Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 5 April 2013

[font size=3]STOCK MARKET WATCH, Friday, 5 April 2013[font color=black][/font]

SMW for 4 April 2013

AT THE CLOSING BELL ON 4 April 2013

[center][font color=green]

Dow Jones 14,606.11 +55.76 (0.38%)

S&P 500 1,559.98 +6.29 (0.40%)

Nasdaq 3,224.98 +6.38 (0.20%)

[font color=black]10 Year 1.76% 0.00 (0.00%)

[font color=green]30 Year 3.01% -0.02 (-0.66%)[font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)Vader, a system originally used to track the Taliban, finds that more immigrants elude capture at the U.S.-Mexico border than previously estimated...A sophisticated airborne radar system developed to track Taliban fighters planting roadside bombs in Afghanistan has found a new use along the U.S. border with Mexico, where it has revealed gaps in security. Operated from a Predator surveillance drone, the radar system has collected evidence that Border Patrol agents apprehended fewer than half of the foreign migrants and smugglers who had illegally crossed into a 150-square-mile stretch of southern Arizona. The number of "gotaways," as the Border Patrol calls those who escape apprehension, is both more precise and higher than official estimates. According to internal reports, Border Patrol agents used the airborne radar to help find and detain 1,874 people in the Sonora Desert between Oct. 1 and Jan. 17. But the radar system spotted an additional 1,962 people in the same area who evaded arrest and disappeared into the United States. In contrast, the Government Accountability Office, the investigative arm of Congress, estimated in January that the Border Patrol had caught 64% of those who illegally crossed into the Tucson sector in 2011.

The new tally of unlawful border crossings could complicate White House efforts to pass comprehensive immigration reform after Congress returns from recess next week. The Obama administration contends America's borders are more strictly policed than ever, with nearly 365,000 apprehensions last year. Republicans have demanded more guards, drones, fencing and other security measures before legal status is granted to the estimated 11 million people believed to have entered America illegally or overstayed their visas.

...The new system is called Vader, for Vehicle Dismount and Exploitation Radar. It was borrowed from the Army's Aberdeen Proving Ground in Maryland and has been deployed in Arizona since March 2012. Michael Friel, a spokesman for U.S. Customs and Border Protection, said the Vader remained in a "preliminary testing phase." He also said the method used in the agency's internal reports to compare apprehensions to arrests was flawed because it didn't include people who were detained after the airborne radar had left the area.

Officials warn that the radar would not work well near border towns and areas where migrants and smugglers can quickly load into a car and blend into highway traffic...The tests have gone well enough that the agency has asked Congress to allocate money to purchase two more Vader systems. Each system costs about $5 million per year to maintain and operate...

The radar is sharp enough to detect and track individuals on foot from a Predator five miles overhead. It uses a synthetic aperture radar to collect high-contrast black-and-white images and to follow scores of moving targets in real time. The processed signals are transmitted from the drone to a ground station, where the figures are displayed as moving dots on a detailed map. "It's a match made in heaven for border security," said a former U.S. law enforcement official. He said the radar had helped Border Patrol agents watch migrants and smugglers gathering on the Mexican side of the border before they start trekking north. But not all of the agents are happy to get a precise head count for the first time of how many people they are missing.

"The rank-and-file guys are afraid it will make them look bad," the official said. He spoke on condition of anonymity because details of the program are not public.

Demeter

(85,373 posts)Jeffrey Skilling, the former Enron Corp chief executive serving a 24-year prison term over the energy company's spectacular collapse, may get a chance to leave prison early.

The U.S. Department of Justice has notified victims of Enron's fraud and 2001 bankruptcy that prosecutors may enter an agreement with Skilling that could result in a resentencing.

Skilling, 59, has served about 6-1/4 years in prison following his May 2006 conviction by a Houston federal jury on 19 counts of securities fraud, conspiracy, insider trading and lying to auditors. It is unclear how much Skilling's sentence could be reduced, and a Justice Department official said no agreement has been reached. CNBC, the television business channel, said prosecutors and Skilling's lawyers have been negotiating a shorter term.

Skilling had previously agreed to forfeit $45 million to be used as restitution for victims of Enron's fraud. That money has been held up because of the negotiations on a new sentence.

"The department's goal is, and has always been, to ensure that Mr. Skilling be appropriately punished for his crimes, and that victims finally receive the restitution they deserve," another Justice Department official said.

