Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Starry Messenger

Starry Messenger's Journal

Starry Messenger's Journal

January 27, 2015

<snip>

Herndon, who did his undergraduate study at Evergreen State College, first started looking into Reinhart and Rogoff's work as part of an assignment for an econometrics course that involved replicating the data work behind a well-known study. Herndon chose Reinhart and Rogoff's 2010 paper, "Growth in a Time of Debt," in part, because it has been one of the most politically influential economic papers of the last decade. It claims, among other things, that countries whose debt exceeds 90 percent of their annual GDP experience slower growth than countries with lower debt loads — a figure that has been cited by people like Paul Ryan and Tim Geithner to justify slashing government spending and implementing other austerity measures on struggling economies.

<snip>

Herndon pulled up an Excel spreadsheet containing Reinhart's data and quickly spotted something that looked odd.

"I clicked on cell L51, and saw that they had only averaged rows 30 through 44, instead of rows 30 through 49."

What Herndon had discovered was that by making a sloppy computing error, Reinhart and Rogoff had forgotten to include a critical piece of data about countries with high debt-to-GDP ratios that would have affected their overall calculations. They had also excluded data from Canada, New Zealand, and Australia — all countries that experienced solid growth during periods of high debt and would thus undercut their thesis that high debt forestalls growth.

<snip>

After consulting his professors, Herndon signed two of them — Pollin and department chair Michael Ash — on as co-authors, and the three of them quickly put together a paper outlining their findings. The paper cut to the core of a debate that has been dividing economists and politicians for decades. Fans of austerity believe that governments should cut spending in order to grow their economies, while anti-austerians believe that government spending in times of economic duress can create growth and reduce unemployment, even if it increases debt in the short term. What Herndon et al. were claiming, in essence, was that the pro-austerity movement was relying on bogus information.

<snip>

http://www.msnbc.com/the-last-word/debunked-the-harvard-study-republicans

<snip>

Additionally, Herndon also uncovered a transcription error with Spain’s average GDP growth. In one of Reinhart and Rogoff’s tables, Spain’s average GDP growth was entered at 2.8% instead of 2.2%. Two other samples showed five countries–Australia, Austria, Belgium, Denmark, and Canada–were removed, adding to the amount of computational errors in the Harvard report.

Herndon concluded, “Contrary to RR, average GDP growth at public debt/GDP ratios over 90 percent is not dramatically different than when debt/GDP ratios are lower.”

An addendum to Herndon’s paper also defines a stronger causal relationship between economic and public debt. A contribution by his professor Arin Dube provides evidence that the causality runs the other way around – from slow growth to high debt.

<snip>

Herndon, along with the economics department at UMass-Amherst, have undercut the austerity argument that there is no definitive threshold for the debt/GDP ratio relationship and that public debt holds a pivotal role in overcoming a financial recession–a topic that has been on the mind of every American.

http://www.huffingtonpost.com/2013/05/30/reinhart-rogoff-debunked_n_3361299.html

<snip>

In a post at Quartz, University of Michigan economics professor Miles Kimball and University of Michigan undergraduate student Yichuan Wang write that they have crunched Reinhart and Rogoff's data and found "not even a shred of evidence" that high debt levels lead to slower economic growth.

And a new paper by University of Massachusetts professor Arindrajit Dube finds evidence that Reinhart and Rogoff had the relationship between growth and debt backwards: Slow growth appears to cause higher debt, if anything.

As you can see from the chart from Dube's paper below, growth tends to be slower in the five years before countries have high debt levels. In the five years after they have high debt levels, there is no noticeable difference in growth at all, certainly not at the 90 percent debt-to-GDP level that Reinhart and Rogoff's 2010 paper made infamous. Kimball and Wang present similar findings in their Quartz piece. (Story continues below chart.)

<snip>

This contradicts the conclusion of Reinhart and Rogoff's 2010 paper, "Growth in a Time of Debt," which has been used to justify austerity programs around the world. In that paper, and in many other papers, op-ed pieces and congressional testimony over the years, Reinhart And Rogoff have warned that high debt slows down growth, making it a huge problem to be dealt with immediately. The human costs of this error have been enormous.

<snip>

http://www.huffingtonpost.com/2013/04/16/reinhart-rogoff-austerity-research-errors_n_3094015.html

<snip>

(Reinhart and Rogoff noted in their Tuesday statement that they have been careful not to claim that high debt causes slow growth, but rather that it has an "association" with slow growth.)

