General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe health care law was the biggest positive for low income Americans since Medicaid was implemented

The mandated doesn't change that.

The mandate will impact about 1.9 percent of the population (across incomes) who will have to pay an idividual minimum of about $8 per month in 2014 climbing to about $58 per month in 2016, assessed as a one-time fee at tax time.

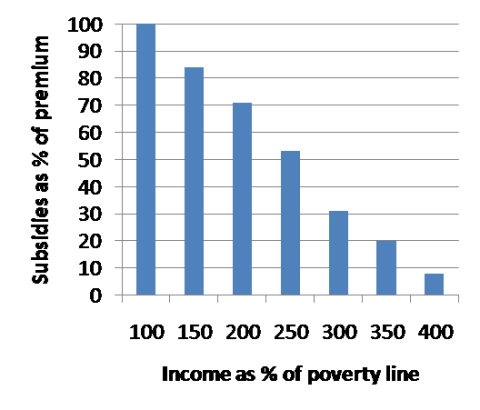

Chart illustrates how the mandate works

http://www.democraticunderground.com/1002881604

The health care law expanded Medicaid to 5 percent of the population.

A key element of the Affordable Care Act (ACA) is the expansion of Medicaid to nearly all individuals with incomes up to 138 percent of the federal poverty level (FPL) ($15,415 for an individual; $26,344 for a family of three in 2012) in 2014. Medicaid currently provides health coverage for over 60 million individuals, including 1 in 4 children, but low parent eligibility levels and restrictions in eligibility for other adults mean that many low income individuals remain uninsured. The ACA expands coverage by setting a national Medicaid eligibility floor for nearly all groups. By 2016, Medicaid, along with the Children’s Health Insurance Program (CHIP), will cover an additional 17 million individuals, mostly low-income adults, leading to a significant reduction in the number of uninsured people.

Medicaid does not cover many low-income adults today. To qualify for Medicaid prior to health reform, individuals had to meet financial eligibility criteria and belong to one of the following specific groups: children, parents, pregnant women, people with severe disability, and seniors. Non-disabled adults without dependent children were generally excluded from Medicaid unless the state obtained a waiver to cover them. The federal government sets minimum eligibility levels for each category, which are up to 133% FPL for pregnant women and children but are much lower for parents (under 50% FPL in most states). States have the option to expand coverage to higher incomes, but Medicaid eligibility levels for adults remain very limited (Figure 1). Seventeen states limit Medicaid coverage to parents earning less than 50 percent of poverty ($9,545 for a family of 3), and only eight states provide full Medicaid coverage to other low-income adults. State-by state Medicaid eligibility levels for parents and other adults are available here.

The ACA expands Medicaid to a national floor of 138% of poverty ($15,415 for an individual; $26,344 for a family of three). The threshold is 133% FPL, but 5% of an individual’s income is disregarded, effectively raising the limit to 138% FPL. The expansion of coverage will make many low-income adults newly eligible for Medicaid and reduce the current variation in eligibility levels across states. To preserve the current base of coverage, states must also maintain minimum eligibility levels in place as of March 2010, when the law was signed. This requirement remains in effect until 2014 for adults and 2019 for children. Under the ACA, states also have the option to expand coverage early to low-income adults prior to 2014. To date, eight states (CA, CT, CO, DC, MN, MO, NJ and WA) have taken up this option to extend Medicaid to adults. Nearly all of these states previously provided solely state- or county-funded coverage to some low-income adults. By moving these adults to Medicaid and obtaining federal financing, these states were able to maintain and, in some cases, expand coverage. Together these early expansions covered over half a million adults as of April 2012.

Eligibility requirements for the elderly and persons with disabilities do not change under reform although some individuals with disabilities may become newly eligible under the adult expansion. Lawfully residing immigrants will be eligible for the Medicaid expansion, although many will continue to be subject to a five-year waiting period before they may enroll in coverage. States have the option to eliminate this five-year waiting period for children and pregnant women but not for other adults. Undocumented immigrants will remain ineligible for Medicaid.

- more -

http://www.kff.org/medicaid/quicktake_aca_medicaid.cfm

Consider all the changes since President Obama took office.

By ROBERT PEAR

WASHINGTON — The House gave final approval on Wednesday to a bill extending health insurance to millions of low-income children, and President Obama signed it this afternoon, in the first of what he hopes will be many steps to guarantee coverage for all Americans.

<...>

The roll call ended a two-year odyssey for the child health legislation, which President George W. Bush adamantly opposed on the ground it would lead to “government-run health care for every American.”

<...>

In a major change, the bill allows states to cover certain legal immigrants — namely, children under 21 and pregnant women — as well as citizens.

Until now, legal immigrants have generally been barred from Medicaid and the State Children’s Health Insurance Program for five years after they enter the United States. States will now be able to cover those immigrants without the five-year delay.

