General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsI'm a CPA. I have been doing taxes since I graduated in 1984.

Initially for KPMG. And on to a large local firm then working for Sandia Labs auditing government contracts. In 2000 I started my own business while raising a family. Still doing it even tho my youngest is 27. Love my aging clients. I’m aging with them.

But man. Is it HARD.

To see first hand how the middle class is over taxed in this country compared to the wealthy. Those with wages, hard earned pensions, IRA distributions, and social security? Compared to the wealthy with qualifying dividends and capital gains?

It’s really hard this year.

I always do my best for each and every client.

But our tax system is jacked when it comes to working folks and those that retire as such.

(Oh and believe me the wealthy are not reinvesting in the “economy” they are hanging on to the money and they will be back with more sheltered income and tax breaks next year).

Response to ALBliberal (Original post)

Wonder Why This message was self-deleted by its author.

ThoughtCriminal

(14,049 posts)Is one of the reasons retirement is so hard. It not only made saving difficult, it lowered the payments into Social Security.

ALBliberal

(2,344 posts)mopinko

(70,222 posts)but no…

The Wizard

(12,548 posts)When the minimum wage was first imposed it was a living wage. Unfortunately, the bribing class writes the tax code and minimum wage standards.

RANDYWILDMAN

(2,675 posts)and FOX corporate entity has spent the past almost 30 years telling the little people that socialism is bad (for business,the part they don't say out loud)

Remember that "Rent is too dam high "presidential candidate, he was onto something...

We do not talk about livable wages ENOUGH and never have in my lifetime

The Wizard

(12,548 posts)The OPEC embargo lowered living standards for blue collar skilled labor. Demand for oil changed everything.

Standard Oil said it had access to vast oil reserves in the South China Sea and Tonkin Gulf. When it was determined the vast oil reserves didn't exist Congress cut back funding the war. Sending a message to OPEC that our hedge on oil prices was non existent. Ever since then the working class has been struggling to stay above water. Corporate profits and upper management pay are draining money from the economy. We need a reordering of wealth distribution.

It was Governor Huey Long, D. Louisiana who said money is like manure. When you spread it around it makes things grow, but when it piles up in one place it starts to stink.

kwijybo

(237 posts)I've been watching it happen since the 70's. Wages creep up, if at all, and inflation beats it. I had one RWNJ argue it was all just taxes.. (SMDH)

brewens

(13,621 posts)one else would be paying taxes either.

Wicked Blue

(5,851 posts)and sends you a bill or a refund.

Of course it's easier to do in a nation of 1.3 million.

But I'd love it if this could be done here.

FoxNewsSucks

(10,435 posts)Method of tax calculation, or who does it, isn't the problem.

ALBliberal

(2,344 posts)I do my own taxes and I remember the first time I had some capital gains. Given my income it was completely exempt from taxation! I recalculated it, read some articles and concluded that yes, the money made by my money was tax free and the money made by my labor was taxed. And therein lies the tale of our nation.

brooklynite

(94,729 posts)FoxNewsSucks

(10,435 posts)Labor has always gotten the shaft ![]()

brooklynite

(94,729 posts)...not much point now.

Dodge, then dodge again.

Did you really think you could sell "Like capital gains are TAXED TOO, man."

Weak, even by your standards.

ALBliberal

(2,344 posts)And many working families won’t have capital gains.

OrangeJoe

(346 posts)Please look at the Capital gains worksheet contained in the instructions for Form 1040. You will see that if your income is lower than a set amount and your capital gains are also only a few thousand dollars you don't pay tax on them. Note especially line 9 on the worksheet. "This amount is taxed at 0%."

Nictuku

(3,617 posts).... but the flash drive that I have last years taxes on is corrupt. Windows tells me that it needs to be formatted! Shit!!!

I've looked all over. I should have AT LEAST printed out last years taxes. Hrrm.... I usualy at least mail it to myself, that is one more place to search... I digress....

My taxes are not all that complicated, but I do own a home and need the tax breaks from that, so I have to buy that 'deluxe' edition. One of the benefits of using TurboTax is that it can load last years tax info to help you get going. But now I can't! I'm stymied! I need to just get over it and get all the tax info papers out and just freaking do it. I usually get a refund, but ever since I've retired, my income sources have changed. The first year it was partially employed, and partially retired. The next year was a full year on my pension, but I was taking $ from my 401(k) to get by. The next year I turned 62 and I lost a supplemental I was getting (until I turned 62) and now get SS.

I /thought/ I had copies on a computer as well as on the flash drive as a backup. But I can't find them. I'm going to do another search (I have 3 different computers it could possibly be on. I didn't find it before, but am going to try again).

4/15 is coming up fast. I need to get this done.

Note to DU friends: Keep multiple backups. Flash drives can get corrupted.

ALBliberal

(2,344 posts)IRS has the return. You can get a copy from them. Go to IRS.gov and you can get the record. Always print a hard copy henceforth. TurboTax is a good program. Intuit. I use the professional version have for years.

Nictuku

(3,617 posts)I'm an IT Tech guru (or was) myself. I'm sure I'll figure it out, if not able to find a copy of it myself. My problem is, I don't trust the internet enough to search for a file retrieval program (they do exist) that won't copy all the important personal info that I have on the drive that is corrupted. So I've about given up on that aspect of it.

Anyway, thanks for providing a post for me to grumble about my stupidity (of not having multiple backups), and another reminder to just get it done.

Learn from my mistakes, if nothing else.

bsiebs

(688 posts)Nictuku

(3,617 posts)bsiebs

(688 posts)Dan

(3,580 posts)Nictuku

(3,617 posts)usonian

(9,875 posts)Standard procedure with the computers. Back up now and then --- the entire machine, via time machine, or icloud or a bootable copy (I use the free version of SuperDuper)

But for removable media (which are easy to lose, smash and otherwise destroy) now and then I copy them to the biggest hard disk I have on hand, currently 3 Terabytes. When a disk is getting old (I have a box full of them) then I copy their contents to the biggest disk on hand, which soon becomes the runt of the litter, so it gets copied, too.

I'm less rigorous with this (removable media) but it usually gets done.

I worked in I.T. in the days when a large disk drive cost $10,000. Same is about a buck now, or so it seems, so disks are in my mind FREE. (and it wasn't so damn long ago).

But see my post on disk recovery software.

Old Crank

(3,628 posts)Fighting to keep the government from offering a free tax prep service. Because they want your money every year for essentially computerizing the forms.

IbogaProject

(2,841 posts)".taxYEAR"

Here is an article about where it gets stored on windows, https://support.carbonite.com/articles/Personal-Pro-Windows-TurboTax#:~:text=TurboTax%20data%20files%20normally%20have,one%20of%20the%20following%20locations.