Beyond that, Baker notes, there were lots of other reasons to question Reinhart and Rogoff, including the fact that their gloomy conclusions about debt relied heavily on slow U.S. economic growth immediately after World War II. At the time, the U.S. was deep in war debt and dismantling its war machine. That relatively brief state of affairs was quickly followed by arguably the greatest economic boom in history.

Despite these questions, Reinhart and Rogoff's 90-percent threshold has been discussed ad nauseum in the press and used frequently to justify austerity measures in the U.S. and Europe, as detailed by Quartz's Tim Fernholz. The 2012 version of the pro-austerity budget plan of Rep. Paul Ryan (R-Wis.) cites Reinhart and Rogoff by name, and specifically refers to the 90-percent threshold.

Washington's constant state of panic over government debt and budget deficits has contributed to severe cutbacks in government spending that have slowed economic growth and helped keep unemployment high. The situation has been even worse in Europe, particularly in troubled nations like Greece, where austerity has been enforced as a bailout condition, only to result in slower growth and higher debt burdens.

<snip>

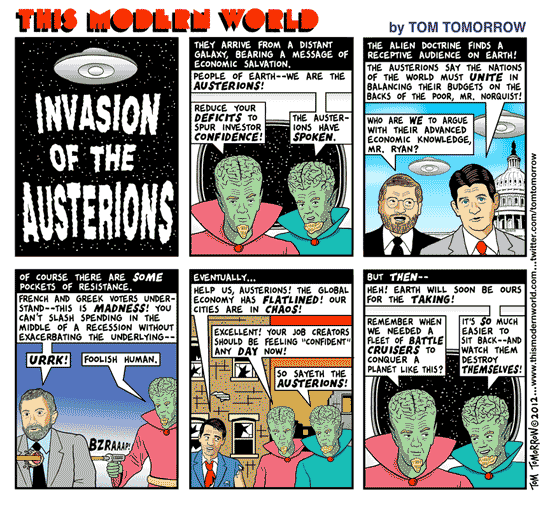

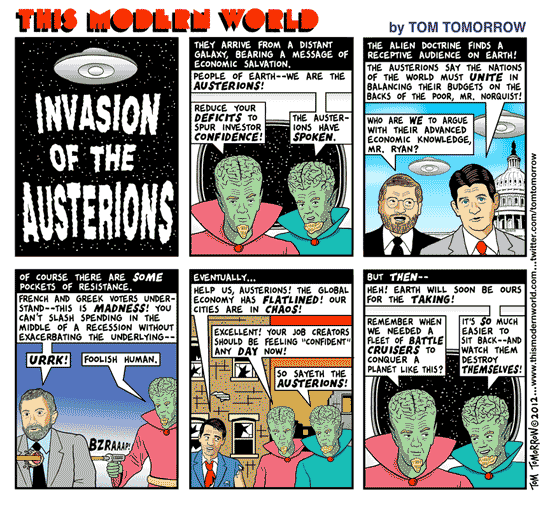

Lots of concern around about Greece possibly abandoning austerity

The victory of Syriza seems to have caused latter-day austerions to emerge from the woodwork again.

I am by no means an economist, but someone who reads. Last year there were a series of strong articles on the falsity of austerity as a way to recover a nation's economic health. I'll post some links here for anyone who needs them handy.

http://nymag.com/daily/intelligencer/2013/04/grad-student-who-shook-global-austerity-movement.html

<snip>

Herndon, who did his undergraduate study at Evergreen State College, first started looking into Reinhart and Rogoff's work as part of an assignment for an econometrics course that involved replicating the data work behind a well-known study. Herndon chose Reinhart and Rogoff's 2010 paper, "Growth in a Time of Debt," in part, because it has been one of the most politically influential economic papers of the last decade. It claims, among other things, that countries whose debt exceeds 90 percent of their annual GDP experience slower growth than countries with lower debt loads — a figure that has been cited by people like Paul Ryan and Tim Geithner to justify slashing government spending and implementing other austerity measures on struggling economies.

<snip>

Herndon pulled up an Excel spreadsheet containing Reinhart's data and quickly spotted something that looked odd.

"I clicked on cell L51, and saw that they had only averaged rows 30 through 44, instead of rows 30 through 49."

What Herndon had discovered was that by making a sloppy computing error, Reinhart and Rogoff had forgotten to include a critical piece of data about countries with high debt-to-GDP ratios that would have affected their overall calculations. They had also excluded data from Canada, New Zealand, and Australia — all countries that experienced solid growth during periods of high debt and would thus undercut their thesis that high debt forestalls growth.

