General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsOne more time, SS is good thru 2090. The only fix 4 SS is jobs creation and raising the Min Wage

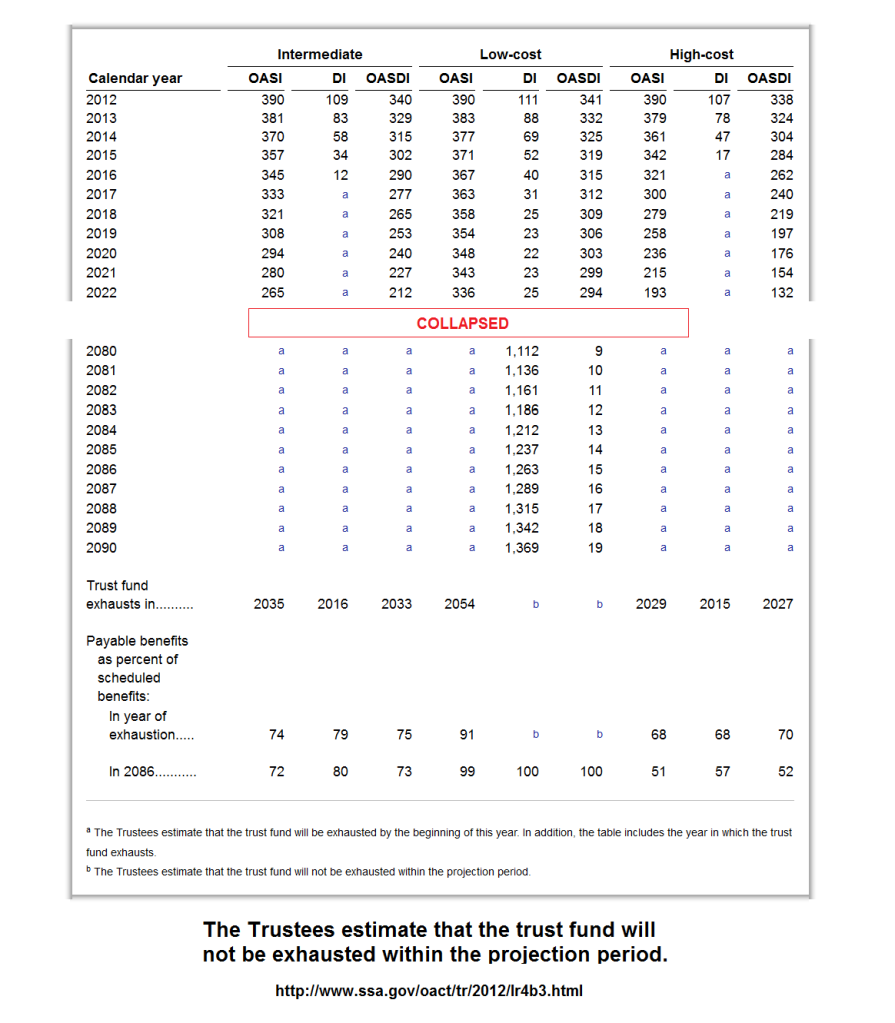

Assuming job creation, raising the minimum wage occasionally, and moderate slowdown of workforce growth, Social Security is good thru 2090. Most of the country understands that the GOP exaggerates the potential for the SS trust fund to be depleted anytime soon..

The only thing wrong with Social Security, is the recession we've been in for 4 years, and the continued increase in income disparity. Yes, if we have 20 more years of recession, the Social Security trust fund will be depleted sometime in the 2030's.

#HandsOffmySS

Looking solely at GDP growth, 2.8% or better and SS is good thru 2090. If you want to go with the "trust fund will be depleted in 2033", well you just picked 2.1% growth for most of the next 20 years. Yup, a 25 year recession, thats your prediction. First time since the Black Plague killed off half the human race on Earth. Sort of a Mad Max Scenario, but without Mel Gibson.

Looking just at the growth in the civilian workforce, it is slowing down, most predictions estimate it will slow down from about 1% growth to .7% in 2050. If we see this number at .6% or better thru 2033, SS wont be broke. And .7% should get us thru 2090. But if you think the US is going to build fences, and cut immigration down to .2%, well then, oh noes, SS is broke.

Okay, I've had a little fun at the expense of some folks, but the point I want to make is that the assumption that SS will be broke by 2033 is based on some very severe assumptions about the next 20-30 years.

Below is a screen capture of the 2012 Trustees pdf "Trust Fund Ratios",found here.