Skilling has maintained his innocence, and according to court filings has been pursuing a new trial. He is scheduled to leave prison around February 2028, assuming good behavior, according to federal prison records....A new sentence would have to be approved by U.S. District Judge Sim Lake in Houston, who had imposed the original sentence...In its Wednesday notice, the Justice Department advised former Enron employees, stockholders and other victims that it is "considering entering into a sentencing agreement" with Skilling. The notice gives recipients until April 17 to voice objections.

In 2009, the 5th U.S. Circuit Court of Appeals upheld Skilling's conviction, but called his sentence too harsh. The next year, the U.S. Supreme Court also upheld the conviction, but rejected one legal theory behind it. In 2011, the 5th Circuit reaffirmed the conviction.

Skilling is being held at a low-security prison for men in Littleton, Colorado...At the 2006 trial, the Houston jury also found Kenneth Lay, who was Enron's chief executive before and after Skilling's six-month term, guilty of fraud and conspiracy. Lay died in July 2006, and his death led to his conviction being thrown out. Among those who testified against Skilling and Lay was Andrew Fastow, who was Enron's chief financial officer and considered the mastermind behind the company's fraud. Fastow was sentenced to six years in prison and released in December 2011.

MORE

Demeter

(85,373 posts)The bunnies worked well last week....thanks, Fuddnik!

What's up, doc?

kickysnana

(3,908 posts)The 90's something couple upstairs is having trouble remembering to put the shower curtain into the base so we have had flooding three times in the last year and a half. This time they sent someone in to fix the damage and repaint. It looks great and he did clean up OK. Glad it wasn't the toilet.

It only took a day but I had to take everything out of the bathroom and front entry closet over the weekend and now I am cleaning and putting it all back. Auntie's PCA is visiting her homes in Africa and England for a month and it was a challenge keeping up before the repairs.

I am so grateful we actually have a spring this year. Last year we went from winter to summer weather and I was getting so much more done. Driving downtown for a doctor appointment tomorrow the furthest I have driven since Thanksgiving.

Demeter

(85,373 posts)I'd need help with Roger Ebert...or a supplemental art...

kickysnana

(3,908 posts)Article: http://www.hlntv.com/article/2013/04/04/grumpy-cat-tardar-sauce-birthday

Colette: Grumpy is not unique in that she is a very cute cat that became famous on the Internet -- dozens of animals have done that. But her meteoric ascent to stardom is rare in that she quickly entered the upper echelon of meme culture and never left. Because of that permanently grouchy expression, people take themselves less seriously when they look at her, which is a major key in her enduring popularity.

Official website: http://www.grumpycats.com/

She shows up on DU regularly but not in SMW.

http://www.memestache.com/lists/456/17-Totally-Amazing-Grumpy-Cat-Memes/1

I must admit Grumpy Cat is a guilty pleasure of mine, currently. ![]()

I've even considered purchasing one of the art mugs. (:

"Turn that frown upside down!" "No."

GP is a natural for Demeter. ![]()

But, maybe this weekend Ebert is the ticket.

Demeter

(85,373 posts)and you are casting aspersions on me!

Hugin

(33,059 posts)

Demeter

(85,373 posts)Still, it is a visual...twist my arm then!

Hugin

(33,059 posts)The man was an era. ![]()

Warpy

(111,175 posts)When he was on PBS with Gene Siskel, the "two thumbs up" really meant a film was something special. They didn't limit themselves to Hollywood, either, and would often showcase foreign films with subtitles rather than bad dubbing for dummies.

He didn't limit himself to film, either, and his last few years were spent chronicling his illness, showing the rest of us how to meet our ends with style and perfect grace.

He will be sorely missed by many of us here at DU.

Demeter

(85,373 posts)I never paid any attention, since the Kid's movie needs are special and unique...

Demeter

(85,373 posts)ONE OF THESE DAYS, HE'S GOING TO MAKE THIS OFFER, AND SOME GOPPER WILL TAKE HIM UP ON IT, AND WE WILL ALL BE SCREWED....THE ONLY THING PROTECTING THE PUBLIC HAS BEEN GOP INTRANSIGENCE AND TEABAG RESISTANCE TO TOUCHING THE THIRD RAIL...

http://news.yahoo.com/obama-budget-offer-program-cuts-seek-deficit-deal-060835057--business.html

President Barack Obama will offer cuts to Social Security and other entitlement programs in a budget proposal aimed at swaying Republicans to compromise on a deficit-reduction deal, a senior administration official said on Friday.

