General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWhy Are Millions Paying Online Tax Preparation Fees When They Don't Need To?

Few taxpayers use the Free File system — intended to help moderate- and low-income filers — and that benefits companies like Intuit and H&R Block. Now Congress is moving to make the program permanent.

by Tik Root for ProPublica June 18, 5 a.m. EDT

This story was co-published with Quartz.

As internet use took off at the turn of the millennium, the Office of Management and Budget asked the Internal Revenue Service to create no-cost electronic tax-filing options for low- and moderate-income taxpayers. The tech-challenged agency turned to the online tax-preparation industry for help and soon struck a deal with companies such as Intuit (the maker of TurboTax) and H&R Block, which had organized as a 12-member consortium called the Free File Alliance.

The Free File Alliance agreed to offer tax-prep service to millions of Americans at no charge. In exchange, the IRS pledged to “not compete with the Consortium in providing free, online tax return preparation and filing services to taxpayers.”

The arrangement went into effect in 2003 and the IRS and the alliance have kept the framework in place ever since. Today the Free File system appears on track to become permanent. In April, the House voted unanimously to enshrine the provision in law, and the Senate is now considering whether to follow suit.

It’s hard to argue with the goal of the program. Free File theoretically allows 70 percent of American taxpayers to prepare and file their taxes at no cost. More than 50 million no-cost returns have been filed using the program over the past 16 years, according to the IRS, saving users about $1.5 billion in fees. Intuit lauds the program as “an example of a public/private partnership that works.” And Tim Hugo, executive director of the Free File Alliance, called Free File “a great product,” adding, “Free File has changed the market.”

But 50 million returns over 16 years represents only about 3 percent of eligible tax returns. By ProPublica’s estimate, that suggests U.S. taxpayers eligible for Free File are spending about $1 billion a year in unnecessary filing fees.

https://www.propublica.org/article/free-file-online-tax-preparation-fees-intuit-turbotax-h-r-block

Wounded Bear

(58,713 posts)I went e-file as soon as it started (well, almost) and once my returns got down to the basic short form, I used the online filling and filing system quite successfully.

It may not be suitable for more complex returns, but I wouldn't know.

turbinetree

(24,720 posts)they know how much you make and how much you have to pay for state and federal and local taxes, if you have mortgage, then it's a different story.................why do we have this Turbo Tax, or H&R Block stuff.....................its about greed...............

![]()

RKP5637

(67,112 posts)turbinetree

(24,720 posts)they don't know what you have in investments..............

https://www.ftb.ca.gov/individuals/efile/allsoftware.shtml

http://taxhow.net/state/california

RKP5637

(67,112 posts)turbinetree

(24,720 posts)global1

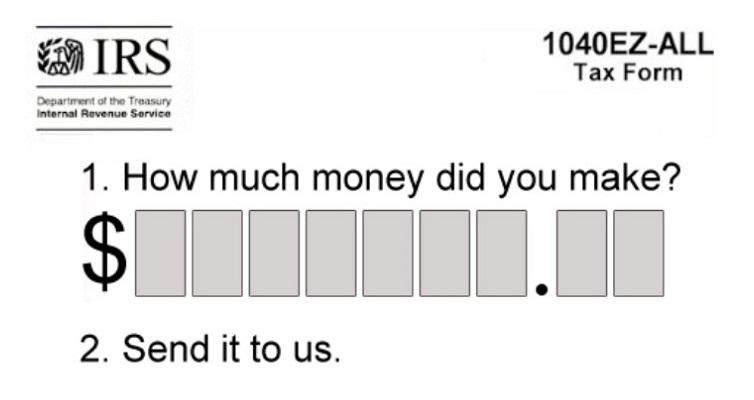

(25,270 posts)a postcard?

Did the big tax filing companies (like H&R Block) get to him and tell him to stop that talk because it would put them out of business?

turbinetree

(24,720 posts)see my above comment to "Wounded Bear"

![]()

Wounded Bear

(58,713 posts)

mythology

(9,527 posts)Republicans don't want wealthy people to pay taxes, just those of us who work for a living.

MiniMe

(21,718 posts)I don't believe any of his promises

marybourg

(12,634 posts)with pencil and paper for 60 years. I found th free file program awkward, haphzard and not fully functional in preparing the various Schedules when I tried it 5 or 6 years ago.

Merlot

(9,696 posts)I've been using it for the past 4 years and it's great. Tried it prior to that without much luck.

marybourg

(12,634 posts)an iPad. Wonder if that would be sufficient.

Proud Liberal Dem

(24,437 posts)Filing taxes is required by law for all but a few select groups of Americans, so why should we have to pay to file? I feel like I get robbed blind paying for tax prep/e-filing files

mythology

(9,527 posts)I did and I lamented the first time I made too much for that. It still irks me that half the time I spend a good chunk of my refund on that. But beats owing.