| Latest | Greatest | Lobby | Journals | Search | Options | Help | Login |

|

|

|

This topic is archived. |

| Home » Discuss » Editorials & Other Articles |

|

| Demeter

|

Fri Feb-26-10 07:20 PM Original message |

| The Weekend Economists "Cash not Trash" Compendium February 26-28, 2010 |

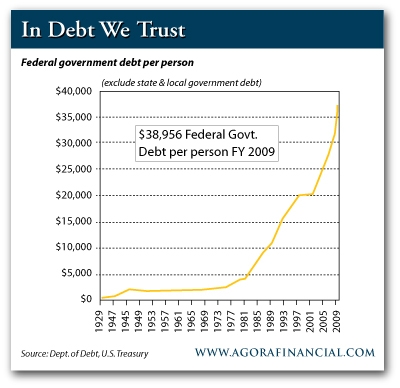

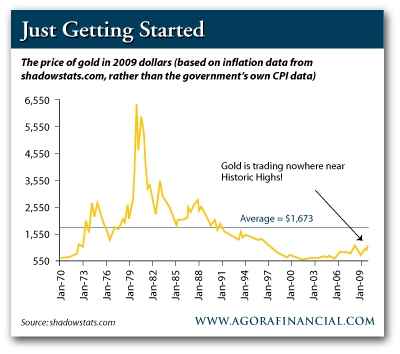

|

Well I got home from work, and shoveled out the driveway, walked the grandpuppy, and here we are again!

Our theme, if I can dignify it with such an organizing thought, is to combine a celebration of the works of Johnny Cash, AND a salute to AnneD's topic: the field of human waste disposal. I do not want anyone to think that Johnny Cash was in any way to be considered human waste--he is the artist in residence for this weekend, since it is his birthday. And as for the toilet humor, well, as AnneD says, everything's in the crapper anyway, so be creative and go with the flow. (I'm cringing already; be gentle!) --------------------------------------- Johnny Cash (February 26, 1932 � September 12, 2003), born J. R. Cash, was an American singer-songwriter, actor,<2> author,<2> and Biblical scholar,<3><2><4> who was one of the most influential musicians of the 20th century.<5> Although he is primarily remembered as a country music artist, his songs and sound spanned many other genres, including rockabilly and rock and roll�especially early in his career�as well as blues, folk, and gospel. Late in his career, Cash covered songs by several rock artists, among them the industrial rock band Nine Inch Nails.<6> Cash was known for his deep, distinctive bass-baritone voice; for the "boom-chicka-boom" freight train sound of his Tennessee Three backing band; for his demeanor; and for his dark clothing, which earned him the nickname, "The Man in Black". He traditionally started his concerts by saying, "Hello, I'm Johnny Cash." Much of Cash's music, especially that of his later career, echoed themes of sorrow, moral tribulation and redemption. His signature songs include "I Walk the Line", "Folsom Prison Blues", "Ring of Fire", "Get Rhythm" and "Man in Black". He also recorded humorous numbers, such as "One Piece at a Time" and "A Boy Named Sue", a duet with future wife June Carter called "Jackson", as well as railroad songs including "Hey Porter" and "Rock Island Line". Cash, a devout but troubled Christian,<7> has been characterized "as a lens through which to view American contradictions and challenges."<8><9> A Biblical scholar,<3><2><4> he penned a Christian novel entitled Man In White,<10><11> and he recited the entire New King James Version of the New Testament<12><13> on a spoken word recording. http://en.wikipedia.org/wiki/Johnny_Cash http://www.youtube.com/watch?v=ZCqpPj87ekE |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 07:21 PM Response to Original message |

| 1. In Spite of My Tardiness, there are no bank failures yet |

|

Can't think of a holiday to shut down the FDIC. Is it snowing in DC?

|

| Printer Friendly | Permalink | | Top |

| AnneD

|

Fri Feb-26-10 08:56 PM Response to Reply #1 |

| 19. As a 'John'ny Cash fan..... |

|

I give it 2 :thumbsup: I guess combining it with Elvis might have lead to tasteless toilet jokes-but hey, it's just been that kind of week for me. I have my Uncle John bathroom readers so I'll post some facts here and there.

Out of curiosity...how many of you have experience with outhouses? They were always 100 yards to far away in the winter and 100 yards to close in the summer In Australia it's a dunny in New Zealand a long drop, it can be a humble one hole or a prosperous 2 story device. This most device represents man's answer to his first ecological problem. http://en.wikipedia.org/wiki/Outhouse answers to your most common outhouse questions...... www.jldr.com/faqs.html |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 09:09 PM Response to Reply #19 |

| 23. My Grandfather's Mother Lived on a Farm North of Detroit Somewhere |

|

It had an outhouse. We only visited in summer. And a hand pump for water to wash with.

The main house was built on a hill, so you could go out a door on the second floor, run down the hill, and come into the first floor. It felt rather like a Mobius strip--changing floors without a staircase.... |

| Printer Friendly | Permalink | | Top |

| Mojorabbit

|

Sun Feb-28-10 02:40 AM Response to Reply #19 |

| 72. My grandmother |

|

had one. I remember using a chamber pot at night when we visited. I loved staying with her.

|

| Printer Friendly | Permalink | | Top |

| Dr.Phool

|

Fri Feb-26-10 09:00 PM Response to Reply #1 |

| 20. We have a bank...Carson River Community Bank, Reno, Nevada. |

|

Press Releases Heritage Bank of Nevada, Reno, Nevada, Assumes All of the Deposits of Carson River Community Bank, Carson City, Nevada FOR IMMEDIATE RELEASE February 26, 2010 Media Contact: LaJuan Williams-Young Phone: (202) 898-3876 Email: lwilliams-young@fdic.gov Carson River Community Bank, Carson City, Nevada, was closed today by the Nevada Department of Business and Industry, Financial Institutions Division, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Heritage Bank of Nevada, Reno, Nevada, to assume all of the deposits of Carson River Community Bank. The sole branch of Carson River Community Bank will reopen on Monday as a branch of Heritage Bank of Nevada. Depositors of Carson River Community Bank will automatically become depositors of Heritage Bank of Nevada. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship to retain their deposit insurance coverage. Customers should continue to use their former Carson River Community Bank branch until they receive notice from Heritage Bank of Nevada that it has completed systems changes to allow other Heritage Bank of Nevada branches to process their accounts as well. This evening and over the weekend, depositors of Carson River Community Bank can access their money by writing checks or using ATM or debit cards. Checks drawn on the bank will continue to be processed. Loan customers should continue to make their payments as usual. As of December 31, 2009, Carson River Community Bank had approximately $51.1 million in total assets and $50.0 million in total deposits. Heritage Bank of Nevada did not pay the FDIC a premium to assume all of the deposits of Carson River Community Bank. In addition to assuming all of the deposits, Heritage Bank of Nevada agreed to purchase approximately $38.0 million of the failed bank's assets. The FDIC will retain the remaining assets for later disposition. The FDIC and Heritage Bank of Nevada entered into a loss-share transaction on $28.5 million of Carson River Community Bank's assets. Heritage Bank of Nevada will share in the losses on the asset pools covered under the loss-share agreement. The loss-share transaction is projected to maximize returns on the assets covered by keeping them in the private sector. The transaction also is expected to minimize disruptions for loan customers. For more information on loss share, please visit: http://www.fdic.gov/bank/individual/failed/lossshare/index.html. Customers who have questions about today's transaction can call the FDIC toll-free at 1-800-894-6802. The phone number will be operational this evening until 9:00 p.m., Pacific Standard Time (PST); on Saturday from 9:00 a.m. to 6:00 p.m., PST; on Sunday from noon to 6:00 p.m., PST; and thereafter from 8:00 a.m. to 8:00 p.m., PST. Interested parties also can visit the FDIC's Web site at http://www.fdic.gov/bank/individual/failed/carsonriver.html. The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $7.9 million. Heritage Bank of Nevada's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to all alternatives. Carson River Community Bank is the 21st FDIC-insured institution to fail in the nation this year, and the first in Nevada. The last FDIC-insured institution closed in the state was Community Bank of Nevada, August 14, 2009. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 09:11 PM Response to Reply #20 |

| 24. And a Second Bank Fails (Thanks Doc!) |

|

Rainier Pacific Bank, Tacoma, Washington, was closed today by the Washington Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Umpqua Bank, Roseburg, Oregon, to assume all of the deposits of Rainier Pacific Bank.