I keep all that for years in a specially named folder and copy that around some, both on that machine and on my wife's plus a few externals.

Good luck

CountAllVotes

(20,878 posts)I ended up going to a CPA to have the taxes done.

This year, I filled out the forms myself and mailed them in.

I'm still waiting for my refund.

TurboTax ruined my laptop! I bought it from Amazon.con . ![]()

![]()

karynnj

(59,504 posts)TurboTax creates files that when you look at the saved files on the computer, they will be there. On my laptop, they are actually under TurboTax.

mjvpi

(1,389 posts)Substantially lower than capital gains, we will never have an equitable system of taxation. Wages amount to monetizing hours of a human beings life. A minimum wage is the least our country feels that is worth. Minimum wage and guaranteed health insurance should be a statement of how our country values those that create wealth.

ALBliberal

(2,344 posts)taxed as low as 0% is really flying under the radar. I have had wealthy clients living off of dividends and capital gains taxed at less than a third of clients with pensions social security and wages. Pensions social security and wages are not sheltered like investment imcome.

Sorry you didn’t ask for that long response.

mjvpi

(1,389 posts)SocialSecurity is tied directly to labor. The effort to free corporations from paying pensions and the invention of 401Ks etc makes, at least to my limited understanding of the art of making money off of money, it hard to draw the line deterrent capital gains and what people have saved as part of their retirement. If I understand correctly, that’s what you are explaining to me. And I agree 100%.

Backseat Driver

(4,399 posts)Federal Reserve Bank, a PRIVATE balancing (LOL) bank. Needing more, the Federal Government assumes some sort of value of labor, like the minimum wage, without further backup value of a real resource, plus the amount of interest, penalties after taxes, etc.. due on certain activities, and just prints off some more debt dollars to spread around the universe...most times it flows right into the military-industrial complex, another black hole. The global culture clash of climate changes and keeping up with the security Jones via energy, including that which comes from nuclear means, bombs or fuel (spare the rod, spoil the child?) is frustrating those government considers of less value as a global human, a citizen, etc...and is further manipulated for debtors dollars by lobbyists and insiders who make the rules and they've made too many debtors of least value...at least the GOP did during my lifetime which isn't over nor as expensive as it's ever going to get, inflicting more pain on new generations to come or another expensive world war, whichever comes first. Best of luck at the Wall Street casino, debt money hoarders! Of course, there's always cyrpto, ahahahahahahahahahahahahahaha and a Banks-Friedman hahahahahahahahahaha. or power grid failures.

Is it any wonder that being in the path of totality on Monday is so marvelously linked to superstitions! Haha, I even read where TPTB have narrowed the deep dark shadow path. Without moving, I can be in it for about 43 seconds. If I burn some gas-fueled energy, I can manage a location lasting almost 4 whole minutes, and my family can pack my glasses away for at least two generations.

Backseat Driver

(4,399 posts)Federal Reserve Bank, a PRIVATE balancing (LOL) bank. Needing more, the Federal Government assumes some sort of value of labor, like the minimum wage, without further backup value of a real resource, plus the amount of interest, penalties after taxes, etc.. due on certain activities, and just prints off some more debt dollars to spread around the universe...most times it flows right into the military-industrial complex, another black hole. The global culture clash of climate changes and keeping up with the security Jones via energy, including that which comes from nuclear means, bombs or fuel (spare the rod, spoil the child?) is frustrating those government considers of less value as a global human, a citizen, etc...and is further manipulated for debtors dollars by lobbyists and insiders who make the rules and they've made too many debtors of least value...at least the GOP did during my lifetime which isn't over nor as expensive as it's ever going to get, inflicting more pain on new generations to come or another expensive world war, whichever comes first. Best of luck at the Wall Street casino, debt money hoarders! Of course, there's always cyrpto, ahahahahahahahahahahahahahaha and a Banks-Friedman hahahahahahahahahaha. or power grid failures.

Is it any wonder that being in the path of totality on Monday is so marvelously linked to superstitions! Haha, I even read where TPTB have narrowed the deep dark shadow path. Without moving, I can be in it for about 43 seconds. If I burn some gas-fueled energy, I can manage a location lasting almost 4 whole minutes, and my family can pack my glasses away for at least two generations.

TheFarseer

(9,326 posts)Get taxed as ordinary income like wages. It’s an investment just like stocks even though it is supposedly risk free. I guess rich guys don’t have savings accounts? Of course, I think it should all be ordinary income. Income is income.

chicoescuela

(1,028 posts)my career spent in the corporate world. I have a hard time working 40 hour weeks anymore. 4/15 is almost upon us. Good luck

ALBliberal

(2,344 posts)I’m very part time now but tell war stories to my kids. Be well fellow CPA.

chicoescuela

(1,028 posts)Take care

surfered

(535 posts)…wealthy individuals with only investment income of Dividends and Long-Term Capital Gains pay a maximum 23.8% tax rate .

Depending on our level of income, the rest of us pay a 10, 12, 22, 24, 32, 35, 37% tax rate PLUS 7.65% for Social Security and Medicare.

Tax planning tip: only earn dividends and long-term capital gains if you can.

gab13by13

(21,405 posts)that the taxpayer does his own taxes. The government does the taxes for people in other countries, with non-complicated returns.

There are several states in the US that are doing that now, free software.

I hate doing taxes worse than just about anything! Had no idea that were places where people's taxes automatically get done for them. God, that sounds wonderful!

Thanks for the reminder that I still have to do our taxes - UGH! ![]()

ALBliberal

(2,344 posts)with a preparer you have the benefit of controlling to some extent your tax liability.

brooklynite

(94,729 posts)My wife receives income from a multinational that does business in 15 foreign countries and pays income tax on her behalf in most of them.

Foreign tax credit forms are never simple.

love_katz

(2,584 posts)Working people are not treated fairly. Wages kept too low, not enough tax breaks for lower and middle income earners, the huge income gap between CEO's and the workers who put in the time and effort which actually creates the profits, etc. Thank you for giving us confirmation that many of us know is true, but don't have access to the kind of information that can help us prove it.

usonian

(9,875 posts)Try Open Tax Solver. Can't vouch for it but it's free. I am going to run it on my data while my daughter runs whatever, just to cross-check.

OTS:

https://opentaxsolver.sourceforge.net

Seems to run on everything. I got it to run on a mac despite all the obstacles Apple puts in the way for third-party apps.

note:

I have used TestDisk

https://www.cgsecurity.org/wiki/TestDisk

Perhaps PhotoRec

https://www.cgsecurity.org/wiki/PhotoRec#Known_file_formats

It may only recover media files.

