APNewsBreak: Upper income seniors' Medicare hike

Source: The Seattle Times

WASHINGTON —

President Barack Obama's new plan to raise Medicare premiums for upper-income seniors would create five new income brackets to squeeze more revenue for the government from the top tiers of retirees.

The administration revealed details of the plan Friday after Health and Human Services Secretary Kathleen Sebelius testified before the Congress on the president's budget. The details had not been provided when the budget was released earlier in the week.

The idea of "means testing" has been part of Medicare since the George W. Bush administration, but ramping it up is bound to stir controversy. Republicans are intrigued, but most Democrats don't like the idea.

The plan itself is complicated. The bottom line is not: more money for the government.

Obama's new budget calls for raising $50 billion over 10 years by increasing monthly "income-related" premiums for outpatient and prescription drug coverage. The comparable number last year was $28 billion over the decade.

Read more: http://seattletimes.com/html/health/2020765089_apusobamabudgetmedicarepremiums.html

SleeplessinSoCal

(9,107 posts)Why on earth are our Medicare dollars going to pay for tv ads promoting the use of so many drugs with countless side effects?

freshwest

(53,661 posts)Since it came out of the amount they charged for adminstration (profits), and not add to cost of care reimbursements.

http://www.democraticunderground.com/10021120987#op

http://www.democraticunderground.com/1002865368#post61

http://www.addictinginfo.org/2012/01/04/obamacare-is-already-helping-the-99-now/

http://www.democraticunderground.com/10165237

http://www.democraticunderground.com/1002873856

I gotta get out to do some business. Bye.

Starting in 2017, there would be nine income brackets on which the higher premiums would be charged. There are only four now.

If the proposal were in effect today, a retiree making $85,000 would pay about $168 a month for outpatient coverage, compared to $146.90 currently.

hue

(4,949 posts)HiPointDem

(20,729 posts)where the *real* 'rich' are, untouched.

Carolina

(6,960 posts)have put in over the past 33 years, plus the money that will continue to be taken from my check until I can collect on my Medicare investment!

Medicare doesn't cover everything (80%). You still need a secondary insurance from one of those for profit blood suckers which puts the squeeze on people. And while the people his budget measurement is aimed at are fortunate, they are not the 1%! They are not the people who can sit home and let their money do the working for them. They are not the ones who have offshore accounts. They are not the ones who pay only 14% on federal income taxes!

Obama, the Grand Betrayer

sinkingfeeling

(51,444 posts)going to be making more than $85,000 at age 65+, then don't you think you can afford another $21?

DURHAM D

(32,607 posts)it is about the pay-in for those under 65.

Carolina

(6,960 posts)And for personal reasons that I don't care to elaborate here. I am not 65 yet, and while it may start at $21 for those who are 65 now, it will undoubtedly rise...

Yes, 85K is a fortunate amount of money, but no one can count someone else's bills, debts or responsibilities. Moreover, it still does not put one in the 1%. And it is earned money put aside in annuities for the future.

doc03

(35,321 posts)Roth IRA two years ago and this year when I started Medicare I found it puts me a couple hundred dollars over the $85,000 mark. So this year I have to pay and additional $42 for Part B and another $11.60 for Part D each month even though I make a little over $35,000. I am also taxed on my SS because I get a pension from my employer.

Skittles

(153,138 posts)WTF

doc03

(35,321 posts)and being single I pay taxes on my pension and anything I withdraw from my IRA but also my SS. The taxes on the SS really

bugs me because anything I withdraw from savings is effectivly taxed at about 40% counting state taxes.

Flatulo

(5,005 posts)of their wealth, there'd just be a new 1%.

Tom Rinaldo

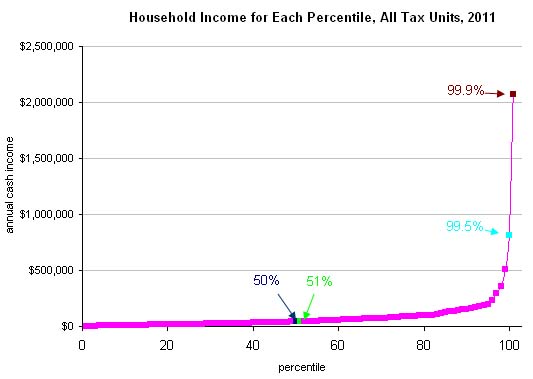

(22,912 posts)It is the shape of that bell curve, it is the slope of that bell curve.