- more -

http://www.nytimes.com/2009/02/05/us/politics/05health.html

By Sarah Barr

At least six states have opened their Children’s Health Insurance Program to the kids of low-income state employees, an option that was prohibited until the passage of the 2010 health-care law.

This relatively small step has as its backdrop years of debate over the program, known as CHIP, including concerns that it encourages states — and consumers — to replace private insurance with taxpayer-subsidized coverage.

Now, as a result of the policy change, families of lower-income state workers who have struggled to pay for family coverage can qualify for the program. CHIP, which is jointly financed by the states and the federal government, provides coverage to the uninsured children of families who earn too much to qualify for Medicaid but cannot afford private insurance.

The federal government had closed that option to most states when CHIP was established in 1997, because of concerns that it might be an easy way for financially strapped states to shift the costs of some public-employee health benefits to the federal government. Federal employees were allowed to enroll their children.

http://www.washingtonpost.com/national/health-science/2011/11/04/gIQAeDvotM_story.htm

dkf

(37,305 posts)If it results in employers dropping or reducing their contributions it could turn out to be a zero sum game with the poor at an advantage and the middle class at a disadvantage. Well maybe that is how the distribution was meant to work.

Guys, this is a major program to aid lower- and lower-middle-income families. How is that not a big progressive victory?

http://krugman.blogs.nytimes.com/2009/12/26/numerical-notes-on-health-care-reform/

The subsidies certainly are.

Zalatix

(8,994 posts)So do the math here...

There are people now who can afford insurance but won't get it. In addition there are the working poor who can't afford the post-ACA premiums either. None of this will won't change.

What has changed is that they can now go get insurance once they get sick, go to the hospital, get care, and then they'll probably drop their coverage.

People here say the Mandate doesn't allow the IRS to punish you for not paying the tax penalty for non-compliance.

That INVARIABLY means that you will see millions of people getting just-in-time coverage. Remember how people used to get auto insurance for registration purposes, then drop it afterwards? Yeah, that. In the health insurance industry.

Who will get socked the hardest by this mass gaming of the system? Insurance companies, who will reap about 6 months of premium at best from these folks, only to shell out THOUSANDS.

It is coming. Wait for it. Bring popcorn.

ProSense

(116,464 posts)"What has changed is that they can now go get insurance once they get sick, go to the hospital, get care, and then they'll probably drop their coverage. "

...rescission. So that's more nonsense.

Zalatix

(8,994 posts)and then going to the hospital and getting coverage? ![]()

You're confused. Again.

ProSense

(116,464 posts)Why don't you create every imaginable situation under the sun and claim it's a crisis!

"So how does that stop people from buying insurance after they get sick and then going to the hospital and getting coverage?"

So now you're complaining that the some among the 1.9 percent are going to wait until they get sick to get insurance? It's still only 1.9 percent, and likely the majority of those people will pay the penalty.

Zalatix

(8,994 posts)Let me say this as simply as possible. There are over 40 million uninsured in America. That number dropped by about 1.1 million last year as the ACA added kids to parents' policies. Still, what's left is orders of magnitude bigger than the 1.9% you threw out there.

If your cohorts' claim that the IRS can't enforce the tax penalty is true, then it ain't a guess to say that no less than 30 million people will STILL not purchase health insurance under this new law. It's not a guess, it's an absolute certainty.

And as you said, rescission is now illegal. That means when those people get sick, they can probably buy coverage at that point, then go in for services. They can and they will. It's the nature of the human beast to do exactly this.

The only guesswork here is how many of 30 million+ will get sick and how much will each person's medical bill be. What's not guesswork is that the insurance companies will have to cover that with at best 6 months of premium from each customer if they're lucky.

There is no guesswork in saying this will be disastrous for health insurance companies.

It is coming. Wait for it. Bring popcorn.

If your cohorts' claim that the IRS can't enforce the tax penalty is true, then it ain't a guess to say that no less than 30 million people will STILL not purchase health insurance under this new law. It's not a guess, it's an absolute certainty.

Math: 40 million minus 30 million does not equal 30 million.

Facts:

http://thinkprogress.org/health/2012/09/28/925121/study-romneys-health-care-plan-leads-to-more-uninsured-americans-higher-premiums-than-obamacare/

http://www.democraticunderground.com/1014249265

Zalatix

(8,994 posts)ProSense

(116,464 posts)"'40 million minus 30 million'? WOAH, where did you get that? It's 40 million minus 1.1 million."

The health care law wasn't fully implemented last year. The law will reduce the uninsured population by more than 30 million.

Still more math: 40 million minus 1.1 million does not equal 30 million.

Even on the face of your attempted distortion, what the math shows is that the health care law has already reduced the uninsured numbers.