Under a proposal that would cut the deficit by $1.8 trillion over 10 years, the president will offer to apply a less generous measure of inflation to calculate cost-of-living increases, the official said on condition of anonymity. That change would result in lower payments to some beneficiaries of the Social Security program for retirees and is staunchly opposed by many congressional Democrats as well as labor and retiree groups.

Obama would agree to cuts to other so-called entitlement programs, the official said.

However, the president will only accept these spending cuts if congressional Republicans, for their part, agree to higher taxes, the official added. The president's budget proposal is due to be laid out in full on Wednesday....

Demeter

(85,373 posts)...In addition, the president will seek to increase revenues by placing a $3 million upper limit on tax-preferred retirement accounts and by barring people from collecting disability benefits and unemployment insurance at the same time, the official said.

Analysts who have seen early drafts of the budget proposal say the president was considering cuts to Medicare through reducing payments to health care providers but also by requiring wealthier beneficiaries to pay more out of pocket.

Reductions to Social Security and Medicare benefits are highly unpopular among many of the president's strongest supporters and groups have already mobilized to oppose them.

wanker

Demeter

(85,373 posts)TOO BAD ISN'T STIRRINGS OF REVOLT...NAH, THEY'D JUST DRONE US.

http://www.nytimes.com/2013/04/05/business/economy/fed-weighs-a-reaction-to-stirrings-of-recovery.html?_r=0

Federal Reserve officials are grappling publicly with a better kind of problem than most they’ve confronted in recent years: what if the labor market continues to improve more rapidly than they had expected?

The economy added an average of 187,000 jobs a month from September to February, slightly faster than the average monthly pace from 2004 to 2006, the best years of the last economic upswing. The government plans to release a preliminary estimate Friday morning of March job creation.

Some Fed officials have suggested in recent weeks that if economic growth continues on its present trajectory, the central bank should begin to roll back its economic stimulus campaign by the middle of the year, ahead of expectations...

I REPEAT: WHAT RECOVERY? I FURTHER REPEAT: WHAT ECONOMIC STIMULUS?

mother earth

(6,002 posts)BOTH the economic stimulus and the jobs have been outsourced...USA, Inc.-style.

Demeter

(85,373 posts)Oil futures edged lower Friday, with investors preparing for any signals on energy demand from the upcoming monthly U.S. jobs report...

THE BURNED CHILD FEARS THE FIRE...

Crude on Thursday dropped $1.19, or 1.3%, to $93.26 a barrel on the New York Mercantile Exchange. It faced a weekly loss of roughly 4%, which would mark oil’s first weekly decline in five weeks.

The Labor Department’s monthly jobs report, due later Friday, should provide further insight into the recovery of the world’s largest economy, with a lower-than-expected reading likely to deepen concerns that hiring in the U.S. is slowing.

Economists surveyed by MarketWatch forecast 190,000 new jobs in March nonfarm payrolls, down from an earlier target of 195,000 new jobs. The report is due out at 8:30 a.m. Eastern.

Energy-demand concerns showed up in oil prices this week after separate reports of bigger-than-expected increases in last week’s U.S. crude supplies, as well as a slowdown in U.S. private-payrolls growth. MORE

Demeter

(85,373 posts)...

MORE

xchrom

(108,903 posts)

Hotler

(11,396 posts)xchrom

(108,903 posts)DemReadingDU

(16,000 posts)

xchrom

(108,903 posts)Tansy_Gold

(17,847 posts)

xchrom

(108,903 posts)

Demeter

(85,373 posts)Hope your day (and year) is very happy!

xchrom

(108,903 posts)

Demeter

(85,373 posts)xchrom

(108,903 posts)Hugin

(33,059 posts)

or not.

i'm traumatized -- i found a new wrinkle

siligut

(12,272 posts)And many more to come.