The 14 branches of Rainier Pacific Bank will reopen during normal business hours as branches of Umpqua Bank...As of December 31, 2009, Rainier Pacific Bank had approximately $717.8 million in total assets and $446.2 million in total deposits. Umpqua Bank will pay the FDIC a premium of 1.04 percent to assume all of the deposits of Rainier Pacific Bank. In addition to assuming all of the deposits, Umpqua Bank agreed to purchase approximately $670.1 million of the failed bank's assets. The FDIC will retain the remaining assets for later disposition. The FDIC and Umpqua Bank entered into a loss-share transaction on $578.1 million of Rainier Pacific Bank's assets. Umpqua Bank will share in the losses on the asset pools covered under the loss-share agreement... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $95.2 million. Umpqua Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to all alternatives. Rainier Pacific Bank is the 22nd FDIC-insured institution to fail in the nation this year, and the fourth in Washington. The last FDIC-insured institution closed in the state was American Marine Bank, January 29, 2010. |

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Fri Feb-26-10 09:17 PM Response to Reply #24 |

| 27. "Two Banks Fell Into Burnin' Ring of Fire" |

|

...went down,down,down

and the flames went higher. And it burns,burns,burns the ring of fire the ring of fire. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 09:20 PM Response to Reply #27 |

| 30. hey Ozy! You Made It! |

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Fri Feb-26-10 09:25 PM Response to Reply #30 |

| 33. Just got home. |

|

Family is in town until tomorrow. I've been busy to say the least. Anyway - here's the 1969 version.

http://www.dailymotion.com/video/x1oipi_johnny-cash-ring-of-fire-1969_music |

| Printer Friendly | Permalink | | Top |

| Robbien

|

Sat Feb-27-10 06:25 AM Response to Reply #1 |

| 48. A brand new vulture group setting up a fund to buy FDIC failed banks |

|

And this one seems pretty sinister due to the people running it. Well, maybe not sinister but when the old FDIC and OTS and GSE guys get together to buy banks from the FDIC something is seriously wrong here.

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aip0Cix5ABew Feb. 26 (Bloomberg) -- William Isaac, former chairman of the Federal Deposit Insurance Corp., is leading a group of ex- regulators and bankers raising $1 billion to buy failed lenders in the southeast U.S., according to people briefed on the plan. The investment group, called BSE Management LLC, will be chaired by Isaac, according to the people, who asked not to be identified because the fundraising is private. David Moffett, who stepped down as chief executive officer of Freddie Mac last year, and former Office of Thrift Supervision regional director John Ryan will help run BSE, the people said. Isaac joins investors hoping to pounce as banks close at the fastest pace since 1992. Regulators have seized at least 160 lenders since Jan. 1, 2009, and the FDIC�s confidential list of �problem� banks stands at 702 with $402.8 billion in assets, according to a Feb. 23 report. �The organizers behind BSE are a �Who�s Who� of the banking system,� said Chip MacDonald, a partner with Jones Day in Atlanta who specializes in deals among banks. �They know the regulators well and are experienced with lenders in the southeast. This is a very capable group.� BSE�s plan calls for raising $500 million in the initial stage, said one of the people. Michael Freitag, an outside spokesman for BSE, said the firm doesn�t comment on potential fundraising. Isaac didn�t respond to requests for comment. The group includes Ray Christman, former CEO of the Federal Home Loan Bank of Atlanta and chairman of the Federal Home Loan Bank of Pittsburgh, and Brendan MacMillan, previously a partner at investment firm Oceanwood Capital Management, according to offering documents dated last May. Soothing Concerns BSE members� experience as bankers and regulators puts the firm �in a good position to win the most desirable bank auctions and recapitalizations,� according to the documents. Regulators have been debating how much leeway to give private buyers of failed banks because of concern that they may take too much risk with federally insured deposits. Some investment groups have recruited former bankers as officers to reassure regulators. In May, WL Ross & Co., Blackstone Group LP and Carlyle Group bought BankUnited Financial Corp., agreed to inject $900 million and named John Kanas, former head of North Fork Bancorp, to run the Florida lender after it collapsed. Stephen Ross Billionaire investor Stephen Ross and his partners in real estate firm Related Cos., Jeff Blau and Bruce Beal Jr., this month raised about $1.1 billion from investors including David Einhorn�s Greenlight Capital Inc. to help their SJB National Bank acquire a seized U.S. lender, according to a person with knowledge of the matter. Former Bank of America Corp. investment bank head Gene Taylor is leading North American Financial Holdings, which wants to buy Florida banking assets. BSE seeks an internal rate of return of at least 25 percent �by building a clean regional bank through a small number of acquisitions and then selling the rebranded deposit franchise in five to seven years,� according to the offering. The fund is focusing on the U.S. southeast, �which represents the area of greatest dislocation for banks and real estate while possessing the most favorable demographics to support a strong economic recovery and a higher exit multiple.� Isaac was FDIC chairman from 1981 to 1985. He�s now chairman of LECG Global Financial Services. Moffett was a senior adviser for the Carlyle Group in Washington before leaving in 2008 to head McLean, Virginia-based Freddie Mac. He also was chief financial officer at Minneapolis-based U.S. Bancorp, now ranked sixth by deposits. �There�s a capital vacuum and there�s a lot of money that wants to fill it,� said Walter Moeling, a banking lawyer at Bryan Cave LLP in Atlanta. �The biggest problem remains that the FDIC has an inherent bias against new money from private equity coming in. But these are bona fide bankers with deep roots.� |

| Printer Friendly | Permalink | | Top |

| Hugin

|

Sat Feb-27-10 07:36 AM Response to Reply #48 |

| 57. Eventually, I figured TPTB would find a way to game the FDIC. |

|

"... rate of return of at least 25 percent"

"Carlyle Group" "Freddie Mac" "U.S. Bancorp" A formula for destruction. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 07:23 PM Response to Original message |

| 2. Max Keiser in a Calm and Collected Interview (for him) |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 07:27 PM Response to Original message |

| 3. The Last Temptation of Risk by Barry Eichengreen |

|

Edited on Fri Feb-26-10 07:33 PM by Demeter

FROM LAST APRIL, BUT MAYBE EVEN MORE USEFUL NOW FOR PERSPECTIVE

A MEA CULPA FROM THE ECONOMICS PROFESSOR AT BUSINESS SCHOOL http://www.nationalinterest.org/PrinterFriendly.aspx?id=21274 EXCERPT: THE GREAT Credit Crisis has cast into doubt much of what we thought we knew about economics. We thought that monetary policy had tamed the business cycle. We thought that because changes in central-bank policies had delivered low and stable inflation, the volatility of the pre-1985 years had been consigned to the dustbin of history; they had given way to the quaintly dubbed �Great Moderation.� We thought that financial institutions and markets had come to be self-regulating�that investors could be left largely if not wholly to their own devices. Above all we thought that we had learned how to prevent the kind of financial calamity that struck the world in 1929. We now know that much of what we thought was true was not. The Great Moderation was an illusion. Monetary policies focusing on low inflation to the exclusion of other considerations (not least excesses in financial markets) can allow dangerous vulnerabilities to build up. Relying on institutional investors to self-regulate is the economic equivalent of letting children decide their own diets. As a result we are now in for an economic and financial downturn that will rival the Great Depression before it is over. The question is how we could have been so misguided. One interpretation, understandably popular given our current plight, is that the basic economic theory informing the actions of central bankers and regulators was fatally flawed. The only course left is to throw it out and start over. But another view, considerably closer to the truth, is that the problem lay not so much with the poverty of the underlying theory as with selective reading of it�a selective reading shaped by the social milieu. That social milieu encouraged financial decision makers to cherry-pick the theories that supported excessive risk taking. It discouraged whistle-blowing, not just by risk-management officers in large financial institutions, but also by the economists whose scholarship provided intellectual justification for the financial institutions� decisions. The consequence was that scholarship that warned of potential disaster was ignored. And the result was global economic calamity on a scale not seen for four generations.... |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 07:35 PM Response to Reply #3 |

