Foreclosures and Negative Equity Why Financial Bailout Programs Fail in California.

Income, Budget Problems, and Underwater Mortgages.

Foreclosures are still a big chunk of the housing market in California. Of homes sold in December in California 41 percent were foreclosure re-sales. What that means is the home has been foreclosed in the last year. Now you would expect in a state like California with historic budget issues that people would be more cautious about forecasting booming home prices. After all, on Friday we learned that the California unemployment rate is up to 12.4 percent bringing the overall underemployment plus unemployment rate up to 22 percent. This in itself should put a damper on housing prices. The major focus has been on how deep prices have fallen so therefore, home prices must bounce back. Yet little focus is given to the actual economy which is the primary driver of home prices. Negative equity is a reflection of bubble prices and a poor economy.

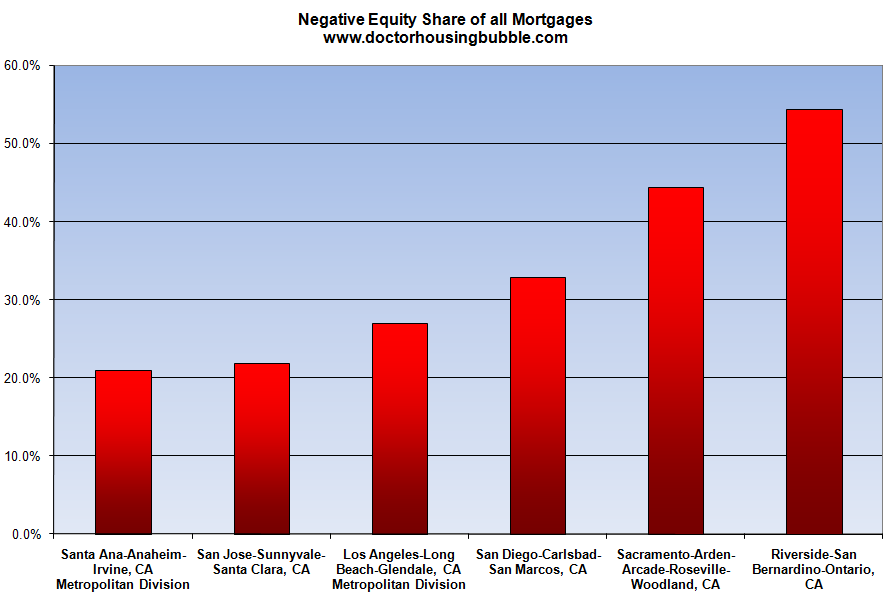

Before we examine the nature of negative equity, let us first look at a few of the biggest MSAs in California and their negative equity market share:

The above data comes from reports from First American CoreLogic. It is rather obvious that nearly every major MSA in California is underwater. North, South, East, or West it really doesnt matter. Negative equity is a big part of the market. Someone can look at the above chart and say well at least Orange County or Los Angeles isnt that bad. Actually there is a large amount of shadow inventory in both of those areas as we pulled up in previous reports. Negative equity is massive in these areas yet the above chart doesnt highlight this fact because it is focusing on what happened and not on what is going to happen. What I mean by this is areas like the Central Valley and the Inland Empire have giant negative equity numbers but these areas have also seen the bulk of home sales in the last year. So current prices actually reflect a more realistic valuation. Therefore, when we analyze the data we get a more accurate look of what is going on.

http://www.doctorhousingbubble.com/foreclosures-and-negative-equity-%E2%80%93-why-financial-bailout-programs-fail-in-california-income-budget-problems-and-underwater-mortgages/