Not being a macroeconomist, I'll take their word for it.

http://macroadvisers.blogspot.com/2010/06/chances-of-double-dip-are-essentially.htmlThe Chances of a "Double-Dip" are Essentially Nil

The Business Cycle Dating Committee of the National Bureau of Economic Research has yet to call an official end to the recession that began in December of 2007, but most forecasters (and at least one outspoken member of the Committee, Bob Gordon) now believe the recession ended around the middle of 2009. We believe the recession ended in either June or July, so that the economy has been expanding for about a year.

Early in the recovery many forecasters, concerned that the nascent expansion was fueled only by temporary inventory dynamics and short-lived fiscal stimulus, fretted over the possibility of a double-dip recession. Now, with the emergence of the sovereign debt crisis in Europe, that concern has re-surfaced. Certainly we recognize that the debt crisis imparts some downside risk to our baseline forecast for GDP growth. However, based on current, high-frequency data � most of which is financial in nature and so is not subject to revision � we believe the chance of a double-dip recession is small.

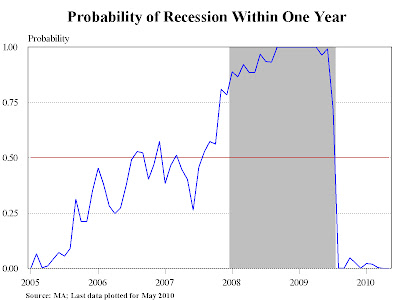

One way we assess these odds is with a simple but empirically useful �recession probability model� in which the probability of experiencing a recession month within the coming year is a weighted sum of the probability that the economy already is in recession and the probability that a recession will begin within a year. The former probability is estimated as a function of the term slope of interest rates, stock prices, payroll employment, personal income, and industrial production. The latter is estimated as a function of the term slope, stock prices, credit spreads, bank lending conditions, oil prices, and the unemployment rate. Currently this model, updated through May�s data, estimates that the probability of another recession month occurring within the coming year is zero. (See Chart).

While ex post this model has a perfect record of predicting recessions, ex ante its predictions are only one factor we weigh when considering whether to introduce a double-dip recession into our baseline forecast. Still, the extremely low current reading is in notable contrast to readings during the early phase of the sub-prime crisis when the probability of recession flirted with 50% for a year before then finally rising strongly above that marker during the second half of 2007. At least by this measure, the economy appears to be in a less vulnerable position now than it was then.