| 4. THEY WALK THE LINE |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 07:38 PM Response to Original message |

| 5. Matt Taibbi Comments on His Own Article: "Wall Street's Bailout Hustle" |

|

http://trueslant.com/matttaibbi/2010/02/19/on-the-bailout-hustle/

...Thus though the piece appears to focus exclusively on the banks and how they skimmed their own bailout � which is totally true � there is actually a more subtle story out there about the mutual dependency of our increasingly broke-ass, politically desperate government in Washington and their virtually insolvent partner-banks on Wall Street. I would like to get into that more in the future. Already I�m getting some criticism in the mail. As I�m still pretty sick right now I can�t really respond to it at length. But one theme that comes back over and over again from some writers is this idea that I ignored what would have happened if the banks had not been bailed out. That would have been an even worse disaster, the theory goes, ergo all this whining about the banks robbing the bailout money is off base. My feeling on that is similar to what Barry Ritholtz (check out his site if you haven�t), the author of Bailout Nation and one of the guys I spoke with at length for this story, proposed. He said that �we should have gone Swedish on their asses.� The Swedes after a similar bubble burst in 1992 temporarily seized control of insolvent institutions, forced banks to write down losses before they got aid, and gave taxpayers a huge share in the upside of recovery. It was a tough-love approach that really worked and forcefully addressed the moral hazard issue in a way we never touched. That�s one way we could have proceeded. But whatever we didn�t do, we can be sure that what we did do was exactly wrong. Barry pointed out the classic pronunciation of Victorian economist/journalist Walter Bagehot, who said that in a crisis, a Central Bank should lend freely to solvent institutions against good collateral, at penalty rates. We did exactly the opposite: we lent to insolvent institutions, against shit collateral, at zero percent interest. We told these guys to drink themselves sober. Total crap thinking and totally typical. Anyway, I�ll get into this more after I return to the living; right now I�m going to go hang a plasma bag from my bedroom lamp and eat the contents of the first prescription bottle I can find in my bathroom. Thanks to those who sent get well wishes. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 07:39 PM Response to Reply #5 |

| 6. The Article In Question: And the Con Games They Pulled in Detailed Study |

|

Edited on Fri Feb-26-10 07:42 PM by Demeter

|

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 07:49 PM Response to Reply #6 |

| 7. Only Music from "the Sting" Could Go Here: |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 07:52 PM Response to Reply #6 |

| 8. COMMENTARY: The U.S. opts for the bailout hustle over the Swedish banking crisis response |

|

Edited on Fri Feb-26-10 07:55 PM by Demeter

http://www.nakedcapitalism.com/2010/02/the-u-s-opts-for-the-bailout-hustle-over-the-swedish-banking-crisis-response.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

I referenced Matt Taibbi�s latest work at Rolling Stone �Wall Street�s Bailout Hustle� recently when talking about a movie on Ponzi schemes and fraud that aired on 60 Minutes. I liked the piece and recommend you read it � fully aware of the awaiting hyperbole Taibbi uses to hype his case. The interesting bit is Taibbi followed up his article with a blog entry �On the Bailout Hustle� in which he contrasts the American bailout hustle with the more effective but less banker-friendly approach used in Sweden after their own housing bubble and financial crisis in the early 1990s. My feeling on that is similar to what Barry Ritholtz (check out his site if you haven�t), the author of Bailout Nation and one of the guys I spoke with at length for this story, proposed. He said that �we should have gone Swedish on their asses.� The Swedes after a similar bubble burst in 1992 temporarily seized control of insolvent institutions, forced banks to write down losses before they got aid, and gave taxpayers a huge share in the upside of recovery. It was a tough-love approach that really worked and forcefully addressed the moral hazard issue in a way we never touched. Of course, it was Barry who pointed this passage on Sweden out. He would, do that, wouldn�t he? I definitely agree with Barry. In fact, I am probably the first major blogger to broach the subject. See my post: The Swedish banking crisis response � a model for the future? from August 2008 which describes a piece by former Riksbanks head Urban B�ckstr�m from way back in 1997! This is the number one entry on the Internet when you search for �Swedish banking crisis.� Now, this was before the Lehman debacle. And I anticipated massive credit writedowns for the global financial system which would precipitate a major financial crisis. Of course, this is what happened. But, pre-Lehman, I was looking for a banking crisis response model which would prove effective. I looked at the Japanese model and found it wanting. The Nordic model is more promising. Here�s what I said in August 2008: Yesterday I pointed out that today�s global banking crisis has some historical precedents worthy of comparison. In particular, I looked at the Japanese bailout schemes from their housing bubble to see if there was anything there to learn. Unfortunately, the Japanese experience leaves doubts as to whether government intervention is helpful or harmful. There are other examples, however. The Nordic model is a particularly useful one to look at as we move forward. Sweden�s Central Bank Chairman B�ckstr�m shared some of his insights from that experience some eleven years ago in a speech to a Federal Reserve symposium that is available on the Swedish Riksbank website. This is a brilliant piece of work. I use the term �Nordic� because Finland and Norway also had deep, deep contractions due to a banking crisis at the same time (see Marshall Auerback�s piece on Finland here). Now, the information about these financial crisis strategies was readily available in the public domain for years. I mean, my blog post was based on a 1997 article for goodness sake. Clearly, the Obama people didn�t want this solution because they are captured by the financial services industry. That�s why the U.S. is going the Japanese route of bailouts and accounting dodges. The Swedes of the mid-1990s did drag their feet too; they didn�t implement a draconian solution until it was obvious the system was insolvent. And I would add that the technology bubble bailed the Finns and the Swedes out. (Oil helped the Norwegians). So, without the boon for the likes of Nokia or Ericsson, where would those economies have been? Nevertheless, this is not the course the U.S. is on. The closest we have seen to this is Ireland � but even there I have had my doubts. The key difference is the Swedes recognized: Their entire banking system was effectively insolvent. Yet, they were able to fashion a workout scheme that had bi-partisan political support, did not unfairly reward shareholders, dealt with moral hazard, separated regulatory and workout roles so as to reduce conflicts of interest, and that quickly wrote down valuations and liquidated the bad debts as opposed to dragging the process out. Fifteen years later, even the Swedes are not using the �Swedish model� despite their massive loan exposure in the Baltics, which are now in Depression. Clearly denial as to the severity of the banking problem is not just an American phenomenon, it is also a European thing too. But you can only hide your head in the sand for so long. Reality has a way of making itself felt. ��� Update: You�ll probably have noticed that I never used the words �nationalisation� in this piece � and for good reason; The nationalisation talk is just a red herring. The crux of the article is not about nationalisation � or even FDIC-style asset seizure at all. What this article is really about is what I highlighted and said it was about: The Swedes �quickly wrote down valuations and liquidated the bad debts as opposed to dragging the process out.� Put simply: we are looking at a choice between the Japanese approach and the Swedish approach. Now, when it comes to seizure, we are really mainly discussing Citi. JPMorgan was never in doubt. Wells Fargo probably could have made it through with TARP funds alone. After the Merrill deal, Bank of America was the only other too-big-to-fail company that probably would have been seized. (Some super-regionals may have been a question as well). But, in the main, what we�re discussing here is whether Citi would have been taken into majority government ownership the way that AIG was. As for writedowns, this could have been done using an RTC-type vehicle as we saw after the S&L crisis or using a bad bank as the Swedes did during their crisis. The key is writing down the assets quickly rather than keeping the deadweight on the balance sheet as was done in Japan. So the article is a reminder that the bailouts were done because they were the preferred option, not because other choices didn�t exist. And this is important yet again because we are about to see this year that having avoided asset writedown and used asset appreciation to bail out the banks is going to have a very negative impact on credit � and the economy. Above I did point out that the Swedish dilemma was tackled in a bipartisan way, so talk of �nationalisation� is germane because this fictitious argument would probably have been used by Republicans purely for political purposes rather than ideological ones. After all AIG was nationalised and Citi and BofA were effectively nationalised, albeit without the requisite strings attached. The point would be to block Obama�s agenda in order to weaken him. But this is just politics. One last point, the Swedes are playing the same game this time too! That�s because it�s politically easier to try to let banks recapitalize themselves via high margin spreads (borrowing short and lending long in a steep yield-curve environment). The problem for banks is always that they lend long � and that means you can never know the true extent of future losses. That gives an accountant a lot of room for playing with the numbers. Writedowns are just an estimate of loan impairment of unrecoverable asset value. So all a bank has to do is pretend that assets are only temporarily impaired. You�ve heard the term �extend and pretend.� That�s what it�s all about � extending the term of the loan so that even if the asset is eventually written down, the profits earned in the interim will restore the bank�s lost capital. The key is asset prices and accounting standards. If asset prices fail to rise, writedowns are going to come sooner than later � and that means insolvency for some banks. If regulators change accounting standards and allow banks to pretend their assets don�t need to be written down as they did in the early 1980s, the problem could be much larger down the line, as it indeed was when the S&L crisis finally blew up � especially if asset prices (the loan collateral) don�t rise. This is indeed what has happened in the U.S. yet again. Update II: a lot of people have bought the �nationalisation� propaganda. It is Fannie/Freddie-style �nationalisation� that is criminal. These companies should be wound down and eliminated. Instead, they are being used as a slush fund for bailing out the mortgage market. Which is more free-market � a bailout and mega bonuses all around or asset seizure and recapitalization? There is a price for bank failure in a capitalist society, you know. It�s called bankruptcy and seizure. The FDIC seizes and resells bank assets every week. That�s the right approach. But apparently, Lehman�s demise and the inadequate preparation for it scared everyone into bailouts � and that�s how it�s going to stay it seems. |