Have a wonderful birthday xchrom!

xchrom

(108,903 posts)Fuddnik

(8,846 posts)xchrom

(108,903 posts)westerebus

(2,976 posts)xchrom

(108,903 posts)xchrom

(108,903 posts)In Cyprus’s divided capital, the early symptoms of the familiar plague are plain. There’s the rash of For Rent and 50% Off signs, scattered still but spreading; the numb, unnatural quiet; the melancholy of shop windows full of things no one will buy. On classy Makarios Avenue, Guess Jeans, Juicy Couture and Planet Organic survive from the cosmopolitan boom time, but the Nike outlet has closed. The pavement opposite is strewn with leaflets from ELAM, the Greek neo-Nazi movement’s small Cypriot franchise. The town center is packed with what one Cypriot called “crowds of indignant journalists” waiting for the sky to fall; in the vegetable market, a widow who lost her catering job six months ago sits hunched by a folding table piled with sesame bread. She got the flour from the church, she says; she was up baking all night and hasn’t sold a single loaf. Today was her last hope.

Cyprus—a small island in the Eastern Mediterranean, a stone’s throw from Turkey and Israel, a three-hour hop from Moscow—is not simply another casualty of the eurocrisis. Here, the troika of the European Commission, European Central Bank and IMF have not just imposed austerity measures; they have decapitated the economy, scalping depositors in the two largest failing banks, Laiki and the Bank of Cyprus, for up to 60 percent of holdings over 100,000 euros (about $130,000 at today’s exchange rate). This will not only affect the Russians, British, Germans and other foreigners drawn by low taxes, loose rules and high interest rates to base their companies and stash their money here, but every Cypriot with a medium-sized business. Until mid-March, banking and financial services were the engine of the island’s economy, accounting for about half of it; now, with confidence fried, the car will be stalled for years. Economists predict a 10 percent decline in GDP and a doubling of the unemployment rate, currently at 14 percent, in 2013 alone. This is not creeping austerity but sudden death: a tiny nation pushed off a cliff to “save” the eurozone—or at least German Chancellor Angela Merkel’s fall re-election prospects.

Most Cypriots I spoke with have few illusions about their elites’ share of responsibility for the mess. After 1974, when the island was split in two by a Greek fascist coup followed by a Turkish invasion, the (Greek Cypriot) Republic of Cyprus turned itself into an offshore banking center. Money came in from the Middle East and, in the 1990s, from the former Soviet Union. When it entered the EU in 2004, Cyprus became an even more attractive destination. But the banks were badly managed, taking bigger and bigger risks. The communist party, AKEL, in power from 2008 until February, ignored repeated warnings from the EU and IMF and dragged its feet on negotiating a bailout agreement, placing too much faith in Russia—which has so far refused to add to its existing loan of 2.5 billion euros.

Then there’s the Greek connection, which has distorted Cypriot life and politics for years. “Cyprus always helped Greece,” an old man, a refugee from the north in 1974, said to me. “Alexander the Great came here, we gave him ships, we gave him everything. We said, ‘We’re Greeks.’ Since then—what, two thousand years?—this lousy place has suffered for the ‘mother country.’” By the end of 2010, Laiki and the Bank of Cyprus held 5.8 billion euros of Greek government bonds, worth a third of Cyprus’s output; after last year’s Greek haircut, they’d lost 4.3 billion of it. A Greek oligarch, Andreas Vgenopoulos, held a controlling share of Laiki until last year; under his chairmanship, the bank made some 12 billion euros’ worth of risky loans in Greece, including a fat tranche to a Mount Athos monastery engaged in a dodgy land deal with the Greek government.

xchrom

(108,903 posts)This morning we learned that the U.S. economy added a measly 88,000 jobs in March. The unemployment rate fell to 7.6 percent, but that was due to a big drop in the labor force participation rate.

The jobs report was much worse than expected, and they reflect a job market that remains incredibly weak even almost four years into the economic recovery.

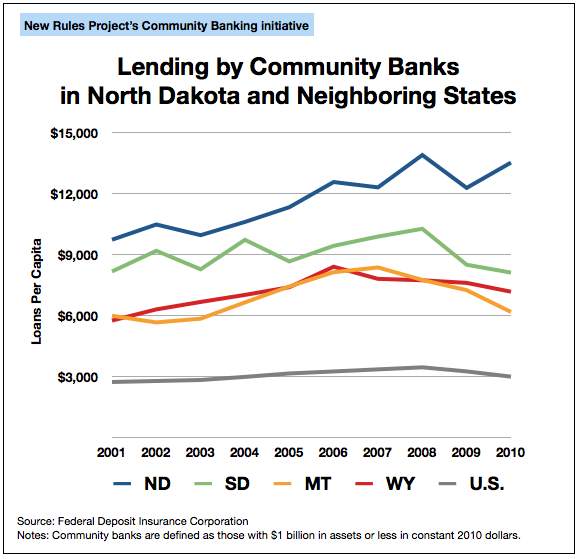

Calculated Risk runs a chart every month putting the current jobs recovery into perspective.

