Federal Reserve Fighting Inflation in the 1970s and Restraining the Housing Market. Today the Federal Reserve is Juicing the Housing Market Trying to Cause Inflation. Researching the 1970s and 1980s Mortgage Markets and how 30 Year Fixed Mortgage Rates went from 7.25 Percent to 17.5 Percent in one Decade.

People have a hard time predicting the future especially when it comes to economic behavior. Many people saw the housing boom and bust but few had the wherewithal to take action at optimal points. Once the herd catches wind, it is usually too late. How many people rushed in at the tail end of the technology bubble only to see their investments vaporize into thin air? How many people overpaid for homes during this boom only to be left with mortgages that dont reflect the value of the item they are supposed to reflect? The U.S. Treasury and Federal Reserve know full well that bubbles and their subsequent busts are only part of human nature. We learned painful lessons during the Great Depression and reigned in the banking sector. It took a full generation to forget all those important rules of the road. Yet we dont even need to go back so far. We can look at the 1970s and 1980s to see how quickly things can spiral out of control with mortgage rates and all things connected to the interest rate.

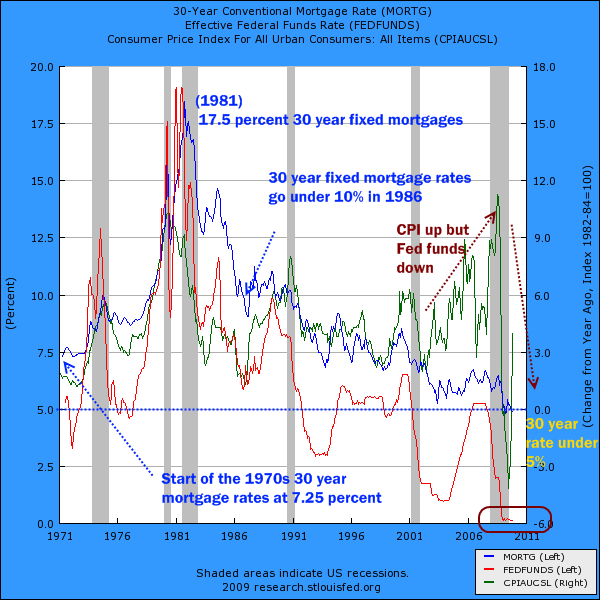

did some sleuthing and pulled up some fascinating articles in older newspapers showing how the typical mortgage rate went from 7.25 percent in the early 1970s to a record 17.5 percent in 1981. In less than a decade rates went up 100+ percent. It is hard for people to imagine this but let us walk through what happened with the benefit of hindsight. Let us chart out the average 30 year fixed mortgage, Fed funds rate, and CPI rate of change:

During the start of the 1970s the 30 year fixed mortgage rate started at 7.25 percent. By the late 1970s the rate was already over 10 percent and by 1981 it reached a peak at approximately 17.5 percent. The 30 year fixed rate didnt go under 10 percent again for another five years until 1986. The Federal Reserve with the help of Paul Volcker brought inflation under control by raising the Fed funds rate over 17.5 percent. Unlike the current U.S. Treasury and Federal Reserve, we had someone at the head of the ship concerned with the viability of the dollar and put mortgages on the back burner. This current Fed and Treasury is concerned more with appeasing the crony bankers on Wall Street.

http://www.doctorhousingbubble.com/federal-reserve-fighting-inflation-in-the-1970s-and-restraining-the-housing-market-today-the-federal-reserve-is-juicing-the-housing-market-trying-to-cause-inflation-researching-the-1970s-and-1980s/