As for the taxes, yes, we have the best politicians that money can buy. Most returns under X00,000 are really simple and could be done on a postcard. The system is insanely complex to help those above the line. (and make up for what they don't pay)

Hikerchick57

(118 posts)soldierant

(6,926 posts)and my SS is not taxed. Above a certain point I believe it is taxable, but mine has not gone above that point. My pension and the minimum required distribution from my 401K ae taxable, but the sum is not big enough to create a tax liability. Granted that my needs are modest, I manage to live comfortably on it and even save a little. And what part of Medicare would be taked? The amount deducted from out SS is just that - a deduction which should reduce your taxable income, not increase it. Your claims? I had a large enough Medicare claim last fall (a week in the hospital and a little over a week in rehab) that I couldn't have failed to notice reveining a 1099 if claims were taxed. I'm always confused when someone brings this up. My returns are complete, and it took the IRS about 2 hours to accept mine this year.

ProfessorGAC

(65,182 posts)No state taxes on retirement income in Illinois, & that includes SS.

But, we pay fed taxes on our SS income. No complaints though, as our combined SS payments are under 25% of total income. It would be most illiberal for us to whine about taxes we can afford to pay.

Hikerchick57

(118 posts)I live in WY and thank goodness we don’t pay state tax either or I would be in real trouble.

soldierant

(6,926 posts)very progressive of you. Thank you. Yes, i knew it got taxed at some point. I just haven't been there yet. Now, Colorado not only doesn't tax it, but requires it to be deducted from what is taxable. So if I were to file a Colorado retiurn, it would show a negative figure for gross income.

oldsoftie

(12,604 posts)Hikerchick57

(118 posts)But now I don’t even come close to meeting $14000, my small deductions are all gone which used to help me.![]()

oldsoftie

(12,604 posts)doesnt that mean you're deducting MORE than before? Or is that not how it works? I dont know because I'm never able to just claim the standard.

LuckyCharms

(17,458 posts)Hikerchick57

(118 posts)I really don’t understand it and need to have my accountant to explain it to me again.

Hikerchick57

(118 posts)My account explained it to me but I don’t get it, I just know I had to pay which I never had to do before. Math ![]() and I never got along…

and I never got along…

LuckyCharms

(17,458 posts)Wages

+taxable interest income

+taxable dividend income

+/- capital gain or loss

+ taxable IRA distributions

+ taxable portion of social security benefits

+other types of taxable income

=total income

-contributions to IRA

=adjusted gross income

-THE LARGER OF EITHER ITEMIZED DEDUCTIONS OR THE STANDARD DEDUCTION

-exemption for dependents (personal exemption has been eliminated)

=taxable income

Tax payable is computed based on taxable income

-tax credits

=tax payable

-amount of tax already withheld during the year

=tax refund or tax owed

Itemized deductions consist of things like mortgage interest, charitable contributions, medical expenses over and above a certain threshold, etc.

If your itemized deductions are less than the standard deduction amount, you use the standard deduction to reduce your adjusted gross income.

With the raising of the standard deduction, many tax payers are finding it more difficult to itemize, because they do not have enough itemized expenses to get over the standard deduction amount, so the standard deduction is used in order to receive the highest reduction in income for tax purposes.

Hikerchick57

(118 posts)snot

(10,538 posts)I'd never have dreamed that after having saved for retirement since I was 16 years old, medical expenses would consume fully HALF of my income despite having Medicare and the best Medigap and Rx insurance available in my state.

I believe the official inflation calculations vastly understate what most of us actually experience.

Hikerchick57

(118 posts)Biden got rid of the gap phase in 2025. Insurance companies and pharma will still find a way to screw us I imagine.![]()

Cheezoholic

(2,033 posts)Yes, getting back the revenue given away by the last 2 republican administrations is huge but folks on main street don't immediately feel it. And unfortunately we live in a very impatient society. Not that we shouldn't do it, should be done a s quickly as possible if we have the numbers.

But also I think there are more "show me" voters out there than our party realizes. Legislation to immediately repeal the of taxing SS and Unemployment income and tipped income would be a great start to do in the first 90 days if we have the numbers to accomplish it. We live in a service based society thats not going to start getting any younger for the next few decades. Those are things that many many people will immediately feel and more importantly remember.!

Also a real across the board income tax cut for wage earners that shows up on their paychecks as soon as its passed, not some tax credit at the end of the year that "saves them" a certain amount come tax time. Your blue collar wage earners don't see that and they need that money now. If they bring home 500 a week then all of a sudden they're bringing home 550, they see it immediately. That's a huge freaking deal I'm telling ya. And they'll remember!

I'm no financial genius, I'm an idiot with money. I don't know how to do what I suggested but I have seen the opposite of what I suggested happen in real time. I've never seen a direct increase in my weekly paycheck because of government policy changes in my life but I have seen more than my share of decreases in my weekly paycheck because of government policy.

It's just a suggestion but, especially where I live, people are fed up with the usual BS. If we get the numbers show them the savings they were promised and put it in their damn pocket.

They'll remember!

MichMan

(11,972 posts)ALBliberal

(2,344 posts)as an example.

MichMan

(11,972 posts)Why just tips ?

ALBliberal

(2,344 posts)But why shelter investment earnings to the expense of wages and tips? How is that fair? Why should someone making 100000 investment wise (capital gains qualified dividends) pay a fraction of someone making 100000 in wages/tips? How is that fair?

Response to ALBliberal (Reply #52)

MichMan This message was self-deleted by its author.

oldsoftie

(12,604 posts)Nothing remotely realistic was ever proposed.

nilram

(2,893 posts)What’s the one where you have to keep all sorts of records for medical expenses? The dependent care tax credit? So much effort, and the people who qualify are earning so little, and having to take care of a family, and a sick person… And it’s not indexed to inflation. The people who can qualify for that are overburdened and under resourced to be able to pull together what they need to qualify, and the amount they qualify for is pitiful.

My state has the highest education requirements for tax preparers and I took the class long, long ago. I apologize I can’t remember what that credit is but I showed the amounts involved adjusted for inflation to my instructor, and she had me present them to the class. She told the story of some other tax credit that had an odd age limit— that just happened to match the age of the mother of the senator who introduced it.

I took the course because I was interested, and as a potential side job. For time and energy reasons, I ended up not practicing. My hat is off to you – as far as arbitrary and insane rules go, the US tax code beats out everything.

MOMFUDSKI

(5,650 posts)get a contract from a tax place that does taxes for Wisconsin farmers. My eyes are popping at the numbers! And the tax breaks. I did our own taxes at home with the standard tax forms. I saw right then and there how ripped-off we little middle class people were getting. Yup

CrispyQ

(36,518 posts)You trade hours of your life for money & they tax you more than the guy playing golf while his money makes money. It's obscene.

ShazzieB

(16,514 posts)

PatrickforB

(14,591 posts)Every billionaire is a massive failure in tax policy.

Corporations do NOT pay their fair share of taxes.

There should NOT be a cap on social security payroll tax.