"This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis," writes Bill McBride of Calculated Risk.

Demeter

(85,373 posts)if you don't count all the permanently discouraged and invalided out....

xchrom

(108,903 posts)Demeter

(85,373 posts)Last month, the Department of Labor released new job market numbers, which suggests that the economic recovery is perpetuating the trend of college graduates turning to minimum wage jobs. Though there has been significant employment gains, many recent college graduates have been forced to resort to low-wage, low-skilled jobs. There are now 13.4 million college graduates working for hourly pay, up 19 percent since the start of the recession.

According to the Department of Labor, there are about 284,000 graduates with at least a bachelor’s degree that were working minimum wage jobs in 2012.

In a recent study released by NELP, the National Employment Law Project, the low-wage occupational sector is the fastest growing sector in the economy, even though this sector only lost about one-fifth of its jobs. Meanwhile, the middle-wage job sector—which usually serves as the pathway into the workforce for many recent graduates—was hardest hit, and has been the slowest to recover.

According to the NELP study:

The burden of student loan debt could be one of the driving forces behind this trend. College graduates are turning to low-wage jobs more than ever in order to pay of their high amounts of student loan debt. By working these low-wage jobs, it hinders their ability to overcome this financial burden and plan for the future. Young people are postponing home purchasing which overall delays economic recovery. Only 9 percent of 29-34 year-olds got a first-time mortgage, according to a recent Federal Reserve survey.

Since higher education is still the best way to ensure higher wages and job security, it is likely that this trend will persist as the recovery continues, which will then leave little room in the job market for low-skilled workers.

xchrom

(108,903 posts)The March jobs report has come in very mediocre.

It'd be nice to blame the sequester (the automatic spending cuts that started in March) but it doesn't even appear to be about that.

A series of tweets from WaPo's Zachary Goldfarb points out that this really more likely to be about the expiry of the Payroll Tax Holiday (as the job losses fell in the retail sector) rather than the sequester (seeing as there was not a big decline in professional services).

Read more: http://www.businessinsider.com/weak-jobs-report-not-about-the-sequester-2013-4#ixzz2PatBXdBO

xchrom

(108,903 posts)

he March jobs report is out and it's ugly.

By far the ugliest component of the report was retail trade jobs, which plunged by 24,000.

"The industry had added an average of 32,000 jobs per month over the prior 6 months," wrote the Bureau of Labor Statistics in its report. "In March, job declines occurred in clothing and clothing accessories stores (-15,000), building material and garden supply stores (-10,000), and electronics and appliance stores (-6,000)."

This is a sign to many that the payroll tax increase at the beginning of the year is really starting to bite.

Read more: http://www.businessinsider.com/retail-jobs-fall-2013-4#ixzz2Patp4KYN

*** i don't think it has anything to do w/ the payroll tax -- employment just hasn't been great -- period.

xchrom

(108,903 posts)The oil and gas extraction industry lost 600 payrolls in March, according to the BLS report out this morning.

That ends a 27-straight month period without job losses for the sector.

Total payrolls fell to 192,500 from 193,100.

We shouldn't necessarily be surprised — oil prices have now entered their second year of a downward trend.

Read more: http://www.businessinsider.com/oil-and-gas-jobs-fall-in-march-2013-4#ixzz2PayJ92N2

xchrom

(108,903 posts)Roland99

(53,342 posts)Nasdaq 3,176 -49 1.52%

S&P 500 1,543 -17 1.09%

GlobalDow 2,070 -13 0.64%

Oil 92.41 -0.86 0.92% [/font]

Gold 1,568 +16 1.00%

wow...oil has dropped quite a bit this week. Last I checked it was pushing $98/bbl.

P.S. Go Cards!!

