Loan Modifications Another Taxpayer Bailout to the Housing Industry: Mortgage Modification Default Rates over 50 Percent. Over 4 Percent of Subprime Loans First Payment Defaults.

Ive gotten a few e-mails asking about loan modifications and their success rates. There is a reason I rarely bring the topic up. The primary reason is that they are, for the most part failures and another handout to the housing industry. Remember the Hope Now program? I actually called this program up when it first started and was connected (amazingly) to a helpful person. Yet they had no power. All they were able to provide was a listening person on the other line. That program of course failed because it had no teeth to dig into the actual mortgage and principal. With loan modifications, the reason they have been such big failures is they fail to strike at the core of the housing problem. Overvalued homes.

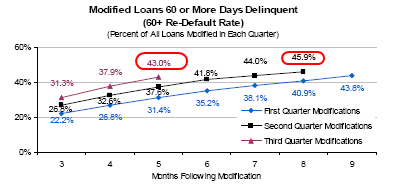

Have you noticed how little the media actually talks about how homes are overvalued? Or how little attention is given to the oncoming Alt-A and option ARM tsunami? Maybe they dont want to disrupt the fantasy world of those that hold these mortgages. Yet that is not the reality of the situation. I can only shake my head when I hear that servicers are getting incentives to modify loans. This is more money down the drain because we already know that many of the modified loans re-default:

This is absurd. Nearly half the loans after 5 months are back in the default bin because they fail to address the root cause of the problem. Homes are still priced too high in many areas. People conveniently forget that we had an epic housing bubble with unstoppable price gains for a full decade. Now with two years of declines they suddenly expect that home prices are somehow adjusted? They are not. Take a look at the Case-Shiller Index:

http://www.doctorhousingbubble.com/loan-modifications-another-taxpayer-bailout-to-the-housing-industry-mortgage-modification-default-rates-over-50-percent-over-4-percent-of-subprime-loans-first-payment-defaults/