Postsecondary education should be considered a public investment in the future of our country.

Shareholder profits should NOT be held above worker welfare, consumer interests and the earth itself.

Childcare should be subsidized.

Our K-12 system should be beefed up so it is the envy of the world.

Instead, we have the constant drumbeat of hate, divide, wedges and the old Wall Street SQUEEZE.

But gosh, we have more billionaires than ever, and CEOs now 'earn' over 300 times what their average workers earn.

And we have a 'justice' system that clearly has two tiers, one for us working schmucks and the other for dirtbags like Trump. Money = justice here in 'Murika.

And our shitty rationed healthcare with financially crippling copays? Healthcare DEBT is the leading cause of personal bankruptcy. Our children and grandchildren are slaves to massive student debt that they may never be able to pay off.

But hey, I sure do get a warm fuzzy when I think about those fluffy billionaires! Gosh, the Mercers, that Leo guy. The living Koch brother. The Waltons. Zuckerberg. Bezos. And let's not forget that nice Elon Musk, who turned off his Skylink satellites to sabotage a Ukrainian operation against Russia.

And how about those Russians and Chinese the DOJ is ALLOWING and the GOP is ALLOWING to come in and try to influence our elections?

You know, this country does not worship God any more. We worship the bronze bull of Wall Street. It is our golden calf. Unless we get wiser much faster than we are doing, we will go extinct along with all other life on the planet and earth will become a smoking cinder circling the sun.

Sigh.

yardwork

(61,710 posts)ShazzieB

(16,514 posts)usonian

(9,875 posts)

OldBaldy1701E

(5,157 posts)But the reality of this country, the sooner we might... might do something about it.

(BWAHAHAHAHAHAHAAHAHAHAHAHAHA! I knew I could not say that with a straight face. We are never going to get rid of the leech that is capitalism and we don't want to. We are too programmed to think that is equitable. It is not nor has it ever been.)

usonian

(9,875 posts)No "ism" in an economic sense is going to work, never has for very long, though capitalism is king now and has been for a long time.

People just want to exceed, and when that turns to symbolic wealth (read "Money, Sex, War and Karma" ), well someone is always going to have more, hence, they bring unhappiness. (Do you think that bag of shit is happy?) So, strive for happiness.

The Buddhist philosophy is that wealth is OK, just frickin share it. Karma points and happiness for doing so. But there was only one King Ashoka, who shared the wealth.

Western "culture" (which is now the dogwhistle for white male supremacy) is wired for zero-sum games, based on inequality of everything. My saying is that we are all equal, but different. Make the best of that. (yeah, that's a shortcut for a longer argument)

Well, there's my righteous rant for the morning. Buddhists vary, but I am of the Lotus Sutra variety, which is quite revolutionary, even among Buddhists.

Helps me understand and cope.

I guess it's like "Christians" as opposed to "Xtians". The real ones imitate their leader. I can count the ones I know on one hand.

OldBaldy1701E

(5,157 posts)Although I would say that I was taught that 'happiness' is not a practical goal to attempt, but 'contentment' is and we should all strive for that.

I salute you for achieving any understanding in this current society. ![]()

usonian

(9,875 posts)and there is the root of the problem.

OldBaldy1701E

(5,157 posts)multigraincracker

(32,720 posts)With guillotines and signs that say “Eat the Rich”. Bing a huge black kettle and firewood.

NanaCat

(1,251 posts)It feels good for the marchers, but it doesn't do much for anyone else.

multigraincracker

(32,720 posts)until head’s start rolling down the street.

doc03

(35,377 posts)makes my blood boil. If you are single and make over $25k and I think $34k if married you have to pay tax on SS.

I have been retired for 14 years and started out paying a little tax on SS but over the years I am now paying tax on 85% of it while

my income is less. That was started in 1983 and the income threshold was $25k and $34k and never adjusted for inflation. If adjusted for inflation that would be $79k and $109K today. So today you are considered rich at $25k and $34K a year.

ALBliberal

(2,344 posts)for middle income folks. It’s changing lives. My clients are using the money saved for their NM taxes for travel property taxes and so on.

Taxing social security so unfair. Like a tax on your taxes. Just wrong. Needs to change at the federal level.

Desert grandma

(804 posts)Residents that graduate from NM high schools now can go to any state college( 4 year or 2 year) and the tuition is paid for by the State Opportunity Scholarship. Our twin granddaughters are members of the Cherokee Nation. Their freshman year they attended Fort Lewis College in Durango, Colorado because they had a tuition waiver for any member of a federally recognized tribe. The next year our Democratic governor and legislature began the new Scholarship program that has allowed many residents the ability to go back to college tuition free. Our girls came back and are now attending a state university. Our state also has free lunches for all children attending state public schools. DEMOCRATIC LEADERS IMPROVE THE LIVES OF ALL AMERICANS, NOT JUST THE RICHEST AT THE TOP!

DFW

(54,437 posts)Supposedly, anyway. The USA will not tax any of my SS payments, and the Germans will tax 100% (not 85% like in the USA, if the German accountants are correct) of them at 50%. Theoretically, the top rate here in Germany is 42% (kicks in at about $85,000 gross income, by the way), but they have add-ons that bring the true rate to more like 50%, plus they have a 19% value-added tax on everything here, so the government gets way more than just income taxes.

There are two countries in the world that do NOT recognize residence-based taxation: Eritrea in Africa and the United States of America. If you have US citizenship, you must file a U.S. tax return no matter where you live. This gets really complicated when you have US income that is taxed by law in the USA, but your country of residence refuses to recognize the US taxes paid, and wants to tax the same income. I get five figure bills from both KPMG in Dallas and PWC in Düsseldorf for trying to keep my taxes legal and in order, and they still have a twelve year ongoing dispute with the German government, who wants to tax American income that has already been taxed in the USA (40% in the USA plus 50% in Germany doesn't leave much to play with). There is a double-taxation treaty between the USA and Germany. There is no high authority that compels either country to respect what's in it.

I've pleaded with all sorts of Congresscritters to get this looked into and maybe fixed. Russ Feingold was sympathetic, but Wisconsin opted for Ron Johnson instead (nice move, Wisconsin). I've talked to Sherrod Brown from Ohio, Jon Ossoff from Georgia, Angie Craig from Minnesota, Colin Allred from Texas, a wide geographic range of members of Congress. I get it, they all want my contributions, but they all have bigger fish to fry. Most of them have no earthly clue how many of us there are. I asked Sherrod Brown point blank--this was less than four weeks ago--"do you know how many Americans abroad there are?" He didn't, but guessed, "maybe two or three hundred thousand?" Try again, Senator. There are NINE MILLION Americans abroad. I gave him my contribution anyway, but his guess was off by a factor of thirty, and he is supposed to be one of the good guys.