| Printer Friendly | Permalink | | Top |

| BR_Parkway

|

Sat Feb-27-10 05:38 AM Response to Reply #8 |

| 42. Interesting how everyone wants to go back and look at how Japan |

|

solved their crisis, how Sweden handled theirs, Norway, Finland - on and on

How come no one looks to see how the crisis can be averted in the first place? They all want to focus on the barn door, not the horse. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat Feb-27-10 05:50 AM Response to Reply #42 |

| 43. These Are The People Who Care |

|

They aren't in a position to make policy.

The people who are in policy-making position, on the other hand, simply don't care. They aren't looking at anything, and they are led by misguided fools like Bernanke and Geithner. And Obama is clueless, and it appears likely to remain so. |

| Printer Friendly | Permalink | | Top |

| BR_Parkway

|

Sat Feb-27-10 08:30 AM Response to Reply #43 |

| 58. Sorry, wasn't trying to point out anything wrong with these people |

|

What I so was trying to say was that it's obvious that these systems fail on a regular basis - instead of just reacting to the next crisis - perhaps it's time to figure out more sustainable systems

|

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat Feb-27-10 09:17 AM Response to Reply #58 |

| 60. I Know. I'm Just Trying to Point Out |

|

That's there's something VERY wrong with the people in charge...

|

| Printer Friendly | Permalink | | Top |

| BR_Parkway

|

Sat Feb-27-10 09:53 AM Response to Reply #60 |

| 63. Depends - if they benefit from it, maybe they think there's something |

|

very right about it.

I think a big part of the problem is that too many have no connection to the working class any longer. It's like the whole jobs bill discussion. I'm a small business owner. I don't need a loan so I can buy more inventory, I need customers with money in hand to buy what I already have. I don't need a 6% tax cut if I hire an employee - there aren't enough customers coming in to pay for an employee. And I've got enough tax loss from the economy already that giving me an additional 6% off of zero isn't going to do a thing. Toss that on top of a 28% increase in health insurance and it's getting close to the point of just shutting down. |

| Printer Friendly | Permalink | | Top |

| KoKo

|

Fri Feb-26-10 07:56 PM Response to Original message |

| 9. Ahh...the Great Johnny Cash....this is Spectacular! |

|

:kick: Demeter...you are an ANGEL ...even if you are tearing out your hair...Demeter...

|

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 08:15 PM Response to Reply #9 |

| 13. What Hair? |

| Printer Friendly | Permalink | | Top |

| AnneD

|

Fri Feb-26-10 09:56 PM Response to Reply #13 |

| 37. This will make you feel better..... |

|

Home of the Blues-with a twist

www.youtube.com/watch?v=7ufjeTqOhuM&feature=related Because of her heritage, the fact that she went to my alma mater, and she sings so damn good, she is one of my favs-Hubby scratches his head and thinks she should be playing India Classical-but I tell him a good wine takes elements from the surrounding area and makes it into something new. She has the gift of music and she was planted in this soil and will be as famous as her dad and her half sister. |

| Printer Friendly | Permalink | | Top |

| bread_and_roses

|

Fri Feb-26-10 08:07 PM Response to Original message |

| 10. graphic of the state of affairs out here in the real world |

|

Edited on Fri Feb-26-10 08:08 PM by bread_and_roses

I consider this fits the theme because Johnny Cash knew about hard times and because the friend who sent me the link of the animated map of unemployment by County from 2007 - present said it looked like a case of galloping gangrene.

It's called: "The Decline: The Geography of a Recession" but you tell me if THAT looks like "recession" after you watch it. There's no way to really describe it - you have to watch - takes less than a minute http://www.youtube.com/watch?v=J28tLOpzfpA |

| Printer Friendly | Permalink | | Top |

| AnneD

|

Fri Feb-26-10 10:11 PM Response to Reply #10 |

| 38. The perfect Johnny Cash tune.... |

|

Busted...

www.youtube.com/watch?v=B8kRsoAZjpM&feature=related |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 08:12 PM Response to Original message |

| 11. True Fiscal Insanity: Creating Money to Buy Government Debt By The Mogambo Guru |

|

http://dailyreckoning.com/true-fiscal-insanity-creating-money-to-buy-government-debt/