And for anyone who saw last Sunday's game of UofL vs. Duke and saw Kevin's horrific injury (or has heard or seen the news all week about him), here he is from last night's David Letterman:

xchrom

(108,903 posts)***SNIP

Call me a skeptic, but I am a bit dubious of cultural explanations for financial malfeasance at investment banks, especially explanations that imply it could be prevented by adopting new internal guidelines and forcing the inmates to take remedial classes in humane behavior. Investment bankers are investment bankers, and they always will be. With rare exceptions, the reason they go into the profession is to satisfy their competitive cravings, earn as much money as they can in as little time as possible, buy a big house in a fancy neighborhood, retire early, and do something more interesting with the rest of their lives. Trying to inculcate them with finer values is a pointless endeavor, and so, with the demise of the partnership model, is trying to make them think long-term.

Trapped in a competitive environment that in many ways resembles the “prisoner’s dilemma” beloved of game theorists, investment bankers will inevitably be driven to cut corners, take outlandish risks, and generally engage in behavior that, although privately rational, is socially pernicious. In the famous words of Chuck Prince, “as long as the music is playing, you’ve got to get up and dance.” The only way to control investment banks, and to direct their activities in a more socially useful direction, is to sit on them hard—with strict limits on leverage, intrusive regulation, and harsh punishments for self-dealing behavior.

What went wrong at Barclays wasn’t simply a cultural failure: in some ways, it was a cultural success. Unlike most of its British rivals, the firm survived the financial crisis without an infusion of public equity. (Like all the other big banks, it did get the benefit of cheap emergency lending from the Fed and the Bank of England.) By adopting the scorched-earth tactics and outlook that Diamond and others learned from Wall Street, it transformed itself into the one British firm that could stand toe-to-toe with the likes of Goldman and JP Morgan. But, in accomplishing this, it was driven to do things that contributed to the disasters we have seen in the past five years.

The most startling fact in Salz’s report isn’t that in 2010 and 2011, at a time when its stock price was shot and its dividend payments had been slashed, Barclays paid its employees about nine billion dollars in bonuses and incentive payments. That merely shows that old habits die hard, or don’t die at all. To me, anyway, the real shocker is that, by 2008, Barclays’ leverage ratio—total assets divided by total equity—was forty-three, which means a mere three per cent fall in the value of its assets could have wiped out its entire capital. Even Bear Stearns wasn’t as highly geared as that. (In March, 2008, its leverage ratio was thirty-six.) And Bear, at least, was well known to its debtors and counterparties as a trading house that pushed things to the edge. Barclays was a retail bank that had purposely built up inside it a vast casino.

Read more: http://www.newyorker.com/online/blogs/johncassidy/2013/04/why-do-banks-go-rogue-bad-culture-or-bad-regulation.html#ixzz2PbBAYYyl

Demeter

(85,373 posts)Or, one could go the way of making banking a public utility, and let all the banksters try their luck at the blackjack tables, instead.

xchrom

(108,903 posts)xchrom

(108,903 posts)Of the institutions under scrutiny by an international consortium of investigative journalists, Germany's Deutsche Bank appears to be a significant European player in the flow of offshore money. Research by German public broadcaster NDR and the Süddeutsche Zeitung newspaper has found that the company has helped to maintain more than 300 secretive offshore companies and trusts through its Singapore branch. Most of these are located in the British Virgin Islands.

The information comes from records obtained by the International Consortium of Investigative Journalists (ICIJ) in a reporting project that has been jointly published by media in 46 counties.

The records include details on more than 122,000 offshore companies or trusts spread across over more than 170 countries and territories and the names of 130,000 people who have allegedly parked their money in offshore tax havens. They involve a "well-paid industry of accountants, middlemen and other operatives" who have "helped offshore patrons shroud their identities and business interests, providing shelter in many cases to money laundering or other misconduct," the ICIJ wrote. This network includes "many of the world's top banks -- including UBS, Clariden and Deutsche Bank," which it accuses of having "aggressively worked to provide their customers with secrecy-cloaked companies in the British Virgin Islands and other offshore hideaways."

Bank Defends Operations

In response to questions by journalists, a Deutsche Bank spokesman said the company offers "services to wealthy clients on the basis that these customers fully comply with all tax rules and reporting requirements." He said the bank's operations in Southeast Asia primarily offer services to customers based in the region.

xchrom

(108,903 posts)American employers hired at the slowest pace in nine months in March, a sign that Washington's austerity drive could be stealing momentum from the economy.

The economy added just 88,000 jobs last month and the jobless rate ticked a tenth of a point lower to 7.6 per cent largely due to people dropping out of the work force, Labour Department data showed today.

Analysts polled by Reuters had expected a gain of 200,000.