Maybe certain propagandists can make some hay yelling about some billionaire living off the grid on a yacht moored in the harbor of Monte Carlo, but so what? There are NINE MILLION of us who are not. We are teachers, business reps, security specialists, retired persons, medical specialists, engineers, geologists, researchers, editors, architects, writers, whatever. That's the population of a mid-sized state. If we WERE a state, we'd be close to the middle of the 50 states in population, somewhere between #25 and #27, last I looked.

I'll tell you one group who loves us and doesn't ignore us: the accountants!

doc03

(35,377 posts)nearly 50 years and have a decent income in my retirement. It is means testing. The same goes for the VA

I am a veteran but can't get any VA benefits because they say I have too much income. I am a veteran and

wasn't in combat OK. But a friend of mine was a Corpsman in Vietnam patching up wounded Marines and can't get

any benefits because he has too much income. While I know people that never left the states that get free everything from

the VA.

DFW

(54,437 posts)Is the money a Social Security recipient receives from funds that were deducted pre or post taxation? If that money was never taxed at the time of deduction from a paycheck, then I can at least see the logic behind taxing it now, although the government gets the huge advantage of not having to compensate for decades worth of inflation. Considering the hoops they made me go through to get it in the first place (almost a year), I guess I should be happy I got anywhere at all. I sent in the application online, got no response, called Washington about five times, finally got transferred to Albuquerque, who transferred me to Baltimore, who said it was too complicated for them, but the US Consulate in Frankfurt should be able to handle it--oh, wait, no they can't, they are deluged, so the US embassy in Warsaw, Poland would have to do it. Seriously? Poland? Got it. I was staying with my brother in Langley, VA at the time of that call, but sure enough, the next day, I got a call from Warsaw, Poland. It was the US Embassy, walking me through the steps. They even told me that if I filled out some more forms (there are always more forms to fill out), and took them to the US Consulate in Frankfurt within 6 months, my wife could get $1000 a month as well. I thought that sounded ridiculous, but OK, we are going to lose half of it in taxes anyway, so why not? She's a German citizen, but her pension is only about €1200 a month. Even that is increased from €850 because as a two-time cancer victim (they know that kind of stuff about everybody), she counts as "handicapped"--whatever). And her €1200 is also taxed by the Germans, so she only sees about half of that, too.

Fooling around with VA benefits is lousy, in my book, but I'm not a vet, so I'm not directly affected one way or the other. It's my personal opinion that VA benefits should be untaxed and unrestricted (i.e. none of this "you make too much" crap), but my opinion counts for exactly nothing in this particular instance. My dad was in World War II, but came back in one piece. My father-in-law was also in World War II, and he did not come back in one piece. He came back in about ¾ of a piece. At age 18, he got one leg blown off by an artillery shell at Stalingrad. I think he got some consideration, but he never talked about it, and I sure wasn't gonna ask.

doc03

(35,377 posts)It is tax.

DFW

(54,437 posts)To the tune of about $9900 a year. That plus getting half of what I receive taken out in taxes again means I get to keep somewhere around 29% of what SS pays me. That's only a number on a paper somewhere. What I end up with is what matters, and that is less than a third of what their payments to me amount to. I bow in deepest respect to those who have to live on those payments.

applegrove

(118,781 posts)moonbeam23

(313 posts)and i heartily agree...It made me so angry and depressed to see this in action.

The turning point for me was when i heard my boss conspiring with his wealthy doctor client to set up a pension plan to deliberately freeze out his assistant who had worked many years for him. My own father was a dentist who treated his nurse like family and included her in his plan and insurance.

That sickened me and i decided that i was not going to spend my life making creeps like that even richer.![]()

ALBliberal

(2,344 posts)and with the notion I’m helping some.

After 40 years of this your clients become your friends.

And mostly my clients are middle class folks like most of us.

It’s the few wealthy that grab my attention. And how they feel cheated because of the national debt etc. when they aren’t paying same proportion we pay.

Hence my post.

mitch96

(13,924 posts)politicians to make the tax laws in your favor.

Follow the money...

How did those tax laws get generated?

Which politicians help to generate those laws

and how did he benefit from making those laws?

The trick is how do we change it for the "little people" like us

m

ALBliberal

(2,344 posts)Yes I’m a cpa. And clearly know more about this subject than most (it’s been my career). But where they get us is through withholding. The pay as you go system. So it’s withheld on the spot. Based on married single kids and so forth. I can’t even imagine people that aren’t getting their earned income credits and proper daycare and childcare credits. Some people don’t even file.

Yes I know. I will be that little old lady volunteering to file taxes at the library.

Gladly.

moonbeam23

(313 posts)every year, you can even see which industry was lobbying Congress that session. Sometimes it's really blatant.

There is a lot that could be done to make the code fairer and see that all those people that aren't getting their credits get money automatically. The covid money that was going to families directly should never have been stopped. God forbid something went to people instead of the military-techno-industrial barons.

moondust

(20,006 posts)sipping fruity liqueurs out on one of your yachts floating around in the Bahamas, deciding which offshore tax havens will get the profits your shares are racking up as you watch the market boom.

Thank goodness for meritocracy.

![]()

Hekate

(90,805 posts)Skittles

(153,193 posts)and us single folk get fucked even more

ALBliberal

(2,344 posts)I have a new client whose husband passed last year and since in 2024 she will be single rather than married she will have big decrease in standard deduction. Maybe it will work out somehow with less income. But it’s very surprising and different for her.

RipVanWinkle

(233 posts)The Internal Revenue Code, written by Congress, is 95% special interest, in favor of - guess who? - rich people.

To paraphrase Will Rogers, we have the best congress that money can buy.

BlueWaveNeverEnd

(8,052 posts)twodogsbarking

(9,814 posts)maxrandb

(15,357 posts)In 1980, I was a full-time stock clerk at a Big Bear Grocery Store in Columbus, OH. Started in 1975 as a Bag-Boy bagging groceries. In 1980, I was making $12.60 an hour, time-and-a-half for overtime (any hours over 40 a week), double-time on Sundays and Holidays, and even got 8 hours of pay for my birthday, whether I worked that day or not.

I have used various calculators, but that would basically be equivalent to $96K per year in today's money.

Next time you are at your local Harris Teeter, ask one of the stock clerks if they are making $96K a year, but be prepared to run.

You have to understand. I was a High School graduate. This was a choice job! It was the kind of job you could support a family on. It was a job that could place you solidly in the Middle Class.

Then, St. Ronny RAY-Gun came along with this "trickle-down" bullshit, and a vast majority of Americans decided that what was holding them down was NOT the already ultrawealthy, it was their own fucking neighbor that was paid a Middle Class wage. We've been on a frickin Hamster Wheel ever since. In fact, one of the "great" corporate screed that became a national "bestseller" was about how workers needed to "adjust" to find the fucking cheese corporate America was fucking stealing.