Flatulo

(5,005 posts)I don't know what the actual distribution looks like, but I suspect it's heavily skewed.

daleo

(21,317 posts)If the average person was about six feet tall, the top end of the one percent would be so tall that their heads would be up in space, with the satellites (converting money to height and scaling according to the actual income distribution.

bvar22

(39,909 posts)

doc03

(35,321 posts)makes under $85000. So under Obama's plan a person making over $85000 would pay $68 more per month not $21. I happen to fall in that category myself this year and make less than $40000 a year. The reason is I converted $50000 from a regular IRA to a Roth two years ago, I started Medicare this year, they based my Medicare premium on my income that year. An income of $85000 a year is hardly the 1%.

Flatulo

(5,005 posts)Next year your income will fall below $85K again, unless you take another large distribution.

Just trying to find a silver lining for you, I guess.

doc03

(35,321 posts)base my Medicare premium on that year's tax return. If I would have rolled over $49500 instead

of $50000 I would have been Ok. I know not to do that now. The reason I converted to the Roth was I found out if I withdrew from my regular IRA being single I would be taxed about 40% on any withdrawals from $5000 to about $15000. I calculated by making a large conversion to the Roth it would save a good bit of tax in the long run. I attended three financial planing classes but none of them said anything about the huge tax penalty on a single person.

sinkingfeeling

(51,444 posts)to pay more for the next 3 or 4 years until I decide to retire.

doc03

(35,321 posts)pays is no problem any doctor is covered as long as they accept Medicare. The problem is the other 20% Medicare doesn't pay that is covered by insurance. My company has a Medicare advantage plan and now it turns out two of my specialists that I have been seeing for 8 years are out of network. If I leave the group plan I can't get back in so I am going to try it for now hoping maybe they get a better plan like a regular supplemental policy that doesn't have networks. Those idiot teabaggers talk about rationing healthcare, it isn't govment (Medicare) that is rationing it is Blue Cross.

This is only for individuals over 65 and on Medicare. I really think that an individual earning more than $85K a year can pay a few dollars more for single payer 80% coverage.

Carolina

(6,960 posts)see my reply above.

marybourg

(12,606 posts)income generated in tax-deferred accounts, like IRAs or 401ks, or deductions or exemptions. Someone with a taxable income of $85,000 probably has a true income north of $120, 000.

DURHAM D

(32,607 posts)It is based on modified adjusted gross income.

Downwinder

(12,869 posts)$12,000 bracket.

dixiegrrrrl

(60,010 posts)Yeah, really.

I don't have a problem with premiums being higher for high income people.

I may have a problem if it is implemented and "bracket creep" creeps downwards.

the real truth is that a lot of pain could be avoided by lowering across the board medical costs.

We all know by now for profit medical costs are staggering.

But I do not expect a heavily lobbied Contress or White House to touch THAT issue.

Downwinder

(12,869 posts)it would help.

Carolina

(6,960 posts)for the bracket creep comment... you get it!

This measure will hurt people, actually all the little people, eventually. It doesn't do a damn thing to get to those who make megabucks.

Also, it's not for profit medical costs; it's for profit insurance companies. Doctors don't see the money that shows up on your insurnace statements and those dastardly "explanation of benefits" statements.

Check this out: http://www.politicaljack.com/showthread.php?29922-Medicare-overhead-vs-HMO

sinkingfeeling

(51,444 posts)freshwest

(53,661 posts)Carolina

(6,960 posts)but it will creep up and the income brackets affected will creep down.. it will also kick in at a time when people tend to be more fragile and likely to be sicker.

Your attitude smacks of the: First they came for... mentality

Remember, this is not going to affect the 1%

SunSeeker

(51,545 posts)Carolina

(6,960 posts)but you are still clueless of what this measure WILL mean for you eventually. So yes, at first they came for fits

READ! And remember this was first a Bush idea!

SunSeeker

(51,545 posts)Response to SunSeeker (Reply #34)

Post removed

Skittles

(153,138 posts)that's harsh - there are plenty of idiots making six, seven, eight figures

Lasher

(27,553 posts)Last edited Fri Apr 12, 2013, 09:27 PM - Edit history (1)

But check it out, that post by Carolina was hidden by a 5-1 jury decision. This just sucks and blows.

Edit to share jury results:

hurtful, rude, insensitive personal attack

JURY RESULTS

A randomly-selected Jury of DU members completed their review of this alert at Fri Apr 12, 2013, 04:52 PM, and voted 5-1 to HIDE IT.

Juror #1 voted to HIDE IT and said: No explanation given

Juror #2 voted to HIDE IT and said: I don't hide much anymore, but the economic insult got me here. Not the "daftness" comment, the paycheck comment. That's just crap.

Juror #3 voted to HIDE IT and said: Attack the position, not the poster.

Juror #4 voted to HIDE IT and said: No explanation given

Juror #5 voted to LEAVE IT ALONE and said: No explanation given

Juror #6 voted to HIDE IT and said: Obviously rude.

