Economics / Credit Crisis 2008 Jun 08, 2008 - 03:52 AM

By:

Mike_Whitney

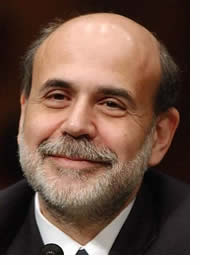

"In the financial sphere, the three longer-term developments I have identified are linked by the fact that a substantial increase in the net supply of saving in emerging market economies contributed to both the U.S. housing boom and the broader credit boom. The sources of this increase in net saving included rapid growth in high-saving East Asian countries and, outside of China, reduced investment rates in that region; large buildups in foreign exchange reserves in a number of emerging markets; and the enormous increases in the revenues received by exporters of oil and other commodities. The pressure of these net savings flows led to lower long-term real interest rates around the world, stimulated asset prices (including house prices), and pushed current accounts toward deficit in the industrial countries--notably the United States--that received these flows."

Whew. That's a pretty long-winded way of saying the Chinese are to blame for everything that's gone wrong in the markets for the last 10 months. But is it true?

Ask yourself this, dear reader; do "savings" cause massive equity bubbles or are bubbles the result of low interest rates and rotten monetary policy? It is universally agreed that Greenspan created the housing bubble by dropping rates below the rate of inflation for 31 months following the dot.com bust. This sparked a multi-trillion dollar speculative frenzy in real estate. Artificially low interest rates distort the market; bubbles appear. "Savings" had nothing to do with it; Bernanke is just trying to dodge responsibility by blaming the Chinese. It's the old "dog ate my homework" routine.

The Fed is also responsible for the surge in oil prices. As Frank Shostak points out in his recent article "The Oil Price Bubble":

"There is a high likelihood that the massive increase in the price of oil that we are currently observing is the manifestation of a severe misallocation of resources � a large increase in nonproductive activities. It is these activities that have laid the foundation for the oil-market bubble, which has become manifest in the explosive increase in the price of oil. The root of the problem here is the Fed's very loose monetary policy between January 2001 and June 2004. (The federal funds rate was lowered from 6% to 1%.)"

http://www.marketoracle.co.uk/Article4994.html