Long story short, I wanted more out of life, so I took a 75% pay cut and joined the US Navy. Served from summer of 1980, until retirement in the spring of 2010.

Big Bear Supermarkets? Well, they were a typical "trickle-down, greed-is-good" casualty. They got bought out by a New Jersey based conglomerate, that transferred a shit-ton of their debt onto Big Bear as part of the takeover deal, and the last Big Bear Store in Ohio closed in 2000.

My brother was a butcher at Big Bear, and they were paid even more. He stayed on, but was forced to accept pennies-on-the-dollar for his pension when it closed.

He took a job at Krogers for what he was making 10 years prior at Big Bear.

We can complain all we went, but RAY-GUN won 48 states. Even Democrats were forced to begin promoting some of his fucked up economic policies, or face political destruction.

Donnie Dipshit is a shit-sandwich, but RAY-Gun provided the bread.

Mr.Bee

(186 posts)is another example how politicians and the rich have thieved from the middle class.

We were all making good minimum wages in 1980.

Pay them less for more productivity!

Reagan froze any increases to the minimum wage 9 years to cut it in half.

Then Bush/Clinton froze it another 10 years.

Then Bush froze it another ten years.

The last increase to the minimum wage was to $7.25 an hour.

That was 2009, 15 years ago.

The only time the minimum wage was ever frozen for five or more years was because of war:

WWII, Korea, Vietnam War, Nixon, but at least when it was re-instated it kept up.

maxrandb

(15,357 posts)By most accounts, he was a decent, kind and generous man.

He was wealthy, but not extravagant. He paid his employees generously, yet was still vastly wealthy.

The CEO of McDonald's was paid $17.3M in salary, bonuses and stock options in 2023. That is 1,200 times the average hourly wage earner at McDonald's.

Wayne E. Brown did better than his hourly paid workers, but I will guarantee you it wasn't 1,200 times better.

TheFarseer

(9,326 posts)McDonald’s makes an enormous profit and the executives make a ridiculous amount of money that could instead go to the workers making a more livable wage. However, a mom and pop restaurant is very hard pressed to also offer higher wages. 60% of restaurants fail in their first year so I believe money is extremely tight for them. I don’t know how to reconcile that when you are making minimum wage laws.

Mr.Bee

(186 posts)To have the same value, the answer is $50.39 an hour

Adjusted for inflation, $12.60 in 1980 is equal to $50.39 in 2024.

While you're thinking that is unreasonable,

CEOs pay then was 20:1.

CEO pay ratio for S&P 500 companies was 185:1

down from 193:1 for fiscal 2021

up from 178:1 and 181:1 for fiscal years 2019 and 2020, respectively.

while you make $7.25 an hour.

IbogaProject

(2,841 posts)They (GOP) lowered some taxes permanently for the wealthy and pass through businesses but his the cost by having some temporary middle class tax adjustments phase out incrementally stepped every odd tax year. So 2023 taxes are rougher for your clients than previous years. The GOP goal is to have folks pissed up going into the election. I really hope we can draw attention to this. We need to reverse it once we regain all three needed to fix those tax problems by raising taxes on unearned income beyond $200k and end the wealthy and big business tax inequities.

Mr.Bee

(186 posts)So now we have to 'sunset' Social Security and Medicare. Sorry folks, this isn't Europe.

MichMan

(11,972 posts)Helped all income levels

IbogaProject

(2,841 posts)I think the standard exemption is gone for good, and the standard deduction is set to revert to a lower level. The GOP really gamed the accounting to get an artificially low CBO score for their boondoggle tax cuts for the wealthy, while kicking the can on costs to later on and they will blame our party.

MichMan

(11,972 posts)IbogaProject

(2,841 posts)I wish we got better at messaging on these real issues. This is where we can pick up swing voters.

underpants

(182,880 posts)I did taxes for a midsize firm here for one tax season. I probably did about 100.

A buddy of mine had his own business - real estate appraisal. Still does. He was considering taking a job with the local government doing the same work while being able to continue his business (just not in that jurisdiction). As we texted back and forth on it I convinced him to take it. It was for about 40% less money. Of course it a salary versus his per-job situation.

He will only pay 1/2 of the Social Security he was paying.

Healthcare dropped from $500/month to $144 and with good coverage.

He gets paid when he goes hunting (leave) as opposed to his past-time costing him money.

Jacson6

(353 posts)They work in construction and strictly do work at homes & biz that pay cash. Of course, a lot of immigrants do the same thing. We should just have a simple flat tax system. Let's say all income received is taxed at a flat rate of ten percent no matter the source.

IMHO.

Silent Type

(2,954 posts)MichMan

(11,972 posts)Regardless of the tax system, unless we went to a National Sales Tax.

Jacson6

(353 posts)They can't deduct their wages or 1099 contract without proper tax documents. If they do that then they face IRS criminal prosecution. The guy I know asks for cash and walks away with no provable tax liability. But those people have usually paid taxes on their W2 wages or Contract income. Of course, he works for below the common wage or costs that most licensed tax paying employees contracts receive.

![]()

Farmer-Rick

(10,212 posts)A middle class person gets a tax hike.

New taxes since Raygun: doubled withholding taxes, doubled self employed taxes, taxed Social Security income, raised Medicare Copay by over 30%, raised middle class taxes by eliminating the most common deductions.

I'm sure others have more than can throw onto the pile.

Mr.Bee

(186 posts)it's not a tax cut, it's a tax-shift!

You said it best.

Happy Hoosier

(7,390 posts)It’s a bit of a humble-brag I guess, but I’ve done well in my career the last couple years and have had a windfall. At the beginning of that a friend who is a CFP has steered me to ways of saving that can be essentially tax-free. It’s the kind of things that feel illegal, but aren’t. I have to live in the world, so I’m taking advantage of these things, but I admit it feels like cheating.

mdmc

(29,074 posts)"I bet Donald Trump doesn't pay a dime in taxes."

iluvtennis

(19,873 posts)don't pay their fair share. ![]()

Thank you @ ALBliberal for the service you provide to folks.

world wide wally

(21,755 posts)and continues to increase it every year.

LetMyPeopleVote

(145,563 posts)There is no tax cut fairy and there is no evidence that tax cuts pay for themselves in the real world. Why does it matter that the Republicans' Trump-era tax breaks failed to pay for themselves, despite GOP promises? Several reasons, actually.

Link to tweet

https://www.msnbc.com/rachel-maddow-show/maddowblog/fresh-evidence-republicans-tax-breaks-didnt-pay-rcna141882

The corporate tax cuts came nowhere close to paying for themselves, as conservatives insisted they would. Instead, they are adding more than $100 billion a year to America’s $34 trillion-and-growing national debt, according to the quartet of researchers from Princeton University, the University of Chicago, Harvard University and the Treasury Department.