...The family had cleared out because my Mogambo Machine To Measure Magical Money (MMTMMM) was going nuts, banging and beeping, and clanging and cleeping, which is not even a real word, which only shows you how freaked out I still am when I instantly saw why: Federal Reserve Credit (the magical �money out of thin air� of story and song, which the gold standard would prevent), jumped a massive $31 billion last week � $31 billion in One Freaking Week (OFW)! � taking the total to a record $2.264 trillion. The banks, for their part, can take this new credit that has appeared, as if by magic, on their books, and loan out Huge Freaking Multiples (HFM) of this $31 billion, according to the Fed�s preposterously-low required fractional-reserve ratio which is (and has been for almost two full decades) almost a zillion-to-one, which (multiplying a zillion times $31 billion) is slightly more than, as I understand it, a freaking gazillion. Well, apparently, none of this reached the banks, as the Fed bought up, for itself in a disgusting orgy of monetization of government debt, in One Freaking Week (OFW), a massive $53.6 billion of �Securities bought outright�! The Fed created the money to buy government debt! Gaaaaagakkk! That last word, properly pronounced with a guttural ending, was to indicate another in a series of Timeless Mogambo Truths (TMT), which, in this case, is don�t eat a burrito while you are reading Bad, Bad News (BBN) because you will gag and choke, mostly because it makes a big mess all over everything and the guy in the next cubicle starts whining, �Hey! Stop spitting on me!�, but also because transcripts of the people bugging your office will read it as �unintelligible, followed by gagging and choking�, which proves my point about eating burritos while reading BBN, although I am not sure if it works with, for example, tacos, so they are still OK as far as I am concerned. In case you were wondering how much credit the Federal Reserve has made, so that it can use up some of it to buy, for itself in a loathsome fraud known as �monetizing the debt�, government debt, that particular horrific total comes to a record of $1.967 trillion, which is an astonishing $1.397 trillion higher than this time last year!! As you would expect, the money supply is still rising, and the monetary base rose a whopping $56 billion in the last week, which is more than $560 for everybody in the Whole Freaking Country (WFC) that has a non-government job! In One Freaking Week (OFW)! As Junior Mogambo Rangers (JMRs) know, perhaps intuitively or perhaps because I (as a proxy for the Austrian school of economics but who, if you call them up and ask them, say, �We never heard of this Mogambo person you speak of! Goodbye!�, but you can tell by their suspicious change of mood that they have) never seem to shut up about inflation being properly defined as an increase in the money supply and that inflation in consumer prices is a result of that, and here it is! This increase in the money supply usually, firstly, has a stimulating effect or, in our case, prevention of the Big Freaking Bust (BFB) and economic devastation that we so richly deserve for a ridiculous, laughable half century of experimental socialist governmental deficit-spending and �putting every leveraged dollar to work!�, and the abysmal, total failure of the loathsome Federal Reserve to control the money supply so that the damned government couldn�t do crap like that without entering the money marketplace and bidding for the funds, like any other borrower, thus driving up interest rates, which made the economy slow down, which infuriated worker/voters, and the government would stop doing that fiscal incompetence immediately, or as soon as the next election rolled around, ignoring the possibly of a recall election in the interim, or even a general insurrection and revolution, perhaps ending with the people carrying me on their shoulders, a hero to rule the country as Emperor Mogambo (EM) who immediately installs a gold standard to protect the people�s money from inflation (which keeps from making the poor poorer because of the inevitable higher prices that the additional money causes), and, also as a treat for all my adult loyal subjects, dovetailing the arrival of 3-D TV with hearty encouragement to develop, at great speed, a brave, new world of 3-D pornography, leading America to a new golden age in many, many, many ways! I can hardly wait! In the meantime, however, accumulate gold, silver and oil, especially using some kind of Dollar-Cost Averaging scheme, which has not been improved upon, either in its simplicity (you spend the same number of dollars per month, month after month) or its efficacy; it kicks butt over a long trend, as you are always buying more when they are cheap, and you buy less when they are more expensive. Or, if you are like most people, you are an impatient, greedy little bastard who wants to make the biggest, most maximum profit possible, as soon as possible, by taking maximum risk that gold, silver and oil will never be cheaper than they are now, then you should rush out and buy as much gold, silver and oil as possible Right Freaking Now (RFN), exhausting every source of credit you can get your clutching, grasping little hands on, and then selling the kid�s stuff and buying more gold, silver and oil with that money, too! Somewhere in between these extremes you will find yourself, my budding Junior Mogambo Ranger (JMR)! The effects of massive increases in the money supply (horrifying inflation) will lead you to True Mogambo Enlightenment (TME) about how economics really, really works, and in a blazing moment of incandescent, transcendent clarity, you will suddenly realize you have to buy gold, silver and oil, right away, because, �Whee! This investing stuff is easy!� The Mogambo Guru for The Daily Reckoning |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 08:13 PM Response to Reply #11 |

| 12. It Couldn't Be Anything Else |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat Feb-27-10 07:21 AM Response to Reply #11 |

| 54. Bernanke Delivers Blunt Warning on U.S. Debt |

|

Edited on Sat Feb-27-10 07:26 AM by Demeter

http://www.informationclearinghouse.info/article24879.htm

With uncharacteristic bluntness, Federal Reserve Chairman Ben S. Bernanke warned Congress on Wednesday that the United States could soon face a debt crisis like the one in Greece, and declared that the central bank will not help legislators by printing money to pay for the ballooning federal debt. TELL THAT TO THE MUGAMBO GURU. IF YOU DARE. Recent events in Europe, where Greece and other nations with large, unsustainable deficits like the United States are having increasing trouble selling their debt to investors, show that the U.S. is vulnerable to a sudden reversal of fortunes that would force taxpayers to pay higher interest rates on the debt, Mr. Bernanke said. "It's not something that is 10 years away. It affects the markets currently," he told the House Financial Services Committee. "It is possible that bond markets will become worried about the sustainability It was some of the toughest rhetoric to date about the nation's fiscal and budgetary woes from the Fed chief, who faces a second round of questioning Thursday before a Senate panel. RELATED STORY: Fed to look at high-risk contracts on Greek debt Mr. Bernanke for the first time addressed concerns that the impasse in Congress over tough spending cuts and tax increases needed to bring down deficits will eventually force the Fed to accommodate deficits by printing money and buying Treasury bonds � effectively financing the deficit on behalf of Congress and spurring inflation in the process. Some economists at the International Monetary Fund and elsewhere have advocated this approach, suggesting running moderate inflation rates of 4 percent to 6 percent as a partial solution to the U.S. debt problem. But the move runs the risk of damaging the dollar's reputation and spawning much higher inflation that would be debilitating to the U.S. economy and living standards. Rep. Brad Sherman, California Democrat, asked Mr. Bernanke directly whether the Fed would consider such a strategy, especially since IMF officials endorsed it. "We're not going to monetize the debt," Mr. Bernanke declared flatly, stressing that Congress needs to start making plans to bring down the deficit to avoid such a dangerous dilemma for the Fed. I THOUGHT LYING TO CONGRESS WAS A FELONY "It is very, very important for Congress and administration to come to some kind of program, some kind of plan that will credibly show how the United States government is going to bring itself back to a sustainable position." Separately, Mr. Bernanke's predecessor, Alan Greenspan, told Bloomberg News that "fiscal affairs are threatening the outlook" for recovery from recession as Congress and the White House have been unable for years to make tough decisions to raise taxes or cut spending. He said he is so concerned about a sudden sharp increase in interest rates that every day he checks the interest rate on 10-year Treasury notes and 30-year Treasury bonds, calling them the "critical Achilles' heel" of the economy. Despite his gloomy testimony, Mr. Bernanke dismissed concerns that the United States will lose its gold-plated AAA credit rating any time soon. Moody's Investors Service recently said that the U.S. rating would come "under pressure" at some point if Congress does not rein in the budget deficit. The Fed chairman said repeatedly that he understands how difficult it will be for Congress to tame deficits by curbing spending in popular programs like Social Security, Medicare and defense, while also considering tax hikes. But he said there would be an immediate payoff: lower interest rates. "It would be very helpful, even to the current recovery, to markets' confidence, if there were a sustainable, credible plan for a fiscal exit," he said. A plan that eases market worries by laying out how Congress will address the long-term insolvency of Social Security, Medicare and other entitlement programs also would give Congress more room to take the actions needed today to address the jobs crisis, Mr. Bernanke added. "There could be a bonus there," he said. "To the extent that we can achieve credible plans to reduce medium- to long-term deficits, we'll actually have more flexibility in the short term if we want to take other kinds of actions." Separately, the debate continued over whether Fannie Mae and Freddie Mac, the two mortgage financing giants, should be included in the federal budget books now that the Obama administration has taken the limits off aid the Treasury Department is prepared to give the companies to keep them solvent. Republicans, including Rep. Spencer Bachus of Alabama, the top Republican on the banking committee, have argued that the government is now effectively guaranteeing Fannie and Freddie's nearly $5 trillion of mortgage-backed securities and other debt, so their revenues and liabilities should be included in the federal budget as obligations of the government. Taking this step would greatly bloat the federal balance sheet. Mr. Bachus said he worries that keeping Fannie and Freddie's status off the federal books is "the same sort of financial shell game that has brought governments like Greece to a crisis point." But Treasury Secretary Timothy F. Geithner, who also testified on Capitol Hill on Wednesday, said the administration opposes including the quasi-government entities in the budget, although it lifted the limits on aid to Fannie and Freddie with the intent of assuring financial markets that the U.S. government stands behind their obligations. "We do not think it is necessary to consolidate the full obligations of Fannie and Freddie onto the nation's budget. But we do think it's very important � that we make it clear to investors around the world that we will make sure that we will take the actions necessary" to keep the two entities stable, he told the House Budget Committee. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat Feb-27-10 07:22 AM Response to Reply #54 |