CONSEQUENCES OF THIS DECISION

You will no longer be able to participate in this discussion thread, and you will not be able to start a new discussion thread in this forum until 5:52 PM. This hidden post has been added to your Transparency page.

Skittles

(153,138 posts)unless I read it wrong, the insinuation was you needed to be intelligent to make lots of money, but there's a lot of idiots making a lot of money - heck, just look at Congress

SunSeeker

(51,545 posts)Skittles

(153,138 posts)yes INDEED

Lasher

(27,553 posts)Last edited Sat Apr 13, 2013, 12:54 PM - Edit history (1)

And I don't think Carolina's post crossed the line into legitimately hideable territory.

Response to SunSeeker (Reply #29)

Post removed

onenote

(42,660 posts)doc03

(35,321 posts)50% of SS on singles making over $25000 and couples making over $32000. Later Clinton increased that to 85% of SS. The threshold of $25000 for singles and $32000 for a couple has never been adjusted for inflation. If adjusted for inflation they would be over $58000 and over $74000 in 2013 dollars.

on edit: So what was considered upper income in 1983 is certainly not upper income today is it?

usGovOwesUs3Trillion

(2,022 posts)Like a penny tax on EVERY stock trade/transaction ![]()

SunSeeker

(51,545 posts)usGovOwesUs3Trillion

(2,022 posts)

SunSeeker

(51,545 posts)usGovOwesUs3Trillion

(2,022 posts)SunSeeker

(51,545 posts)They haven't budged on cutting tax loopholes for the rich, despite public pressure and losing a presidential election over it. What makes you think they'll agree to tax stock transactions? That's their bread and butter.

I just don't see anything significantly progressive happening (like a much-needed tax on stock transactions) until we get a Democratic House and a filibuster-proof majority in the Senate, like we had for those two short months in Obama's first term.

usGovOwesUs3Trillion

(2,022 posts)call-to-action

lots of folks never thought civil rights, women's rights, etc. would ever happen either... but even a journey of a thousand miles begins with a single step.

Lasher

(27,553 posts)For the first time in Medicare's history, millions of seniors will be required to pay substantially more for their Medicare Part B premiums than other seniors next year. In 2007 the government will begin "income relating," or means testing. Higher income seniors will have to pay more for their doctors' services and outpatient coverage. The change, which comes as part of the 2003 Medicare drug legislation, could affect as many as 2.3 million seniors according to estimates by the Congressional Budget Office (CBO).

<snip>

Means testing of the Part B premium was one of the most controversial elements of the 2003 Medicare drug law. Neither version of the law originally passed by the House or the Senate even contained the provision. The Washington Post reported in 2003 that the House version of the legislation would have required Medicare beneficiaries to pay more for medicine under the new Part D drug plans. The provision to charge higher income beneficiaries more for the Part B premium rather than for prescription drug coverage was inserted at the last minute by the small handful of Congressional leaders who negotiated the final version of the law behind tightly closed doors.

Means testing radically changes the nature of Medicare. The program was designed as universal social insurance with everyone paying a uniform premium and receiving a standard package of benefits. Supporters of means testing argue that it's needed to cut Medicare costs and make the program more sustainable. Government estimates, however, indicate that higher premiums for some will not save Medicare.

http://www.democraticunderground.com/discuss/duboard.php?az=view_all&address=364x2978842

Some of you think Medicare means testing is a good idea, unless you yourselves are affected. Once thresholds are established, however, the next step is to lower them. And that's just what is happening now. If you're still not caught up in this means testing, maybe it will be your turn in the next go-around, sure to follow.

DURHAM D

(32,607 posts)I am already affected by it.

ETA: But then I am a Democrat.

Lasher

(27,553 posts)The Seattle Times article says most Democrats don't like it. And Medicare means testing was established by GWB and his Bush league lapdog GOP Congress.

But you are entitled to your opinion. No need to apologize to me for it.

Carolina

(6,960 posts)I see from responses here that the high rollers are pitting we, the people against each other, since there are so many in this thread who think this latest proposal is no big deal. They fail to see it's the beginning of yet another assault on earned benefits that is wrongheaded and will ultimately do nothing to save Medicare.

Thank you especially for your last paragraph which so aptly expresses what this action will eventually lead to:

Some of you think Medicare means testing is a good idea, unless you yourselves are affected. Once thresholds are established, however, the next step is to lower them. And that's just what is happening now. If you're still not caught up in this means testing, maybe it will be your turn in the next go-around, sure to follow.