To be sure, these findings aren’t altogether surprising. We’ve known for several years that the Trump-era tax breaks for the wealthy and big corporations didn’t pay for themselves. We’ve also known for quite some time that this question has been tested and re-tested, and the results are always the same......

So why does the evidence matter? Several reasons, actually.

First, there’s the question of accountability. The Republicans who claim to care deeply about “fiscal responsibility” and balanced budgets insisted that their tax giveaways wouldn’t add to the deficit that they occasionally pretend to take seriously. The public, when assessing these policymakers’ work, deserves to know that the GOP officials got this important question wrong.

Second, credibility matters, too. Republicans — who are inexplicably enjoying a sizable advantage in polling on economic policy, despite the realities of recent decades — claim to know what they’re talking about. When compelling evidence to the contrary comes to the fore, it warrants attention.

Third, at the heart of Republicans’ thinking about economic policy isn’t just the discredited belief that giving tax breaks to the wealthy produces broad prosperity, but also that the party need not concern itself with paying for the giveaways. Ideally, when presented with decades’ worth of evidence disproving their core assumption, the party would reconsider this misguided belief.

But perhaps most important of all is the fact that GOP officials are eager to repeat their mistake. In fact, The Washington Post reported in January that Donald Trump has privately told his allies “that he is keenly interested in cutting corporate tax rates again,” despite the failures of his 2017 effort.

Tax cuts are not magical and do not pay for themselves. The current deficits are due in large part to TFG's tax cuts. The next battle will be on to whether to extend some or all of these tax cuts when they expire

Link to tweet

oldsoftie

(12,604 posts)12% corp flat rate (which is HIGHER than what the avg corp is actually paying now) with NO deductions.

TRILLIONS of $ go untaxed with our ridiculous system.

But neither party will do what NEEDS to be done. One will bitch about spending (when the other party is in office) and the other will bitch about :"fair share" without proposing realistic changes that would have a real impact.

Remember when Obama had the National Debt Commission? They provided several steps to reduce the national debt. ALL were ignored.

kelly1mm

(4,734 posts)Mean 12% of gross revenue? You do know that there are MANY corporations that have operating profit margins of WAY less than 12%, right? (Operating profit margin means actual dollars left over after paying actual expenses). Walmart for one only has an operating profit margin of less than 3%. Less than 3% of billions in revenue is still a lot but there is no way they could pay 12% of revenue without massively increasing prices. Same for most other non-tech corporations ......

oldsoftie

(12,604 posts)When I say no deductions I dont mean you cant deduct wages & costs of goods sold. Was mart paid 5 billion in taxes last yr. From what I can figure, I think they would've paid 15 billion under my idea. But my idea is also more geared to taxing the huge amount of untaxed income of individuals & small businesses.

kelly1mm

(4,734 posts)kelly1mm

(4,734 posts)Mean 12% of gross revenue? You do know that there are MANY corporations that have operating profit margins of WAY less than 12%, right? (Operating profit margin means actual dollars left over after paying actual expenses). Walmart for one only has an operating profit margin of less than 3%. Less than 3% of billions in revenue is still a lot but there is no way they could pay 12% of revenue without massively increasing prices. Same for most other non-tech corporations ......

Shermann

(7,440 posts)I would owe quite a bit more in taxes every year without it and am not wealthy.

So, I guess I'm in the "sounds good if it doesn't get MEEEEEE" group.

ALBliberal

(2,344 posts)of long term capital gains rates or the qualified dividend exclusion. I think my post is directed at discussing the unfairness of how income is taxed on working income versus investment income and how I see people with large investment portfolios generate the same income as someone with a salary or wage paying a fraction of what the wage earner does. And the person with the investment portfolio has more “in the bank” to pay that bill.