<snip>

After consulting his professors, Herndon signed two of them — Pollin and department chair Michael Ash — on as co-authors, and the three of them quickly put together a paper outlining their findings. The paper cut to the core of a debate that has been dividing economists and politicians for decades. Fans of austerity believe that governments should cut spending in order to grow their economies, while anti-austerians believe that government spending in times of economic duress can create growth and reduce unemployment, even if it increases debt in the short term. What Herndon et al. were claiming, in essence, was that the pro-austerity movement was relying on bogus information.

<snip>

http://www.msnbc.com/the-last-word/debunked-the-harvard-study-republicans

<snip>

Additionally, Herndon also uncovered a transcription error with Spain’s average GDP growth. In one of Reinhart and Rogoff’s tables, Spain’s average GDP growth was entered at 2.8% instead of 2.2%. Two other samples showed five countries–Australia, Austria, Belgium, Denmark, and Canada–were removed, adding to the amount of computational errors in the Harvard report.

Herndon concluded, “Contrary to RR, average GDP growth at public debt/GDP ratios over 90 percent is not dramatically different than when debt/GDP ratios are lower.”

An addendum to Herndon’s paper also defines a stronger causal relationship between economic and public debt. A contribution by his professor Arin Dube provides evidence that the causality runs the other way around – from slow growth to high debt.

<snip>

Herndon, along with the economics department at UMass-Amherst, have undercut the austerity argument that there is no definitive threshold for the debt/GDP ratio relationship and that public debt holds a pivotal role in overcoming a financial recession–a topic that has been on the mind of every American.

http://www.huffingtonpost.com/2013/05/30/reinhart-rogoff-debunked_n_3361299.html

<snip>

In a post at Quartz, University of Michigan economics professor Miles Kimball and University of Michigan undergraduate student Yichuan Wang write that they have crunched Reinhart and Rogoff's data and found "not even a shred of evidence" that high debt levels lead to slower economic growth.

And a new paper by University of Massachusetts professor Arindrajit Dube finds evidence that Reinhart and Rogoff had the relationship between growth and debt backwards: Slow growth appears to cause higher debt, if anything.

As you can see from the chart from Dube's paper below, growth tends to be slower in the five years before countries have high debt levels. In the five years after they have high debt levels, there is no noticeable difference in growth at all, certainly not at the 90 percent debt-to-GDP level that Reinhart and Rogoff's 2010 paper made infamous. Kimball and Wang present similar findings in their Quartz piece. (Story continues below chart.)

<snip>

This contradicts the conclusion of Reinhart and Rogoff's 2010 paper, "Growth in a Time of Debt," which has been used to justify austerity programs around the world. In that paper, and in many other papers, op-ed pieces and congressional testimony over the years, Reinhart And Rogoff have warned that high debt slows down growth, making it a huge problem to be dealt with immediately. The human costs of this error have been enormous.

<snip>

http://www.huffingtonpost.com/2013/04/16/reinhart-rogoff-austerity-research-errors_n_3094015.html

<snip>

(Reinhart and Rogoff noted in their Tuesday statement that they have been careful not to claim that high debt causes slow growth, but rather that it has an "association" with slow growth.)

Beyond that, Baker notes, there were lots of other reasons to question Reinhart and Rogoff, including the fact that their gloomy conclusions about debt relied heavily on slow U.S. economic growth immediately after World War II. At the time, the U.S. was deep in war debt and dismantling its war machine. That relatively brief state of affairs was quickly followed by arguably the greatest economic boom in history.

Despite these questions, Reinhart and Rogoff's 90-percent threshold has been discussed ad nauseum in the press and used frequently to justify austerity measures in the U.S. and Europe, as detailed by Quartz's Tim Fernholz. The 2012 version of the pro-austerity budget plan of Rep. Paul Ryan (R-Wis.) cites Reinhart and Rogoff by name, and specifically refers to the 90-percent threshold.

Washington's constant state of panic over government debt and budget deficits has contributed to severe cutbacks in government spending that have slowed economic growth and helped keep unemployment high. The situation has been even worse in Europe, particularly in troubled nations like Greece, where austerity has been enforced as a bailout condition, only to result in slower growth and higher debt burdens.

<snip>

Profile Information

Name: Decline to StateGender: Female

Hometown: Sacramento, CA

Home country: USA

Current location: Left Coast

Member since: Sat Apr 9, 2005, 08:01 PM

Number of posts: 32,342