Facts:

http://thinkprogress.org/health/2012/09/20/881491/obamacare-improved-health-coverage-in-20-states-census-analysis-confirms/

Zalatix

(8,994 posts)Health insurance corporations will be bankrupted by the mass gaming of the system that is coming. Enjoy the ride! ![]()

ProSense

(116,464 posts)"Health insurance corporations will be bankrupted by the mass gaming of the system that is coming. Enjoy the ride!"

And that's bad?

Wendell Potter Agrees: Big-Profit Health Insurance Almost Dead

http://www.democraticunderground.com/1002390746

You're making arguments and throwing around cliches and still don't know what you're talking about.

Zalatix

(8,994 posts)NashvilleLefty

(811 posts)The mandate.

Zalatix

(8,994 posts)The mandate tells you to buy insurance but what if you choose not to?

NashvilleLefty

(811 posts)the law and human nature.

"There are people now who can afford insurance but won't get it." That's what the mandate is for. If they choose not to get insurance, they pay insurance fees which go to Healthcare.

"In addition there are the working poor who can't afford the post-ACA premiums either" that's why the ACA gives them subsidies or exempts them from the mandate - and also why Medicaid was expanded to insure they get the care they need.

"People here say the Mandate doesn't allow the IRS to punish you for not paying the tax penalty for non-compliance." Oh, the IRS will get their money. I know this from personal experience. No, they can't send you to jail, but they have other ways to get money that's owed.

That makes the rest of the post moot, since it is based on invalid assumptions.

Zalatix

(8,994 posts)You won't find anywhere in the law where people who don't buy insurance will be made to pay an insurance fee.

In fact, you will find people here who say the IRS can't even enforce the tax penalty.

caps on out of pocket premiums, free contraceptives, no co-pays on preventive care, ban on lifetime limits and denying coverage for pre-existing condition, and the benefits to small business owners, among others.

How Small Business Owners Get Health Insurance

http://www.democraticunderground.com/10021439415

dkf

(37,305 posts)ProSense

(116,464 posts)the RW line for everything (see credit card reform/swipe fee).

Remember when BoA tried to pull a fast one? Times have changed. These assholes are hard press to get away with that kind of thing. That's why they're fighting reform with every last dollar.

dkf

(37,305 posts)That is the way it works. So costs get distributed somehow.

ProSense

(116,464 posts)"Insurance is meant to spread out costs among a larger pool."

...works. The financing for the health law includes a tax on the wealthy.

By Kelly Kennedy and Richard Wolf, USA TODAY

WASHINGTON – President Obama's health care law is constitutional as a tax — but only a small percentage of Americans will pay more, a USA TODAY analysis of federal data shows.

Though the law is projected to raise more than $800 billion in taxes, fees and penalties over a decade, 40% comes from about 3.5 million households with adjusted gross incomes above $200,000. Employers, insurers and health care providers are slated to fork over much of the rest.

That leaves only a few taxes that will fall partially on middle-income taxpayers:

- more -

http://usatoday30.usatoday.com/news/washington/story/2012-07-16/health-care-tax/56256676/1

dkf

(37,305 posts)Services. Geez Louise.

NashvilleLefty

(811 posts)and share expenses, it can be must cheaper on individuals. Plus, it can lower expenses or at least keep them from rising as much as they would otherwise.

For instance, part of the problem now is that most people can't afford preventative care, so they wait until the problem gets worse and more expensive and then go to the emergency room. If they cannot afford the emergency room fees, then those fees are shifted elsewhere, as you said. Thus raising costs for those who can pay.

However, if they can afford preventative care which is much cheaper, then there are no emergency room fees for the rest of us to absorb. If they cannot afford the preventative care the rest of us still have to absorb and share those costs, but the costs are much lower than they would be otherwise.

It's a simple matter of paying less now, or paying much more later. Plus the added advantage of keeping these people in good health.

porphyrian

(18,530 posts)ProSense

(116,464 posts)porphyrian

(18,530 posts)The legislative process should be mandatory watching for all American citizens. Maybe then we wouldn't end up with so many shitty lawmakers.

dsc

(52,163 posts)agree to do so. My state will be GOP dominated in 2014 and is highly unlikely to expand medicaid. At that point you will have people who can't get subsidies due to having too low of an income (they were supposed to be covered by medicaid) but who will be covered by the mandate. I hope the states take the generous deal but have grave doubts.

By Annie-Rose Strasser

Eight days after the Supreme Court upheld the constitutionality of the Affordable Care Act’s individual mandate and ruled that the federal government cannot penalize states that refuse to expand Medicaid, Texas Gov. Rick Perry (R) announced that he would not open the program to more applicants. But while he was making a public show of turning down federal funds, Perry was using the additional dollars in state budget projections.