| 55. NASTY BEN |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 08:22 PM Response to Original message |

| 14. How to Enjoy an Economic Depression By Bill Bonner |

|

http://dailyreckoning.com/how-to-enjoy-an-economic-depression/

The depression is alive and well! Unemployment claims just came in higher than expected. And new house sales in January were at their lowest ever. Pundits were quick to blame the snow. But sales were off even in areas that had better-than-usual weather. Household income has gone nowhere in 10 years. Stocks have suffered a lost decade too. And now Ben Bernanke says we�d better be careful�because the recovery ain�t no sure thing. The Fed chief has no idea. But average people know what�s going on. They know how hard it is to find a job. If you�re in the building trades�or you have only a year or two of college�you�re pretty much out of luck. You may have to retire before you ever start work again. That�s why there was such a big drop in consumer confidence. But look on the bright side. Building more houses for people who couldn�t afford to live in them was not exactly the greatest business strategy. And all those people who were appraising, mortgaging and selling houses can now find more useful work. Real jobs. Doing something more useful. What are those real jobs going to be? We don�t know yet. But it could take a long time to find out. And in the meantime, we have a depression on our hands� So, let�s enjoy it� How do you enjoy a depression? Well, the first thing is to make sure you�re not in its way� When you�re investing real money, you need some discipline�and some rules. At the Family Office, we�ve developed a methodical approach that let�s us choose investment themes very carefully � after much thought, consultation and deliberation. And then it prevents us from making any changes�again, except with much reflection and discussion. We also have our own timing index, which would practically take an act of congress to override. If the timing index says to get out�we get out. Why are we telling you this? Because you need to follow some rules too � or you�re going to suffer in this depression along with everyone else. What�s the number one rule in a depression? Conserve cash. In a depression, cash goes up. Everything else goes down. Almost everyone loses in a depression. All assets go down. Against what? Against money�cash. So, the thing to do is obvious. Get rid of your investments. Cut your expenses. Sit tight. Do nothing. When you�re given an investment opportunity, just say no. Wait until the depression has run its course. If Japan is any indication, this could go on for another 10 to 20 years � with generally sinking prices for just about everything, but particularly for stocks and real estate. It�s going to be hard to sit out a downturn that long. You�re going to be tempted to speculate�to get back in� You�re not going to want to be left behind. And yet, in a real depression, getting left behind is the best you can hope for� A year or two ago, we would have thought that you couldn�t increase the monetary base so dramatically without grave inflationary consequences. Inflation � with a lag of about 18 months � was a dead certainty. Now that we�re closer to the situation, we see that inflation may be hard to avoid�but it�s hard to summon up too. Japan couldn�t do it. And now the Bernanke Fed can�t seem to do it either. Central bankers are talking about increasing their inflation targets from 2% to 4% in order to give themselves more flexibility to deal with situations such as the crisis of the last 2 years. But they are dreaming. They can�t really control inflation that perfectly. Maybe they can�t really control it at all, except in the grossest, clumsiest way. They have tripled the world�s monetary reserves in the last 7 years. Prices for gold and oil have responded more or less in line with the monetary base. But most consumer prices are heavily dependent on capital investment in China�housing prices in the US�and a million other things that the economists at the Fed can�t begin to control. Of course, in extremis, as Ben Bernanke once told the world, a central bank can always create un-controlled inflation. They �have a technology known as the printing press,� he said. Crank up the presses�and let people know that you are cranking up the presses�and you�ll have price inflation lickety split. But the financial and economic costs of cranking up the presses are so great that very rarely is any central bank�and certainly not any major central bank of a civilized nation�reckless or bold enough to do it. It�s the nuclear option of the monetary world. You have to be very desperate to take the nuclear option. We don�t think Bernanke and crew will get there�not for a long time. That said, there are also conventional weapons�such as those being used now. One in particular�quantitative easing�packs a lot of firepower. It�s not nuclear. But it can still make one helluva mess. Stay tuned. Regards, Bill Bonner for The Daily Reckoning |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 08:25 PM Response to Reply #14 |

| 15. Another Snippet from Bill |

|

�There is some analogy to the Great Depression in the present situation. Between 1918 and 1939, American agriculture was in permanent decline, because the end of the First World War reduced demand for American exports, and because the substitution of the tractor for draught animals freed up an enormous amount of land set aside for animal feed. There was nothing to be done but to get the farmers off the land into other occupations, and that was not accomplished until the Second World War.�

The farmers found work in wartime factories�and in military service. After the war, they took up new jobs, in a new economy with new factories and new professions. What work will today�s laid-off construction workers find? Darned if we know. http://dailyreckoning.com/depression-causes-a-shift-in-economic-models/ MY BET? TRUCK FARMING IN RECLAIMED URBAN AND SUBURBAN DEVELOPMENTS... |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 08:48 PM Response to Original message |

| 16. A NEW ENDEAVOR: GUERRILLA ECONOMICS |

|

I, Demeter, will be pursuing a new train of thought: Guerrilla Economics, or alternatively, Economics as if People Mattered.

What we have had too much of in this species is maintaining, polishing, and serving Institutions. We treat Institutions like Gods. In fact, most institutions have Godhead in their foundation: either elevating and immortalizing a mere human for some better than average talent or accomplishment, or creating a fictional equivalent and embellishing it over time. Think of Lloyd Blankfein, "Doing God's Work" over at Golden Sacks... Well, name me an Institution that really gives a damn about an average real person. I can't think of one, either. Not even such institutions as the Family or the Marriage. Although an actual family or marriage may care about some actual people, it's a hit-or-miss arrangement, and only good for specific individuals, and usually only over certain spans of time, as membership turns over and fortunes wax or wane. Some religions may claim to care about Everyone in the Abstract, but I'm not talking abstraction here. I'm talking about food, clothing, shelter, medicine, education and quality of life for the 6 billion plus that cover the earth, and then throw in as many other species as possible and the earth itself. (I do not require anyone to give a fig for the tse-tse fly or other plagues). So, Economics As If People Mattered. The first thing would be Universal Single Payer. And a steeply progressive tax on all income and wealth to pay for it. And go from there. Direct elections; completely transparent, with no machines or other hurdles to channel, discriminate, or otherwise meddle with direct expression of the voters' will, and no influence peddling. The articles under this thread build upon this idea. Feel free to add your own finds or thoughts. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 08:50 PM Response to Reply #16 |

| 17. FICO is Shocked by Default Data By Addison Wiggin |

|

http://dailyreckoning.com/fico-is-shocked-by-default-data/

FICO, the outfit that computes your vaunted �credit score,� has just noticed that consumers with high scores are more likely to default on their mortgages than their credit cards. Last year, the firm says, folks with FICO scores of 760 or higher defaulted on real estate loans at three times the pace they defaulted on plastic. This shouldn�t be any surprise to FICO. We noticed a few days ago that the number of consumers current on their cards but delinquent on their mortgages exploded by 50% in the year after Lehman went belly up. FICO has access to this data in real time. But it appears flabbergasted by this development, marveling in the first paragraph of a press release that �most credit cards are unsecured credit and mortgages are secured by real estate.� Earth to FICO: If you�re in an underwater home, why wouldn�t you commit strategic default and use the difference between a mortgage payment and rent on a similar home to pay down those cards? You might not even have to move if your mortgage lender doesn�t want to follow through on foreclosure and book the loss! Still, FICO�s CEO told Bloomberg TV he�s stunned the phenomenon isn�t limited to subprime: �Now we�re starting to see at the high end of the marketplace people with good FICO scores having serious delinquency problems.� There�s a hint of panic in the man�s words, as if he senses his entire business model is going down the toilet. Good riddance. Millions of mortgages were issued in the last decade on the basis of nothing more than the �score� issued by this company, which reveals exactly nothing about a borrower�s income, or how his debt load compares to his income. FICO wasn�t the cause of the housing bubble, just a trifling enabler. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 08:55 PM Response to Reply #16 |