The slower pace of growth in payrolls marks a steep reversal of the recent trend in which the labour market appeared to be stepping up its pace of recovery. It also comes after Washington increased taxes in January and just as across-the-board federal budget cuts began in March.

xchrom

(108,903 posts)The U.S. Securities and Exchange Commission gets a lot of well-deserved brickbats for settling cases with crooks and cheats without making them admit to breaking the law. The deals often show the agency to be gutless and weak. Other times they look plain stupid.

Here is one of those times when it’s all of the above. This week, a federal judge in New York approved a $14 million settlement between the SEC and a unit of Steven A. Cohen’s hedge fund, SAC Capital Advisors LP, over insider-trading allegations. Cohen’s firm neither admitted nor denied the SEC’s claims, which was a ludicrous formality. The former SAC Capital analyst at the heart of the case, Jon Horvath, already had been convicted criminally. The violations he committed were central to the SEC’s allegations against the $15 billion hedge fund.

Horvath, who worked at SAC’s Sigma Capital Management unit, pleaded guilty to three felony counts last year, including securities fraud. He is cooperating with the government while awaiting sentencing. Had the SEC taken Cohen’s firm to trial, the case should have been straightforward, at least on paper: Simply call Horvath as a witness to describe his own crimes. “I knew that what I was doing was wrong and illegal,” Horvath said at his September plea hearing.

Feeding Colleagues

Horvath’s actions were imputed to the firm, as the SEC’s settled complaint made clear. The inside information he fed his SAC Capital colleagues about Dell Inc. and Nvidia Corp. let the fund reap millions of dollars illegally.

xchrom

(108,903 posts)German factory orders rose more than twice as much as economists forecast in February, adding to signs that Europe’s largest economy returned to growth in the first quarter.

Orders, adjusted for seasonal swings and inflation, increased 2.3 percent from January, when they dropped a revised 1.6 percent, the Economy Ministry in Berlin said today. Economists forecast a 1.1 percent gain, according to the median of 33 estimates in a Bloomberg News survey. In the year, workday-adjusted orders were unchanged.

While the euro area remains mired in recession, the German economy probably found its way back to growth in the first quarter after a 0.6 percent contraction in the last three months of 2012. Retail sales unexpectedly rose in February and the jobless rate remained close to a two-decade low. At the same time, business confidence dropped for the first time in five months in March amid renewed concerns about Europe’s sovereign debt crisis.

Today’s data “provide further evidence of the strength of German domestic demand,” said Christian Schulz, an economist at Berenberg Bank in London. “However, the latest setbacks in sentiment caused by Italy and Cyprus may delay the return to strong growth by a few months.”

xchrom

(108,903 posts)Some key data about bond purchases by Bank of Cyprus - now the focus of a controversial EU-IMF bailout - is missing, investigators have found.

The gaps were found in computer records studied by a financial consultancy, Alvarez and Marsal, Cypriot media say.

Bank of Cyprus - the island's biggest bank - bought Greek bonds which turned into some 1.9bn euros (£1.6bn; $2.4bn) of losses in the Greek debt crisis.

Depositors with more than 100,000 euros in the bank are now facing a big loss.

xchrom

(108,903 posts)Japan's stock market has hit its highest level in almost five years, after a central bank stimulus plan raised hope of economic revival.

The main Nikkei 225 stock index climbed as much as 4.7% to 13,225.62, its highest since August 2008.

The Bank of Japan said on Thursday it would double the country's money supply to spur growth and halt falling prices.

The step was much bigger than expected and signalled a more aggressive approach towards driving growth.

xchrom

(108,903 posts)xchrom

(108,903 posts)Flipping through the visitor book at the end of a new exhibit in Bonn on the United States, it comes as no surprise to find entries like "Guantanamo = USA, shame on you!" or "Propaganda style: The winner writes history." America took a big hit in popularity with Germans because of the Iraq War. And, despite President Barack Obama's outsized personal appeal, his climate change policies and drone warfare have done little to improve America's overall standing here.

Still, "The American Way: The USA in Germany," at the Haus der Geschichte der Bundesrepublik Deutschland, a national museum dedicated to postwar German history, explores this 68-year-old relationship and strongly concludes: No, the love has not died. It's just complicated -- or, as the museum prefers to say, "special."