In a letter explaining how he would fill a budget gap left by Texas’ decision to defund Planned Parenthood, Perry’s office uses the money the federal government will pay states that make Medicaid available to individuals up to 133 percent of the Federal Poverty Line in its budgetary assumptions:

Several months ago, the Texas health commissioner signed a rule to ban Planned Parenthood or any organization the state considers an “abortion affiliate” from participating in Medicaid’s Women’s Health Program, which “provides low-income women with family planning exams, related health screenings and birth control” throughout Texas. The state’s discrimination against a specific health provider violated federal rules and led Washington, which had financed 90 percent of the WHP through Medicaid funds, to block Texas from receiving further funding for the program.

- more -

http://thinkprogress.org/health/2012/08/06/647211/perry-medicaid-expansion-pp/

Six governors say they will opt out of Medicaid. How long will they hold out?

http://www.democraticunderground.com/1002923048

States stand to lose a lot more than Medicaid funding by refusing the expansion

http://www.democraticunderground.com/1002914241

flamingdem

(39,313 posts)Now if people could just do the minimum to see how they'll save $ and have security for their health, it will be embraced even more.

dkf

(37,305 posts)We've seen they've already undercalculated the cost for the ACA, and how many will be hit by the mandate's Tax. What about their estimate for the drop in employer coverage? Has that been estimated correctly?

CBO ESTIMATES 3-5 MILLION COULD LOSE EMPLOYER INSURANCE UNDER ACA | The Congressional Budget Office’s best estimate, subject to “tremendous amount of uncertainty,” is that 3 to 5 million fewer people would have insurance through their employer under the Affordable Care Act. In that estimate, 11 million workers would lose their employer coverage, while 3 million would choose to drop their coverage and go into the state health exchanges or on Medicaid. Another 9 million workers would gain coverage through their employer, for a net total of 5 million in 2019. Republicans argued business surveys showed that a larger number of employers would drop coverage, but the CBO said employer surveys “have uncertain value and offer conflicting findings.”

http://thinkprogress.org/health/2012/03/15/445446/cbo-employer-sponsored-insurance-estimate/?mobile=wp

"How do you calculate for the drop in future employer coverage?"

...you prepare to add more people to the exchanges.

This is what scares Republicans. They talk big about not expanding Medicaid, not implementing the exchanges and employers dropping coverage, but the reality is that these factors will likely speed the expansion of the federal government's role. It's already built into the law.

dkf

(37,305 posts)So now my employer pays 70%. If they drop it I pay the full expense.

I am at a significant disadvantage if I am one of the 11 million who loses coverage through my employer and has to go through the exchange.

Except that won't happen to me because Hawaii has an exemption from the ACA so that we keep our employer mandated health coverage. But it will happen to 11 million other people by CBO estimates.

2ndAmForComputers

(3,527 posts)BenzoDia

(1,010 posts)I think it will really help out low income Americans by identifying larger issues early and often.

Edit:

Removed accidental emote

ProSense

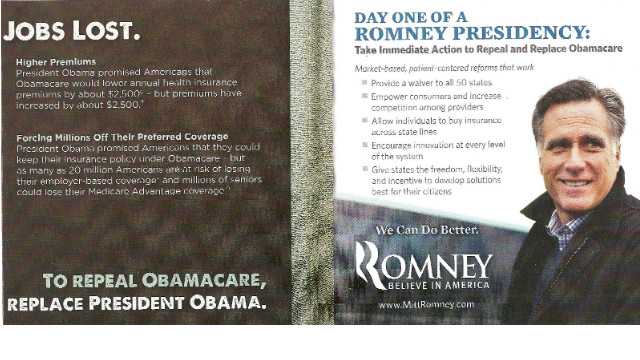

(116,464 posts)He's still campaigning on repealing the health care law.

Romney mail piece takes aim at 'Obamacare'

http://politicalticker.blogs.cnn.com/2012/10/01/romney-mail-piece-takes-aim-at-obamacare/

So he's trying to take credit for the MA law (http://www.democraticunderground.com/10021430496), but denouncing the law based on it?

Romulox

(25,960 posts)ProSense

(116,464 posts)Romulox

(25,960 posts)ProSense

(116,464 posts)"It was Mitt's idea in the first place. Duh! "

...believe Mitt?

http://sync.democraticunderground.com/10021430496

"Duh!"

BenzoDia

(1,010 posts)There's enough money for at least one in each State. And if I'm not mistaken, the federal government may start one up in a state if there isn't one.

http://www.healthcare.gov/law/features/choices/co-op/

ProSense

(116,464 posts)http://www.healthreform.gov/affordablecareact.html

It needs addtional funding, and Senate Democrats have proposed it.

S.1088 - Retiree Health Coverage Protection Act

http://www.opencongress.org/bill/112-s1088/show