| 18. A graphic representation |

| Printer Friendly | Permalink | | Top |

| AnneD

|

Fri Feb-26-10 09:05 PM Response to Reply #18 |

| 21. This might be better..... |

|

www.jldr.com/realaudio/odetoshack.mp3

And you didn't think I could find music to go with this. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 09:06 PM Response to Reply #16 |

| 22. Science briefing: Biofuel breakthrough |

|

http://www.ft.com/cms/s/2/2721293a-2247-11df-9a72-00144feab49a.html?ftcamp=rss

Biofuels made from wood, grass and agricultural wastes such as corn stalks are environmentally attractive because, unlike crops such as maize and sugar grown primarily to produce fuels, they do not take over good farmland. The trouble is that, until now, these �cellulosic biofuels� have been hard to convert into useful liquid fuels. Researchers at the University of Wisconsin report a breakthrough on Friday in the journal Science. Their two-step chemical conversion turns waste biomass efficiently into liquid hydrocarbons that could fuel vehicle or jet engines. The process turns biomass first into a chemical called gamma-valerolactone or GVL, which in turn is converted into jet fuel hydrocarbons. This preserves 95 per cent of the energy from the original biomass, while the waste carbon dioxide can be captured under high pressure for storage or burial underground. �The hydrocarbons produced from GVL in this new process are chemically equivalent to those used in the present infrastructure,� said David Martin Alonso, a member of the Wisconsin research team. �The product we make is ready for the jet fuel application and can be added to existing hydrocarbon blends, as needed.� |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 09:36 PM Response to Reply #16 |

| 35. Fighting the Subversion of Our People's Sovereignty By Jim Hightower |

|

http://www.informationclearinghouse.info/article24858.htm

As you've probably heard, corporations are now "people" � humanoids that are equivalent to you and me. This miraculous metamorphosis happened on Jan. 21. Accompanied by a blinding bolt of lightning, and a terrifying jolt of thunder, five Dr. Frankensteins on the Supreme Court threw a judicial switch that endowed these pulseless paper entities with the human right to speak politically. Never mind that inanimate corporate constructs have no tongue, brain, heart or soul � the five judicial fabricators breathed unprecedented legal life into corporations, decreeing that the vast wealth held in their corporate treasuries is their voice. With a cry of "Shazam!" the court ruled that, henceforth, every corporation � from Wal-Mart to Wall Street � is entitled to "speak" by spending unlimited sums from their treasuries to elect or defeat candidates for any and all public offices in our land, from city council to the presidency. By a bare five-to-four majority, the justices created an artificial, uber-wealthy, political monster that will overpower everyone else's voices. For example, just the 100 largest corporations have assets totaling more than $13 trillion. No combination of human people's political organizations can amass even a tiny fraction of that spending power. With their ruling, five unelected guys in black robes have subverted our people's sovereignty with a semantical perversion that twists special-interest things into "people" and money into "speech." In so doing, the Supreme Five have substituted their personal political views for the clearly-expressed wisdom of America's founders, every Congress since Teddy Roosevelt's time, 22 states, dozens of cities, the court's own precedents and the People themselves. Bizarrely, the five court corporatists seemed to think that their sneak attack on America's democratic ideals was so cleverly done that it would be meekly accepted by the public and even widely applauded. Hardly. The ink of their signatures on this absurd opinion wasn't dry before the justices were pelted with ridicule. "Hey," demanded one blogger, "it's time to reinstitute the draft." Others raised an intriguing constitutional conundrum that the Court obviously failed to contemplate. Since the 13th Amendment bans slavery, which is the ownership of a person, the newly born corporate "persons" cannot legally be bought and sold. Thus Wall Street � now a slave market � must be shut down! Let us all join hands and march for this new civil rights cause, chanting, "Free the Corporate Slaves!" Meanwhile, Americans of all political stripes have risen in overwhelming opposition to the court's contortion of both the Constitution and common sense. In a Washington Post-ABC poll published last week, 85 percent of Democrats, 81 percent of independents and � get this � 76 percent of Republicans reject this act of gross judicial overreach. So, with eight of 10 Americans decrying the decree and nearly as many demanding that it be reversed, we can expect swift and decisive action from Congress. Right? Uh ... no. First, Republican leaders (who've consistently proven to be tail-wagging kowtowers to corporate power) flatly say they will oppose any legislation to restrict the ruling. Second, Democrats have designated Sen. Schumer to lead their effort to undo the decision. Schumer is a notorious CEO-hugging Democrat who serves as the party's chief shaker of the corporate money tree, so sending him into this battle is like going lion hunting with a flyswatter. Sure enough, Schumer has started by declaring that he wants a reform that can get "bipartisan support" in the Senate, and he is not even considering anything as bold or effective as a constitutional amendment to force these corporate behemoths out of our elections. Instead, he's lamely offering a patchwork of regulatory fixes designed to cover up this theft of political power from actual people � fixes that corporate lawyers and lobbyists will riddle with loopholes. To get remedies that work, We the People will have to take direct grassroots action. Already, three major national coalitions have formed to retrieve our democratic authority from the court and its corporate clients: MoveToAmend.org, FreeSpeechForPeople.org and FixCongressFirst.org. Let's get connected and get moving. � 2010 Creators.com |

| Printer Friendly | Permalink | | Top |

| burf

|

Sat Feb-27-10 08:42 AM Response to Reply #16 |

| 59. Speaking of Blankfein |

|

From the first time I heard his ridiculous claim, I was reminded of a scene in the movie The Blues Brothers. I tried to find the clip but its not out there. It is where Jake and Elwood go into a diner to get Matt "Guitar" Murphy and Blue Lou to rejoin the band. Elwood tells Matt's wife (Aretha Franklin) "We're on a mission from God". She goes berserk and tells them "Don't you blaspheme". Every time I see Lloyd's quote, the scene pops into my head. I wish some news organization would play clips of the two quotes, back to back. Maybe something to get the peoples attention to what these financial terrorist are doing to this country.

So much for my morning coffee sermon, now back to your regularly scheduled programing. Good day to all! Thanks again Demeter for all you do here and at SMW. |

| Printer Friendly | Permalink | | Top |

| DemReadingDU

|

Fri Feb-26-10 09:12 PM Response to Original message |

| 25. Johnny Cash Song Download Wins Apple Contest |

|

2/26/10 Louis Sulcer, 71, of Woodstock, Georgia, won a $10,000 iTunes gift card. The song he bought, Johnny Cash's "Guess Things Happen That Way" was the 10 billionth song downloaded on iTunes. The grandfather of nine says he was putting together a mix of Johnny Cash songs for his son. Sulcer started downloading music three years ago. click to hear the audio and read transcript http://www.npr.org/templates/story/story.php?storyId=124105191 Johnny Cash - I Guess Things Happen That Way Town Hall Party, Los Angeles, California August 8, 1959 http://www.youtube.com/watch?v=u1O5hxhrI6Y |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 09:24 PM Response to Reply #25 |

| 31. The Man In Black's History |

|

Cash was of Scottish royal descent but he learned this only upon researching his ancestry.<14> After a chance meeting with former Falkland laird, Major Michael Crichton-Stuart, he traced the Cash family tree to 11th century Fife, Scotland.<15><16><17> Scotland's Cash Loch bears the name of his family.<15>