The exhibit, two years in the making, is divided into four sections that examine how American security policies, economic interests and everyday culture have shaped postwar Germany. The first, "Victor and Vanquished," welcomes visitors with a black-and-white film of American bombers dropping their payloads over Germany during World War II, before detailing how the US later imposed order, meted out justice and molded the nation from the ground up. But America's role quickly morphs from that of victor to helper as the focus turns to C.A.R.E. relief packages, the Marshall Plan and the Berlin Airlift, all of which served to recast the image of Americans in West Germany from that of occupiers to something else, the topic of the next section.

In "America as a Role Model?", the focus turns to everyday life. Cars, jeans, films, Tupperware, comic books, hula hoops, Coca-Cola machines, jukeboxes -- the displays show how American culture inundated Germany in the early postwar years. This was the honeymoon period of the relationship, when many Germans fell in love with American culture. One look at the visitors tells you it was fun: A woman marvels aloud at vintage jeans and excitedly reminisces with a friend about her first pair. A 50-year-old teacher unabashedly does the twist to Bill Haley's "Rock Around the Clock" before an on-screen jukebox and two younger colleagues.

A poster advertises the benefits of the Marshall Plan: Visitors entering the exhibited are greeted by a black-and-white film showing American bombers dropping their payloads over Germany. But the focus quickly turns to how Americans helped reshape the country from the ground up. Among the display items are the uniform of a military guard at the Nuremburg Trials and the nose cone of a V-2 rocket.

Tupperware was introduced in Germany in the 1960s: The exhibit, two years in the making, has three unifying threads on how American security policies, economic interests and popular culture molded postwar Germany. In addition to documentary display items, much of the exhibit is made up of films, music and video recordings.

DemReadingDU

(16,000 posts)some of the original lids have Tupper the Seal on them!

After Tupperware, Rubbermaid came out with a nice brand of heavy plasticware. Today there are all sorts of throw-away containers.

Probably some younger people have thrown out Tupperware and Rubbermaid products thinking they are disposable, when in fact, they are re-useable!

xchrom

(108,903 posts)Demeter

(85,373 posts)

Demeter

(85,373 posts)Fear reigns. Reality comes for a bite.

They will get the Valkyries out, next.

Demeter

(85,373 posts)While Wall Street crooks walk, thousands sit in California prisons for life over crimes as trivial as stealing socks...Despite the passage in late 2012 of a new state ballot initiative that prevents California from ever again giving out life sentences to anyone whose "third strike" is not a serious crime, thousands of people – the overwhelming majority of them poor and nonwhite – remain imprisoned for a variety of offenses so absurd that any list of the unluckiest offenders reads like a macabre joke, a surrealistic comedy routine.

Have you heard the one about the guy who got life for stealing a slice of pizza? Or the guy who went away forever for lifting a pair of baby shoes? Or the one who got 50 to life for helping himself to five children's videotapes from Kmart? How about the guy who got life for possessing 0.14 grams of meth? That last offender was a criminal mastermind by Three Strikes standards, as many others have been sentenced to life for holding even smaller amounts of drugs, including one poor sap who got the max for 0.09 grams of black-tar heroin.

This Frankenstein's monster of a mandatory-sentencing system isn't just some localized bureaucratic accident, but the legacy of a series of complex political choices we all made as voters decades ago. California's Three Strikes law has its origins in a terrible event from October 1993, when, in a case that outraged the entire country, a violent felon named Richard Allen Davis kidnapped and murdered an adolescent girl named Polly Klaas. Californians were determined to never again let a repeat offender get the chance to commit such a brutal crime, and so a year later, with the Klaas case still fresh in public memory, the state's citizens passed Proposition 184 – the Three Strikes law – with an overwhelming 72 percent of the vote. Under the ballot initiative, anyone who had committed two serious felonies would effectively be sentenced to jail for life upon being convicted of a third crime...

AND ONCE YOU'VE SEEN THE TAIBBI ARTICLE, GO TO THE ANALYSIS:

http://www.alternet.org/civil-liberties/taibbi-politicians-and-law-enforcement-have-trapped-too-many-people-jail-life?akid=10276.227380.OtMFjK&rd=1&src=newsletter818889&t=8&paging=off

Taibbi: Politicians and Law Enforcement Have Trapped Too Many People in Jail for Life with Extreme Three Strikes Laws By Steven Rosenfeld

Fuddnik

(8,846 posts)After they signed a private prison contract with GEO to keep it at least 90% filled.