#HandsOffmySS

Eliminating the current cap of $113k is a drastic solution to a problem that doesnt exist. Whats broken is our economy, fix the economy and SS is very likely good thru 2090. Unfortunately too many Americans buy into the hype that SS is going to go broke in 2033 or sooner. And way too many Democrats are in that group. Too many DUers believe its going to go broke in 2033 or sooner. Once you buy into the falsehood there is a problem, then you start looking at solutions, instead of fixing the economy, creating jobs, raising the minimum wage and reversing income disparity.

I will probably starting a DU group, Social Security Defenders, a companion group to the Daily Kos group Social Security Defenders, in preparation for the #HandsOffMySS blogathon Macrh 25-29.

pipi_k

(21,020 posts)Well shit!

I'll be 138 years old!!!

What do I do then? Move in with my kids?

Seriously, though...SS has been such a lifeline all these years that I can't conceive of the government ever allowing it to die out.

dkf

(37,305 posts)By law reports of the solvency of the fund are required and those are the assumptions congress must use. So unless you are going to be chief economist or some such thing I don't see how your assumptions will change anything. If we see receipts pick up then that in itself will change things but that's the best you can hope for.

FogerRox

(13,211 posts)If you think thats a theory, well- think away all you want.

HiPointDem

(20,729 posts)FogerRox

(13,211 posts)right now at about 1%, over the last 10 yrs the low cost scenario is right on the mark.

duffyduff

(3,251 posts)Cato Institute has admitted they have lied about the projections in order to further their ideology.

FogerRox

(13,211 posts)That persons comment made little sense, as if it was meant for something else.

joeglow3

(6,228 posts)I am set for retirement.

WooHoo.

FogerRox

(13,211 posts)joeglow3

(6,228 posts)Or, cut spending from other areas to pay these "special" treasuries, cause a huge recession and throw millions onto the street without government support (as that has now been cut).

Either way, awesome...

FogerRox

(13,211 posts)joeglow3

(6,228 posts)It is not like there is an infinite supply of money coming in. At some point, the supply and demand curve will go the wrong way and what options will we have left then?

FogerRox

(13,211 posts)we can print lots of money.

Thanks for cvhanging the subject, I will now return you to the subject at hand:

When the Special Treasuries are due, we sell bonds, private money buys them, and the money is used to pay off the Special Treasuries, and said money enters the money supply after being paid to seniors, they spend it, where it becomes private money again.

joeglow3

(6,228 posts)pretty big assumption

HiPointDem

(20,729 posts)than 2 trillion 'out of thin air' for the banksters.

and the economy has not yet collapsed, somehow. in fact, we're told that doing so kept us from outright depression and saved the day.

i doubt that creating a couple of trillion over 30 years would be anywhere near as problematic as the bailout that created about 14 trillion or more within 1 year.

joeglow3

(6,228 posts)In fact, I was even more mad.

FogerRox

(13,211 posts)I'm sure it'll be ignored.... LOL. By someone who knows next to nothing about things monetary.

FogerRox

(13,211 posts)freshwest

(53,661 posts)FogerRox

(13,211 posts)Sirveri

(4,517 posts)Reduce retirement age to 65 effective immediately.

Expand the cap to recapture 90% of incomes, then tie cap increases to top 5% income growth rate.

Tie COLA to same measure.

Or direct the BLS to compile CPI-E as a measure of inflation for the elderly and use that number.

Rebalance the rate at which the income tiers vest to further skew them to a more progressive rate structure.

Establish a glass floor mandatory minimum benefit.

Allow a way to retire at age 62 for those with physically demanding jobs with full benefits.

Close the ability to pay back in after early retirement for full benefits.

Establish a one time benefit rate boost for elderly who reach the age of 85.

FogerRox

(13,211 posts)The 90th income percentile is about 215k, that would increase the max benefit of about 31k to 36k, a nice increase, it would also increase revenue into the trust fund.

Expand the cap to recapture 90% of incomes, then tie cap increases to top 5% income growth rate.

This helps deal with income disparity, a laudable goal. Just keep the cap at 90%, right now its at 84%.

Rebalance the rate at which the income tiers vest to further skew them to a more progressive rate structure.

Establish a glass floor mandatory minimum benefit.

ALter the bends points, I think thats what your saying, not a bad idea.

Allow a way to retire at age 62 for those with physically demanding jobs with full benefits.

Very doable. Along with retiring at 65. All very good points, that avoid the problems associated with eliminating the cap. Well thought out.

Sirveri

(4,517 posts)With the exception of a tie in to top 5% income growth rate. That was mine.

I find that amusing.

FogerRox

(13,211 posts)