Silent Type

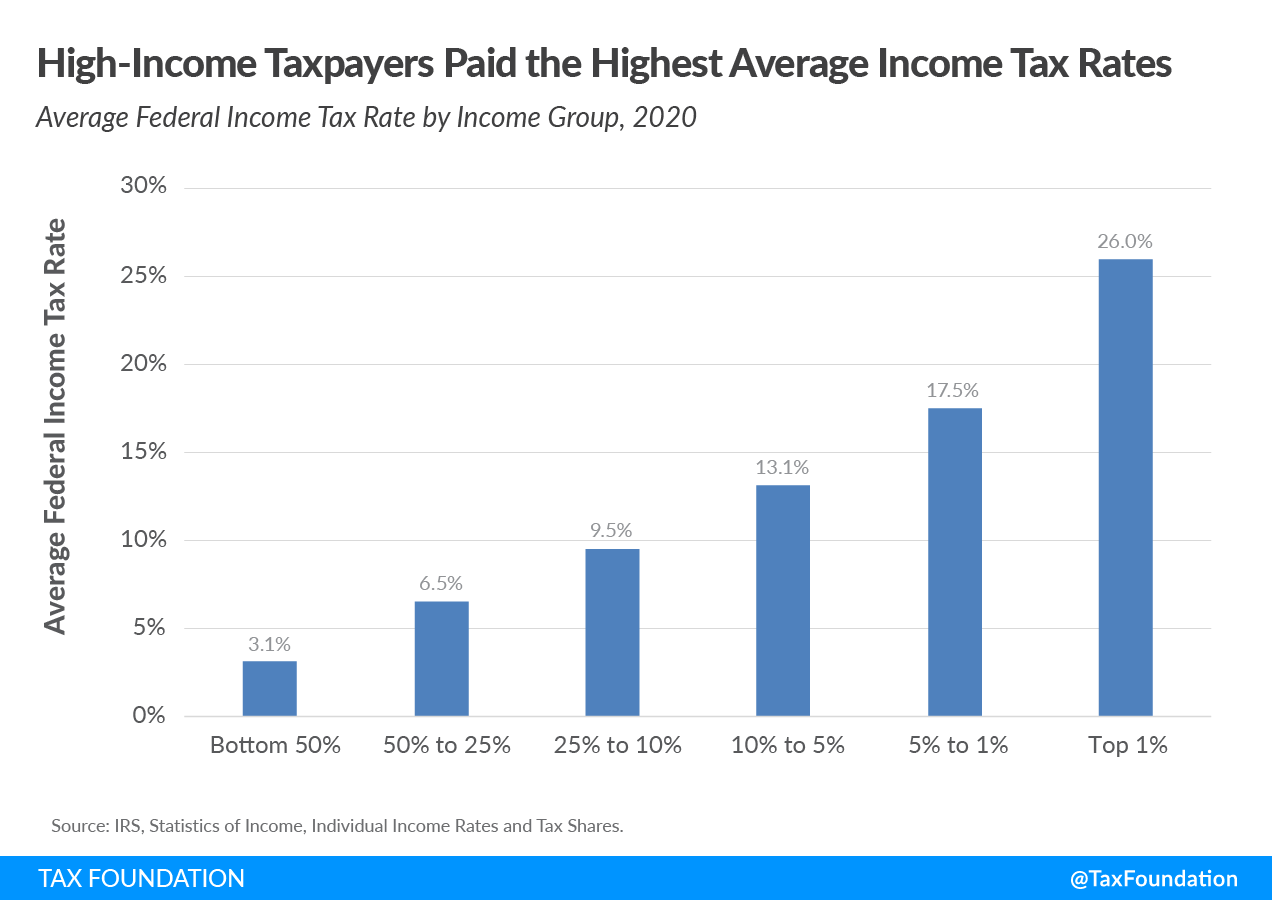

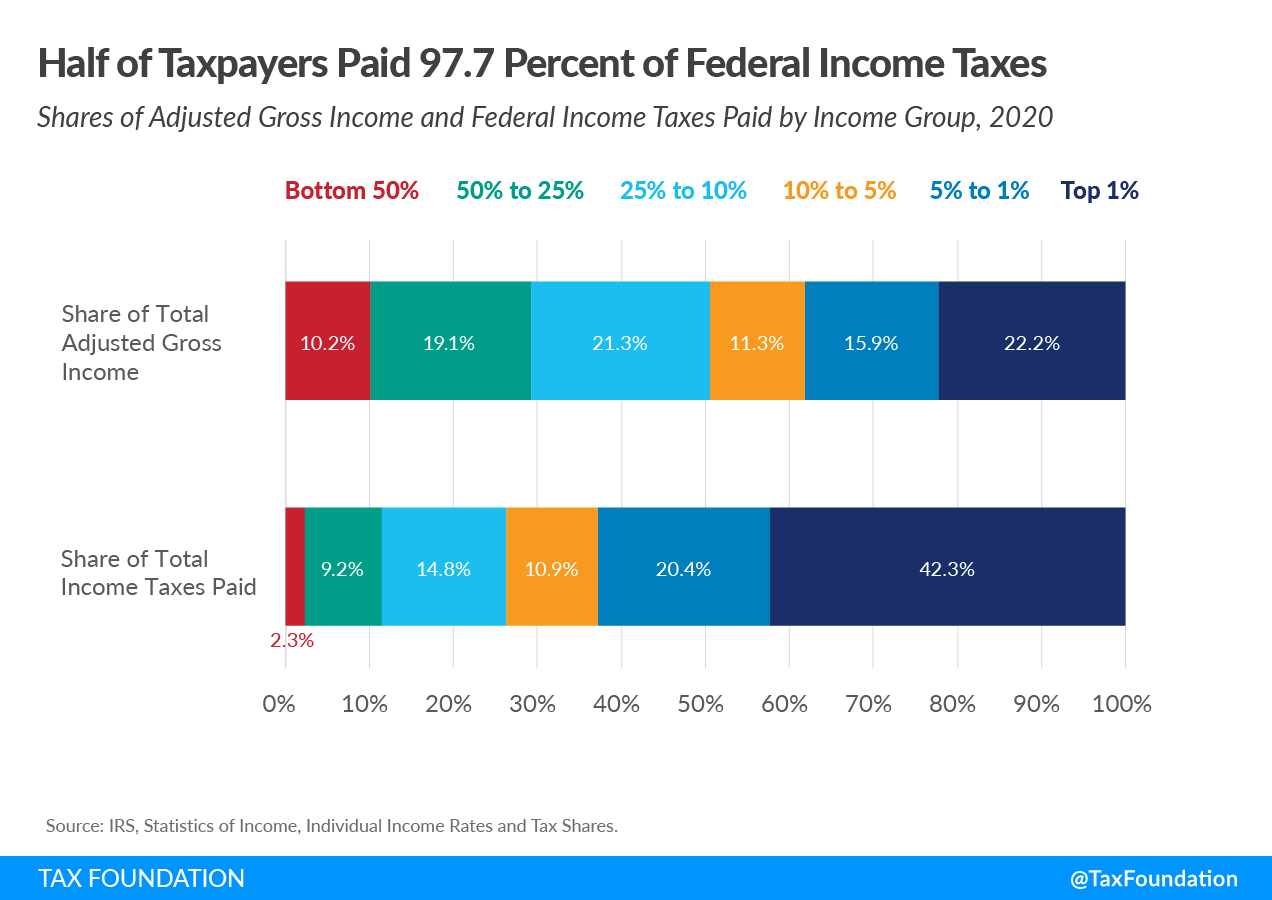

(2,954 posts)The answer is 73%. Should it be more? Sure.

How much more is the debate. Don't have the answer, but I doubt we'll ever come close the rates envisioned in this thread.

https://taxfoundation.org/data/all/federal/summary-latest-federal-income-tax-data-2023-update/

oldsoftie

(12,604 posts)You can tax those top 10% MORE but it still wont be nearly enough. The bigger problem is UNTAXED income; non-W2/1099 income. Think about how many occupations fall into that category. Mechanics, lawyers, doctors, painters, anyone in any type of construction, therapists, heating & air, plumbing, electrical, painters, hairdressers, bar owners, restaurants, etc etc. The first thought people always have is "illegal income" but thats not the big money.

Abolishinist

(1,308 posts)part of the economy, but it has to be huge. We pay a number of the above in the list, a few with cash. Throughout the year we pay a housekeeper, handyman, hair salon, yoga instructor, pedicurist, painter, trainer, pet groomer, gardener and others, and none of them receive a 1099. Our handyman (a Magat) even referenced some obscure, probably Breitbart-inspired take on a "tax law" that he interprets as meaning what we pay him is not taxable income.

And according to the chart posted above, 74% of the taxes are paid by only 10% of the population, with a full 42% by the top 1%. Something needs to change.

oldsoftie

(12,604 posts)That adds up to REAL money! And thats why we need a sales tax/VAT along with a totally new & simplified tax code. Thousands of pages are simply ridiculous. But the people who write the laws also write the deductions for what they have. Unless we want the govt to give all of us a total financial colonoscopy, a sales/VAT tx is the ONLY way to get those high income "small business" people to actually PAY on that income. Because I know several of them and they're out spending that money.

And just for the hell of it, if you pay the MAGA guy over 600 in a yr I'd give him a 1099 just to stick In his craw

Progressive dog

(6,918 posts)by hanging on to their money. Do you think they have stacks of money growing in their basements?

The wealthy are the people whose income comes mostly from investments.

mdmc

(29,074 posts)I need to become rich.

That has never been my goal before.

I've been a social worker for 20 years.

Now, at the age of 53 I am moving into sales

God willing, I will need a CPA![]()