![]()

Lasher

(27,553 posts)Medicare is universal health insurance for people 65+ years old. This is needed for us all, regardless of age, as in all other developed nations. But means testing undermines popular support for this critically important domestic social program. I have no doubt that this was their primary goal when Republicans came up with it in 2003.

Thank you for your kindness.

![]()

Iliyah

(25,111 posts)back into the Medicare system to further help the least unfortunate.

The Second Stone

(2,900 posts)Seniors with more income pay more in taxes. They should not be forced to be taxed again through higher medical costs. They've paid for this as much as anyone else. This is just another way to avoid taxes on corporations. It's bullshit to stand in line at Safeway and hear them whine about donate to "X health problem" of the month. It is the duty of the government to give the people their tax monies' worth through single pay health coverage like every civilized country in the world except us does it. It is not enough to hold a f'in bake sale or pass around the tin cup and only do health care on the crappiest financing.

Tax corporations doing business in the US for health care.

Carolina

(6,960 posts)You and Lasher have provided more substance for what I have been trying to convey to others upthread.

buck201

(4 posts)Obama will probably get to this too. But for now this is a good start.

LarryNM

(493 posts)through means testing, which Will eventually lead to more paperwork, more rules and consideration of assets just like any other welfare program. Get ready for your Pee Tests.

rurallib

(62,401 posts)move people into silos and then they fight for their silo and screw everybody else. In the end we all lose.

Carolina

(6,960 posts)but some in this thread, like SunSeeker and DurhamD, don't get it! I give up trying to show them your exact point

Flatulo

(5,005 posts)It's whoever makes more money than me.

Carolina

(6,960 posts)I have tried to point out upthread, especially to DurhanD and SunSeeker, that while 85K for an individual is fortunate, it doesn't take into account how that is already taxed. 85K gross is one thing; after taxes, it's another. That individual will already get less SS than s/he earned but now will be means tested and taxed again for Medicare. It's a slippery slope

And we're not talking super wealthy (the 1% whose money makes money). We're talking earners and taxpayers. We're not talking about Congress critters (174K for an individual) who are set with pensions and health care on our dimes. We're not talking health insurance CEOs who make millions by denying care, see:

http://www.ilhealthagents.com/blog/tag/health-insurance-company-ceo-salaries-2011/

DURHAM D

(32,607 posts)It is you who has a problem.

Flatulo

(5,005 posts)Depending on where you live, that could be a very nominal income.

People asking you if you'd pay an extra $24 so that poor people could have health care are missing the point.

Could you pay another $20 so that everyone could have dental care? Sure.

Could you pay yet another $25 to help a starving child in some third-world country? Sure.

Could you spare just another $25 for cleft palate? Sure.

How about homeless shelters? Abandoned pets? Housing for the needy? AIDs research? Diabetes? Cancer?

At what magical number/point does one cease to be a selfish dick and turn into a caring, compassionate person, when there is endless need in the world? If I go to bed with a full belly, am I a dick because someone else does not? Should we all be forced to live at an absolute bare subsistence level until every single human need, everywhere has been met?

BlueToTheBone

(3,747 posts)and let it go.

Tom Rinaldo

(22,912 posts)From what I've gleaned the added expense would be pretty modest and fall only on those who are well positioned to absorb it.

CountAllVotes

(20,868 posts)From the medicare.gov website:

Part B premiums by income

If your yearly income in 2011 was You pay (in 2013)

File individual tax return File joint tax return

$85,000 or less $170,000 or less $104.90

above $85,000 up to $107,000 above $170,000 up to $214,000 $146.90

above $107,000 up to $160,000 above $214,000 up to $320,000 $209.80

above $160,000 up to $214,000 above $320,000 up to $428,000 $272.70

above $214,000 above $428,000 $335.70

Link here:

http://medicare.gov/your-medicare-costs/part-b-costs/part-b-costs.html

buck201

(4 posts)I like this plan. Enough cuts have been taken on the bottom. This is my opinion.

muriel_volestrangler

(101,294 posts)I know it's a bit unfair to ask DUers to make up for a truly appalling bit of writing, but, when the article says "the bottom line is not ...", you expect it to explain what the bottom line actually is. Instead, it leaves us hanging. They could have written "the bottom line is not: free ice-cream for everyone", and it would be true, but unhelpful. They don't even explain why this doesn't mean any more money for the government, let alone what the bottom line actually is. I read the whole article, and it sounds like it would mean more money for the government. But that one sentence tells me that's not true.

So what's the real deal? Anyone?

bornskeptic

(1,330 posts)"The bottom line is not:" refers to the previous sentence. It eans

"The bottom line is not complicated."

muriel_volestrangler

(101,294 posts)Thanks for that. I was taking it as "the bottom is not: "more money for the government", so I didn't try to refer back to the previous sentence.