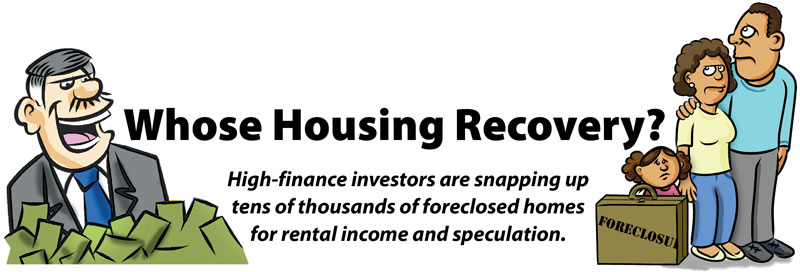

Whose Housing Recovery?

from Dollars & Sense:

BY DARWIN BONDGRAHAM | March/April 2013

The business press has been reporting a “recovery” of the U.S. housing market for over a year now, as the average prices of single-family homes rise across the country. Implied in these stories is the return of a healthy real-estate market, in which the average American family has the resources—in terms of income, savings, and access to credit—to purchase its own slice of the American dream.

The housing recovery we are seeing right now, however, is anything but indicative of broader gains—increased wages, falling unemployment, or renewed access to credit for consumers—being shared across the economy. The biggest buyers of single-family homes today are not new owner-occupants, but investors. While most of these investors are so-called “mom-and-pop” buyers who own an extra rental house or two in their hometowns, large private investors are also increasingly buying up homes.

These investors are especially focusing on foreclosed properties in the “sun” and “sand” belts—from Florida and Georgia to Arizona, Nevada, and California. Private-equity firms, investment banks, and other high-finance investors are gobbling up housing stocks in these markets by the tens of thousands of units. They have taken to calling single-family rental homes a “new asset class,” alongside corporate debt, government bonds, currencies, and financial derivatives.

From Owners to Renters

Under the so-called housing recovery, the foreclosed homeowner is being relegated to the status of renter. Increasingly, the new renters’ role will be to pay their new high-finance landlords for shelter, all in order to secure big returns for the millionaire clients and institutional partners who are backing foreclosure purchases with billions of dollars. ..........(more)

The complete piece is at: http://www.dollarsandsense.org/archives/2013/0313bondgraham.html

Newest Reality

(12,712 posts)it seems, in any economic news is related to the word, "whose"?

We are supposed to assume a position, (oh, that one comes later) were the implied "we" is something like a rising tide that raises all boats. Actually, the rats have very nice, luxury life rafts and float around as the ship sinks. But it is all about "we", huh?

If you buy into much of the "good news" that suggests a recovery, remember the scam of trickle-down economics and how long that big joke sailed before we started to notice it was full of holes.

Trickle-down economic news seems to work the same way. There is a recovery, but you have to be in the right situation to really notice the effects and benefits. Just look into who has recovered and how much. Following the money is always revealing.

just1voice

(1,362 posts)"Investor" purchased homes will cost too much to live in as the greedy "investors" will be charging more than any markets/incomes will support. The U.S. will remain to have an obscene glut of housing sitting empty due to greed and corruption.