He had believed in his younger days that he was mainly Irish and partially Native American. Even after learning he was not Native American, Cash's empathy and compassion for Native Americans was unabated. These feelings were expressed in several of his songs, including "Apache Tears" and "The Ballad of Ira Hayes", and on his album, Bitter Tears. Early life Johnny Cash was born J. R. Cash in Kingsland, Arkansas, to Ray (1897�1985) and Carrie (n�e Rivers) Cash (1904�1991), and raised in Dyess, Arkansas. Cash was given the name "J.R." because his parents could not agree on a name, only on initials.<18> When he enlisted in the United States Air Force, the military would not accept initials as his name, so he adopted John R. Cash as his legal name. In 1955, when signing with Sun Records, he took Johnny Cash as his stage name. His friends and in-laws generally called him John, while his blood relatives usually continued to call him J.R. Cash was one of seven children: Jack, Joanne Cash Yates, Louise Garrett, Reba Hancock, Roy, and Tommy.<19><20> His younger brother, Tommy Cash, also became a successful country artist. By the age of five, J.R. was working in the cotton fields, singing along with his family as they worked. The family farm was flooded on at least one occasion, which later inspired him to write the song "Five Feet High and Rising".<21> His family's economic and personal struggles during the Depression inspired many of his songs, especially those about other people facing similar difficulties. Cash was very close to his older brother, Jack, who in 1944 was pulled into a whirling table saw in the mill where he worked, and cut almost in two. He suffered for over a week before he died.<21> Cash often spoke of the horrible guilt he felt over this incident. According to Cash: The Autobiography, his father was away that morning, but he and his mother, and Jack himself, all had premonitions or a sense of foreboding about that day, causing his mother to urge Jack to skip work and go fishing with his brother. Jack insisted on working, as the family needed the money. On his deathbed, Jack said he had visions of heaven and angels. Decades later, Cash spoke of looking forward to meeting his brother in heaven. He wrote that he had seen his brother many times in his dreams, and that Jack always looked two years older than whatever age Cash himself was at that moment. Cash's early memories were dominated by gospel music and radio. Taught by his mother and a childhood friend, Cash began playing guitar and writing songs as a young boy. In high school he sang on a local radio station; decades later he released an album of traditional gospel songs, called My Mother's Hymn Book. He was also significantly influenced by traditional Irish music that he heard performed weekly by Dennis Day on the Jack Benny radio program.<22> Cash enlisted in the United States Air Force. After basic training at Lackland Air Force Base and technical training at Brooks Air Force Base, both in San Antonio, Texas, Cash was assigned to a U.S. Air Force Security Service unit, assigned as a code intercept operator for Soviet Army transmissions, at Landsberg, Germany. On July 3, 1954, he was honorably discharged as a sergeant. Then, he returned to Texas.<23> |

| Printer Friendly | Permalink | | Top |

| AnneD

|

Fri Feb-26-10 10:19 PM Response to Reply #31 |

| 40. And the circle is now complete.... |

|

www.youtube.com/watch?v=m9S9M_c8034&feature=related

but I can't resist to throw in Pentangle's version www.youtube.com/watch?v=tFGRnUzfOEI&feature=fvw |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 09:16 PM Response to Original message |

| 26. Lehman agrees JPMorgan settlement |

|

http://www.ft.com/cms/s/0/9591bf24-224c-11df-9a72-00144feab49a.html

Lehman Brothers Holdings has agreed to pay JPMorgan Chase $557m in cash and let it keep $7.1bn in collateral to settle claims related to Lehman�s 2008 bankruptcy filing, according to court documents. As part of the settlement, JPMorgan Chase will also transfer back to Lehman illiquid securities with a �face value in the billions of dollars�. JPMorgan served as the primary clearing bank for Lehman�s brokerage division. In the weeks leading up to Lehman�s September 15, 2008, bankruptcy filing, JPMorgan required Lehman Brothers to pledge billions of dollars in collateral to guarantee its borrowings, court papers show. Calls for collateral came on August 26, when Lehman posted billions of dollars in hard-to-value illiquid securities, and again between September 9 and September 12, when Lehman pledged an additional $8.57bn in cash and money market funds. When Lehman failed � in the biggest bankruptcy to date in US history � JPMorgan filed claims against the bank that exceeded $29bn. JPMorgan reduced that amount over time by drawing down on the collateral that Lehman had pledged. The agreement reached yesterday will settle the remaining balance. Both sides have reserved their rights to dispute future claims. The settlement requires court approval. A JPMorgan spokesman declined to comment. A Lehman spokeswoman referred reporters to the documents filed with the US Bankruptcy Court for the Southern District of New York. The terms of the agreement call for JPMorgan to keep $7.1bn in collateral and Lehman to pay an additional $557m in cash. JPMorgan will then return to Lehman the remainder of the collateral, which is in the form of illiquid securities that are hard to value. Lehman said in the court papers that these securities �could be worth billions of dollars�. Once the fourth-largest US investment bank, Lehman Brothers failed amid the financial market turbulence of 2008. Last-ditch attempts to save the investment bank by selling it to bigger competitors such as Barclays of the UK or Bank of America failed, forcing the company into Chapter 11 bankruptcy proceedings. Before filing, Lehman Brothers, which employed about 25,000 people, listed assets of $639bn and debts of $613bn. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 09:18 PM Response to Reply #26 |

| 28. Financial crisis panel to recall bank chiefs |

|

http://www.ft.com/cms/s/0/cc66ba98-2253-11df-9a72-00144feab49a.html

The commission set up by the US Congress to probe the causes of the 2008 financial market meltdown will interview foreign regulators and put bank executives back on the witness stand. Phil Angelides, chairman of the Financial Crisis Inquiry Commission, a latter-day version of the Pecora commission that examined the Great Depression, said he planned to question overseas regulators to understand similarities and differences with US oversight in the run-up to the crisis. In an interview before the second public hearing of the FCIC that begins on Friday, Mr Angelides, a former California state treasurer, said he was most struck so far in his inquiry by the way in which Goldman Sachs had been �creating and selling securities and then fully betting against them�. In a reference to the Greek crisis and the alleged role of securities sold by the bank, Mr Angelides said: �It appears that this action was not confined to creating and selling mortgage securities. It also extended to the creation and selling of foreign debt instruments. I find the practice troubling and it raises questions about fair dealing and trust and transparency in the marketplace.� Bill Thomas, vice-chairman of the FCIC and the former Republican chairman of the House ways and means committee, said the hearing last month that questioned Lloyd Blankfein of Goldman, John Mack of Morgan Stanley, Jamie Dimon of JPMorgan Chase and Brian Moynihan of Bank of America was not the end of the process for the bankers and �doesn�t mean we won�t get to them again�. In the dramatic hearing, the four men were sworn in under oath and questioned about their behaviour before the crisis. Mr Blankfein was forced to field more than his share of the questions, with Mr Angelides accusing him of a conflict of interest in creating mortgage-backed securities at the same time as taking a trading position against them. Mr Blankfein noted that Goldman traded with informed institutional investors in securitised assets who were responsible for their own action but he appears not to have convinced his inquisitor. Mr Angelides said that the FCIC wielded subpoena power and could demand witnesses and documents from banks and regulators. �Remember this: we do have the ability to get information that other folks do not,� he said. �So far, knock on fake wood,� said Mr Angelides, drumming the table, �people are in compliance.� Mr Thomas said: �The corporate world has been pretty co-operative.� Asked whether his inquiry could extend to issues such as the Greek debt crisis, Mr Angelides, himself of Greek heritage, said: �Our view generally is that the crisis is not a past-tense phenomenon.� However, he noted that the FCIC had a hard deadline in December to deliver a report to Congress and that would govern the way the commission went about its business. �That�s what�s driving us crazy: the time we have to get a report,� said Mr Thomas. The report is not supposed to be the �definitive word�, said Mr Angelides. He said it �behooves the country� to pay attention to the product but that �does not mean that the president and the Congress should hold up� on regulatory reform. �I will say that for the long term, a better common understanding of this calamity is important.� He added that a lot of people had told him the regulatory reform � now bogged down in the Senate � would be completed before his work started. �As it turns out, that didn�t happen,� he noted wryly. The FCIC session at the American University in Washington, which continues on Saturday, will hear from academics including Randall Kroszner of the University of Chicago and Markus Brunnermeier of Yale University. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Feb-26-10 09:19 PM Response to Reply #28 |

| 29. Freddie Mac likely to need more cash support |

|

http://www.ft.com/cms/s/0/32f13b76-217d-11df-830e-00144feab49a.html