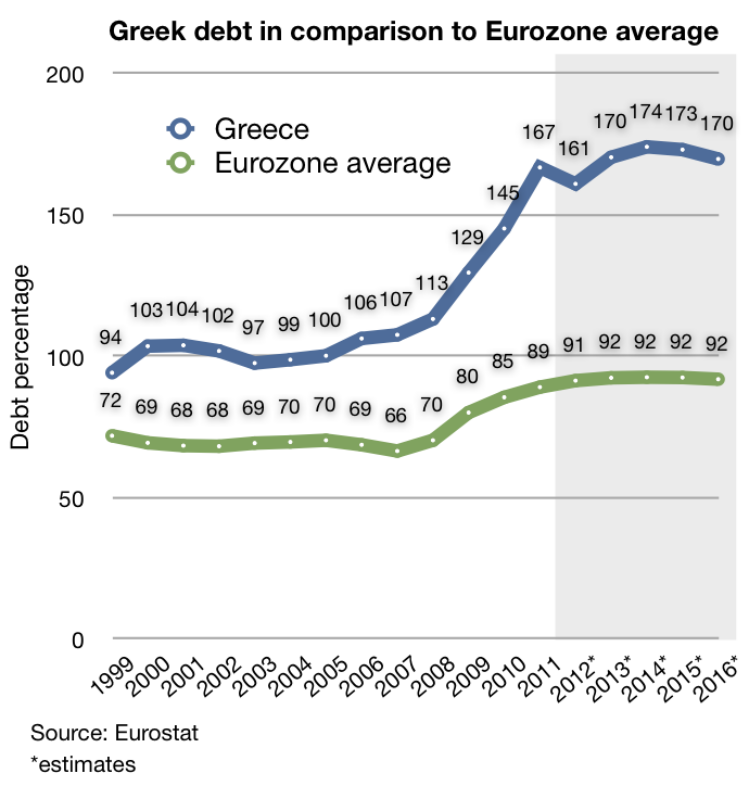

Note that until quite recently (2010), Greece's debt to GDP ratio was less than Italy's now is.

It wasn't until 2010 that Greece's ten year bond yields went over 7%:

http://www.economist.com/node/15452594

The picture had been looking quite decent through much of the 2000s:

Compare that to Italian public debt over the same time frame:

http://www.indexmundi.com/g/g.aspx?c=it&v=143

A cursory glance at Wikipedia will tell you that in 2009, the extent of the Greek budget deficit was not known.

http://en.wikipedia.org/wiki/Economy_of_Greece

Greece was accused of trying to cover up the extent of its massive budget deficit in the wake of the global financial crisis.[35] This resulted from the massive revision of the 2009 budget deficit forecast by the new Socialist government elected in October 2009, from "6–8%" (estimated by the previous government) to 12.7% (later revised to 15.4%).

...

In early 2010, it was revealed that successive Greek governments had been found to have consistently and deliberately misreported the country's official economic statistics to keep within the monetary union guidelines.[53][54] This had enabled Greek governments to spend beyond their means, while hiding the actual deficit from the EU overseers.[55]

In May 2010, the Greek government deficit was again revised and estimated to be 13.6%[56] for the year, which was one of the highest in the world relative to GDP.[57] Total public debt was forecast, according to some estimates, to hit 120% of GDP during 2010,[58] one of the highest rates in the world.

...

On 15 November 2010 the EU's statistics body Eurostat revised the public finance and debt figure for Greece following an excessive deficit procedure methodological mission in Athens, and put Greece's 2009 government deficit at 15.4% of GDP and public debt at 126.8% of GDP making it the biggest deficit (as a percentage of GDP) amongst the EU member nations (although some have speculated that Ireland's in 2010 may prove to be worse)

In 2010, when it was disclosed by the new government, a shock hit. Up until then, Greece's highly stimulative ways had produced GDP growth that was in excess of the European average, and an economy that looked, on the surface, as if it had a lot of potential.

I think you may be thinking of the Goldman Sachs swaps?? For what it is worth, those should have been disclosed as effectively loans (by Greece), and they were not. But by 2005 the swap had been taken over by the National Bank of Greece:

http://www.bloomberg.com/news/2011-05-12/greece-had-13-currency-swaps-with-goldman-eurostat-says-1-.html

Greece followed a consistent pattern of not correctly disclosing its position. It's doubtful that Goldman Sachs understood its position. Certainly other banks did not. But the fact that the National Bank of Greece took over the swaps seems to indicate that everyone in Greece knew what was going on, and was behind it.